July 2025 - A lot of debt, but not just

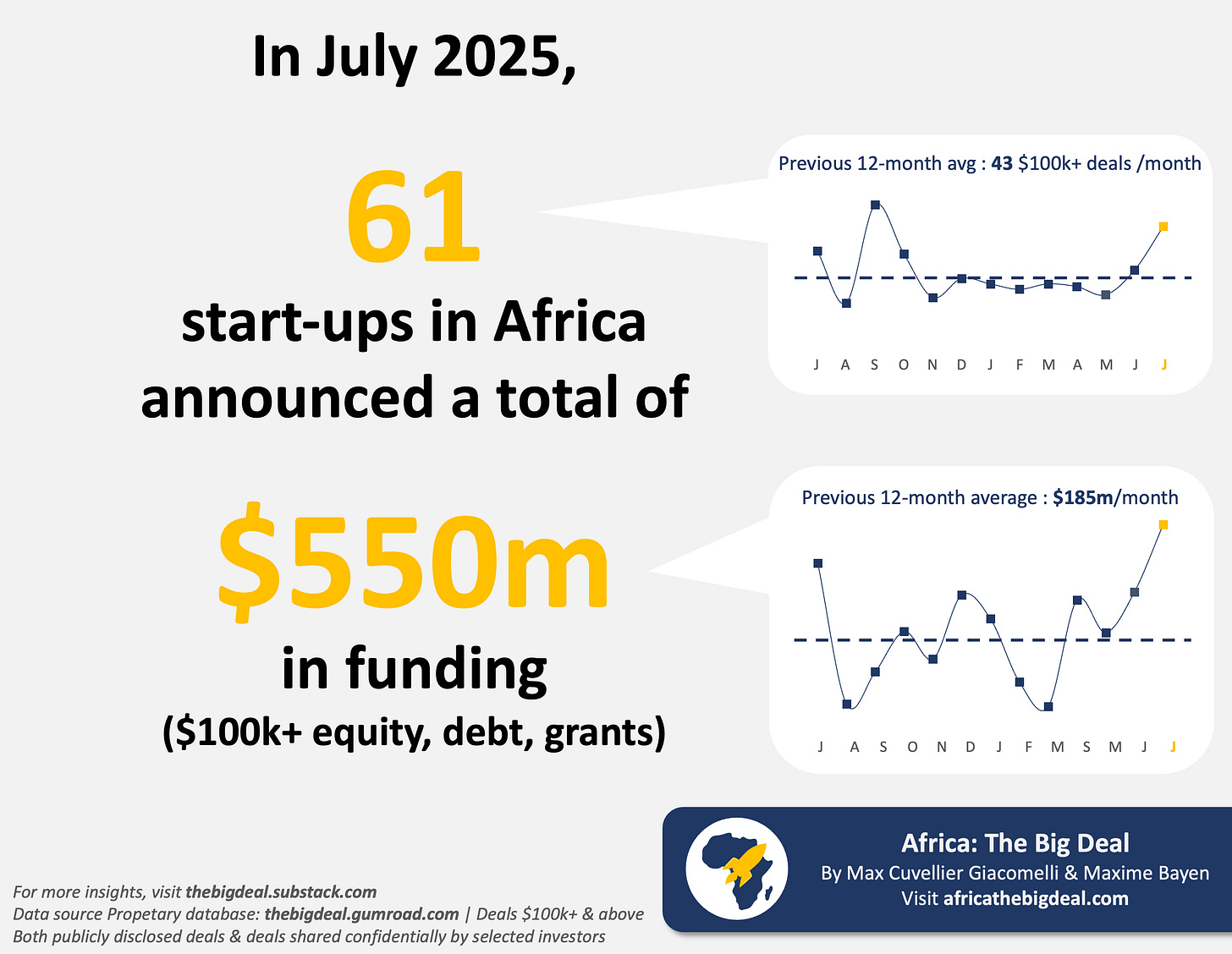

61 start-ups raised $550m last month, crossing (or getting very close to) important milestones

July 2025 was a very good month. 61 start-ups announced at least $100k in funding, which is much higher than what we’d seen in the first half of the year when the number was hovering around 40 a month. 41 were located in the Big Four, but there was a good spread overall, with 15 countries represented (including the first $100k+ deal we’ve ever recorded in Libya).

In terms of amount, $550m were raised in July 2025. This is the most start-ups in Africa have raised in a month in more than two years. 83% of this amount was claimed by just two companies, both operating in the energy sector, both with roots in Kenya, and both raising debt: d.light who expanded its receivables financing by $300m and Sun King who secured a $156m debt facility. If we add other smaller debt deals, debt represented 89% ($493m) of the funding raised on the continent last month, and 45% since the beginning of the year.

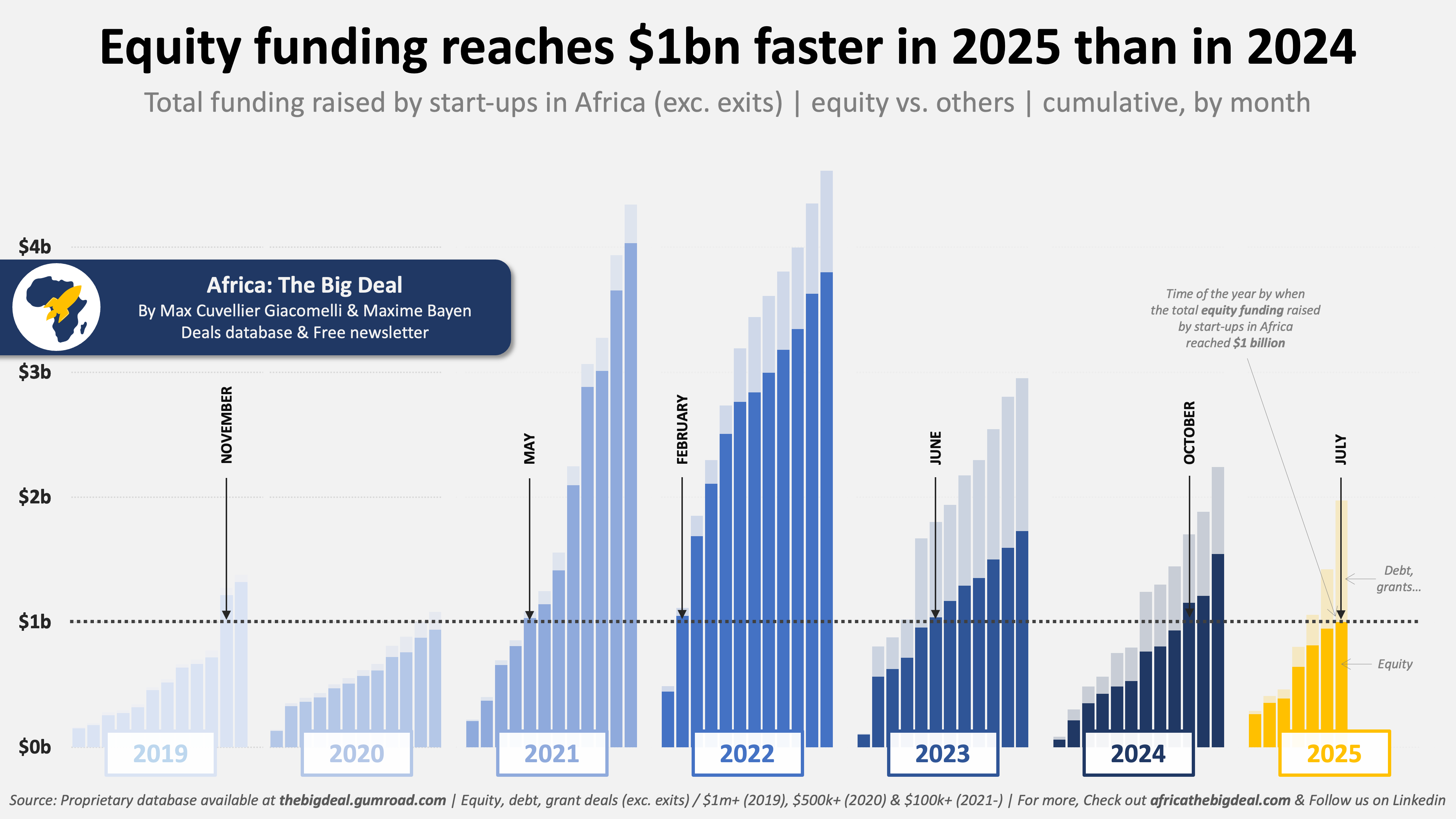

On the equity front specifically, $58m were announced, the second-lowest month this year. The largest equity deal was Rwazi’s $12m Series A. This was enough however, for the $1 billion equity funding milestone to be reached! It was passed much faster than in 2024 (October) and almost as fast as in 2023 (June).

Almost frustratingly, the ecosystem missed the $2 billion milestone in total funding raised (exc. exits) by just $25m… but at least we know this is only a matter of weeks (or maybe even days) now!

ICYMI, you can (re)watch our H1 2025 presentation and download the underlying deck to access all the charts and visuals. All the links can be found here. And for a discounted access to the full database with all the deals we have been tracking since 2019 (worth over $21 billion) you can use this link. We’ve recently added a new "Estimated Valuation" column for pre-seed, seed, series A and series B deals. Cool stuff, if I do say so myself… Have a good day, Max