$2.2 billion and counting: September update 🧗♂️

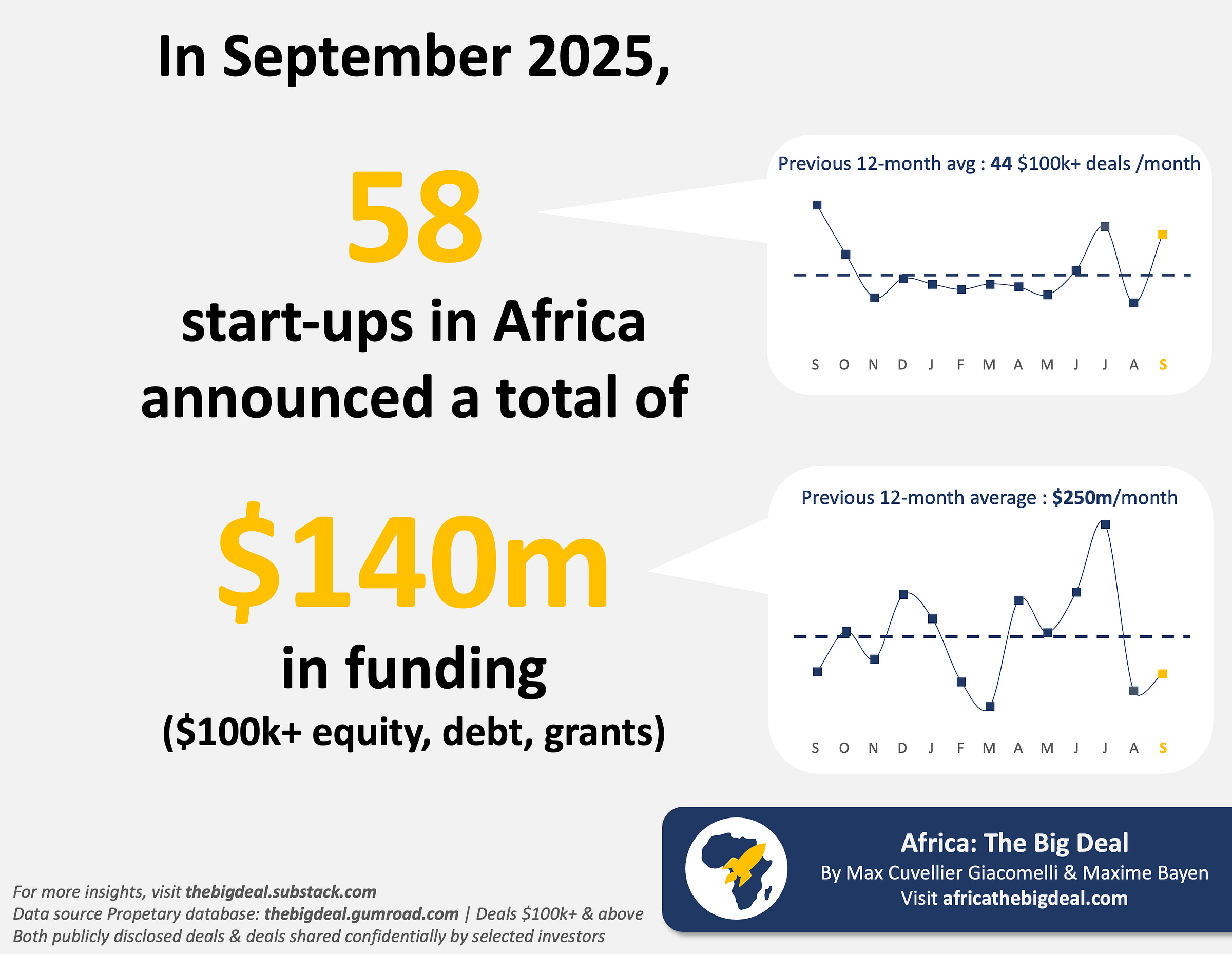

58 start-ups raised $140m+ last month; the total raised in 2025 to date now exceeds $2.2 billion

Before we start. we wanted to make sure you hadn’t missed our three-part feature on the continent’s most-funded start-ups, which has already attracted 25,000+ unique views on Substack alone. Of course, if you enjoyed it, don’t hesitate to pass it around ☺️…

The latest update of our monthly start-up deals database gave us quite a bit of work, as September saw a total of 58 companies raise $140 million on the continent (exc. exits). From an amount point of view, this is below average, yet equivalent to what had been raised in Sept 2024 ($146m), and above the Sept 2023 tally ($124m). What is notable though, is the number of ventures who raised at least $100k last month, the second-best in a year (just behind July).

Of the $140m raised, $105m (75%) were equity, and the rest mostly debt ($32m) and some grant funding ($3m, including 16 match-funding grants from DEG Impulse as part of their new develoPPP Ventures cohort in East Africa - see here and here). The five largest transactions of the month were all equity: Kredete (fintech, Nigeria) announced its $22m Series A; Pura Beverage closed their $15m Series B (not technically a start-up, though they’ve decided to go the VC route for their financing), Contactable (identity, South Africa) bagged $13.5m, Intella (AI, Egypt) closed a $12.5m Series A; and The Invigilator (education, South Africa) secured $11m.

There were also 5 exits announced in September, including 3 in South Africa where a consortium led by Twofold Capital acquired fintech TaxTim, edtech Rekindle acquired EpiTek, and fintech Street Wallet acquired Digitip. In North Africa, logistics start-up Cathedis was acquired by super app start-up Ora Technologies in Morocco, and healthtech Duaya acquired EXMGO in Egypt.

If we zoom back and look at quarterly numbers, start-ups in Africa have raised $785m in Q3, which is lower than Q2 ($963m) but significantly higher than Q1 ($461m). It is however a very strong Q3, comparing very favourably to the same quarter in 2024 ($649m), 2023 ($496m), but also 2022 ($612m). Start-ups in Africa have now raised $2.2b in 2025 to date (‘YTD’, exc. exits), which is only about $40m from the total raised in the whole of 2024…

… but we’ll dive deeper into these numbers soon as we focus on Q3 and 2025 YTD. As usual, and like hundreds of investors and entrepreneurs, you can find all the underlying data in our deals database, updated monthly: over $21 billion in deals by the 4,000+ start-ups who have raised $100k or more since 2019. Yes, that’s a lot, it keeps growing, and we’re here for it! Bonne semaine. Max