Inside Africa's Top💯 Most Funded Start-Ups

🌟 What does it take to have your star in Africa' Start-up Hall of Fame?

It all started with a mistake, a toggled field in a Pivot Table as I was looking through our database to produce the latest 2025 funding numbers. Instead of filtering to focus on this year’s deals, what I did is I included all the deals (4,000 lines in total!) since 2019. But as I started looking through the data tables, I realised this was actually quite interesting… Interesting enough actually to run a deeper analysis, and share it here.

But before we start: What exactly are we including here?… The data I used covers all deals (equity, debt, grants etc.) but it excludes exits, simply because exit data is too patchy. What it means is that certain start-ups are slightly lower on the pyramid than they could have been. That would be the case for PEG Africa for instance, which was acquired in 2022. Or even more notably for InstaDeep which was acquired by BioNTech for more than half a billion in July 2023 (but for which we’re ‘only’ counting the $100m+ they had raised prior to acquisition). A couple other start-up success stories are ‘missing’ from the list because they raised most of their funding pre-2019, and were acquired a few years ago. Notably, this is the case Paystack who was acquired by Stripe for $200m back in 2020, and Sendwave, bought by Zepz (f.k.a. WorldRemit) for close to half a billion in early 2021. Otherwise, we’ve not meddled with the list, which means we’ve kept companies which IPO’ed (such as Swvl), and a few that have either seriously downsized or closed (e.g. Gro Intelligence, Copia Global, 54gene, or Kobo360). We’ve just combined the MaxAB and Wasoko numbers, following their 2024 merger. These are the few choices we made (if any of you decide to run the same analysis but with different assumptions, please do share it with us!). At the end of the day, our focus is to identify trends as opposed to arguing where exactly each start-up should be on the pyramid.

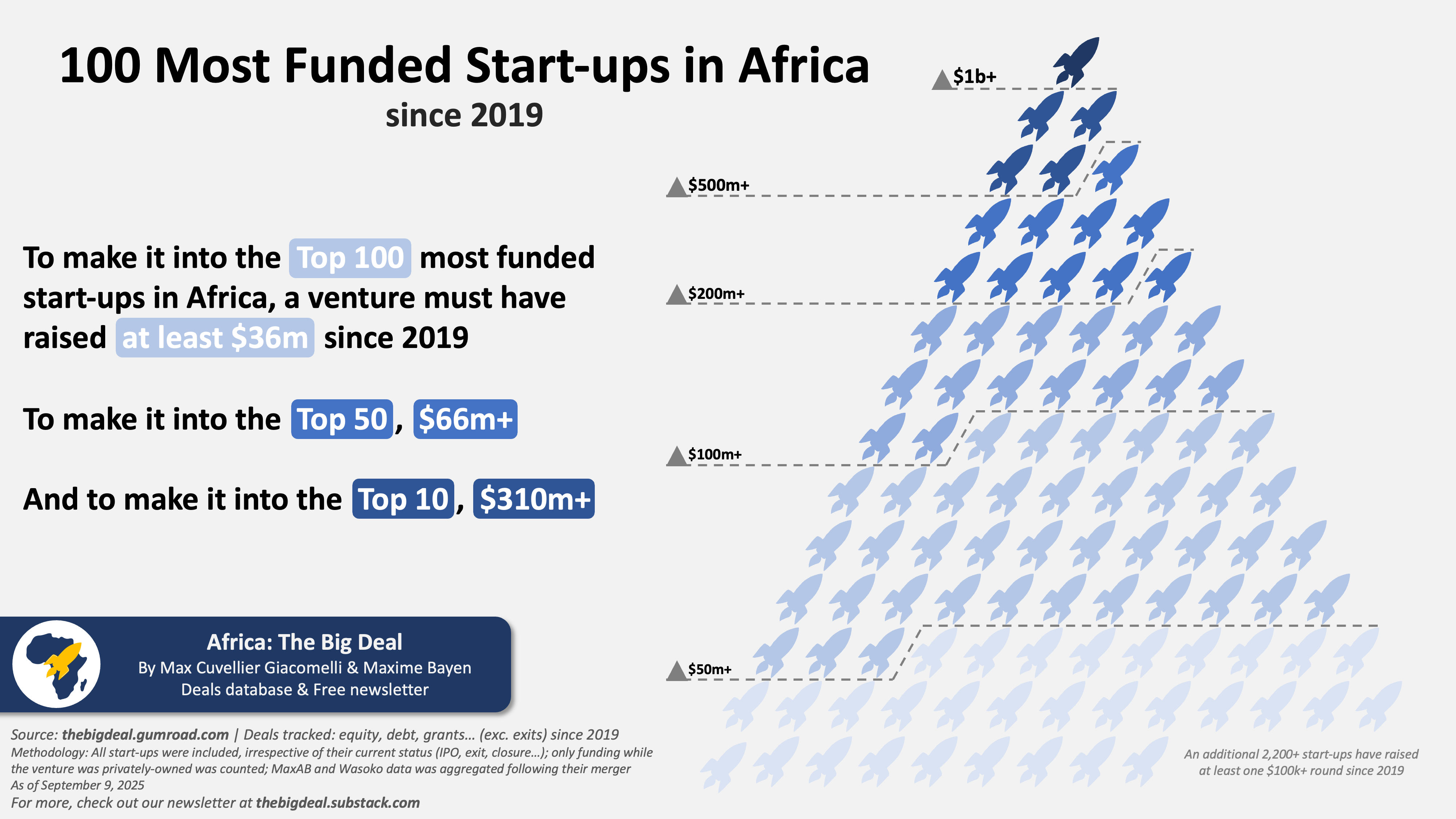

First off: What does it take for a start-up to make this Top 100? Well, it needs to have raised at least $36 million since 2019. Some have raised much, much more than this obviously (we’ll come back to those in a second), but some joined the club just a few weeks ago such as PaymeNow who raised $22m in July (on top of the $14m in debt they had raised in 2023), or Breadfast who topped up their funding with a $10m Series B2 last month. If it has raised at least $100m in total, the start-up is in the Top 30 most funded. To make it to the Top 10, it would need to have raised over $310m. In the Top 5, we find those who claimed over half a billion in combined funding: TymeBank ($530m+), Opay ($570m+), d.light ($617m+) and Sun King ($877m+), with big differences however in terms of the equity/debt split: 100% equity for the two former, 6% equity/94% debt for d.light and 45%/55% for Sun King. ‘Only’ MNT-Halan has recorded more than $1 billion in funding since 2019.

One last thing (for today): Collectively, these Top 100 most funded start-ups have claimed over two thirds (69%) of all the funding raised by start-ups (2,300+ in total) on the continent since 2019 ($12.8b out of $18.7b). More specifically, they’ve attracted 65% of all equity ($9.4b out of $14.4b) and as much as 86% ($3.3b out of $3.8b) of the debt raised on the continent over the period.

Continue reading the story here:

Let’s stop here for today. There was quite a bit of scene-setting, I know, but I think you’ll find the next posts quite interesting. In the meanwhile, if you need access tot he underlying data, you know you can find it by subscribing to our database. You’ll join hundreds of people who receive the fresh data every month, and seem to find it very valuable (if we judge by our 4.9/5 rating). Feel free to also support us by amplifying our work on social media. And don’t hesitate to tag us (Africa: The Big Deal, Élodie, Maxime and myself). on Linkedin for instance. A bientôt. Max

i've been trying to reach you Mr. Giacomelli..!

please contact me as soon as you see this comment.

Thank you.