It’s not just about Fintech... - Top💯 cont'd

The Big Four dominate the charts. Fintech is the most represented sector, but maybe not as much as you'd think...

Last week, we shared a high-level view of the start-ups that had raised the most funding since 2019 in Africa:

This week we’re going to dive a little bit deeper into where they are based, and what sector they operate in. Spoiler alert: No, they’re not all fintech!

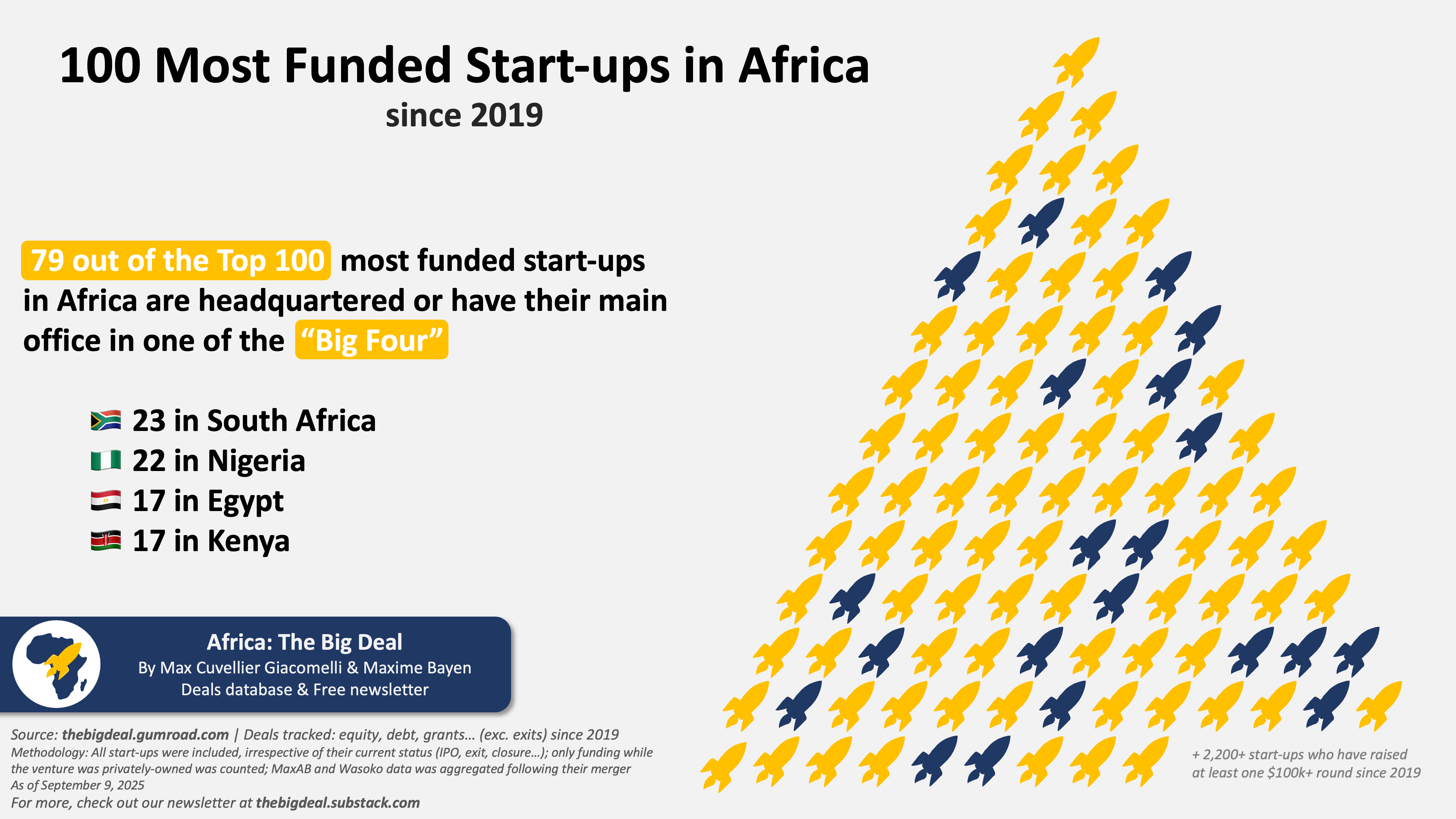

But let’s look at the map first: expectedly, out of the Top 100 most funded start-ups on the continent, roughly four out of five are headquartered or have their main office in one of the ‘Big Four’. The most represented country is South Africa with a total of 23 ventures, followed closely by Nigeria (22). Nigeria however has the highest share of start-ups in the Top 20 with 7 out of 20: Opay, Flutterwave, moove, Interswitch, Moniepoint, PalmPay… and Andela though the company’s leadership is heavily US-based, and the focus on Africa less prominent than it once was (at least on their website).

Africa Tech Festival is back for its 28th edition (!), showcasing a brand new identity that reflects the evolution of the continent's technology landscape. The week-long celebration will showcase how tech and strategy are transforming Africa's diverse industries, and give founders & Funders an opportunity to engage with the wider tech ecosystem, and access networking, sector-deep content and curated matchmaking at the continent's largest tech & innovation event. Interested? Find out more here and

Next are Kenya and Egypt, with 17 ventures each. The biggest difference between the Big Four is probably that in South Africa a good majority of these ventures are fintech (15 out of 23; think TymeBank, onafriq (f.k.a. MFS Africa), Jumo, Planet42…); in Egypt and Nigeria, it is almost half of them. In Kenya however, you only have 2 out of 17: Pula, and M-Kopa (which we recently relabelled as a Fintech but has deep roots in the Energy space). But we’ll come back to sectors in a moment.

First, let’s take a minute to look beyond the Big Four. Ghana is the most represented with a total of 5 start-ups (mPharma, Fido, CarePoint, Zeepay and PEG (acquired by Bboxx back in 2022)). Eleven additional markets have at least one representative on the list: Algeria, Morocco and Tunisia in the North; Benin, Côte d’Ivoire, Senegal and Togo in the West; Rwanda, Tanzania and Uganda in the East; and the DRC. All in all, the most-represented sub-region is Western Africa (31), with Southern, Eastern and Northern Africa almost tying. We couldn’t quite decide where to place Chipper Cash though, as they have strong roots in both Ghana and Uganda…

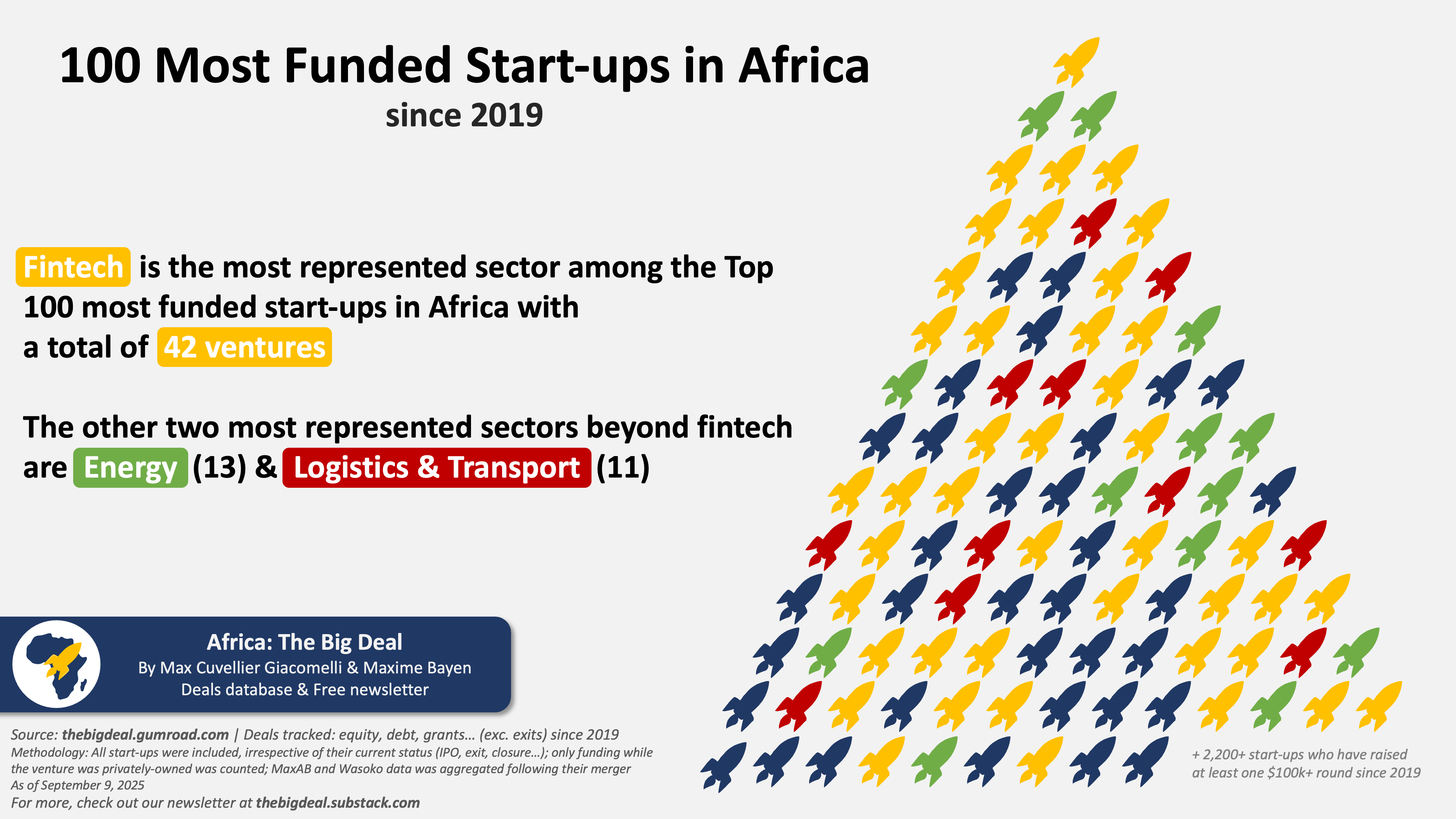

Now on to the sector view. It won’t be a shocker: Fintech does come out on top with 42 ventures in our Top 100. Yet, it is quite far from the shortcut we sometimes hear that ‘only fintechs can raise big money in Africa’. As a matter of fact, the Top 100 is a pretty diverse group with quite a few start-ups in Energy as we’ve mentioned before, but also Transport & Logistics (think moove in Nigeria, Yassir in Algeria or Swvl in Egypt). We also find a few AgriTechs (e.g. Apollo Agriculture or ThriveAgric), some retail start-ups (MaxAB/Wasoko, TradeDepot, or Omnibiz), and 8 Healthtech ventures on the list (LXE Hearing (ex-HearX), Pharma, Cape Bio Pharms…). As well as a long tail of ventures in more niche sectors, such as Sistema.bio in waste management, SunCulture in irrigation, or the proptech Nawy. Education & Jobs is probably the biggest surprise with only one representative on the list (Andela).

Finally, if we group together all the ventures that we can broadly tag as ‘climate tech’ - therefore straddling multiple sectors -, we find that 26 out of the Top 100 most funded start-ups in Africa since 2019 can fall into the ‘climate tech’ category. Half of them are energy ventures (Sun King, d.light, Burn etc.); the rest are mostly Agri & Food (e.g Apollo Agriculture, Komaza) and green transportation (Spiro, Basigo, Ampersand).

Continue reading the story here:

Voilà, that’s it for Part 2 of our analysis on Africa’s most funded start-ups. Your feedback and support sharing our work continues to be much appreciated, and please don’t hesitate to tag us when you do! If you’re curious about the underlying data, and the type of analysis you could do for yourselves, check out our deals database which is available for readers of the newsletter at a discount here. Have a lovely week, and see you next Tuesday for Part 3, focused on founding team size, founder and CEO gender, and more… Max