All things seem possible in May 🌺

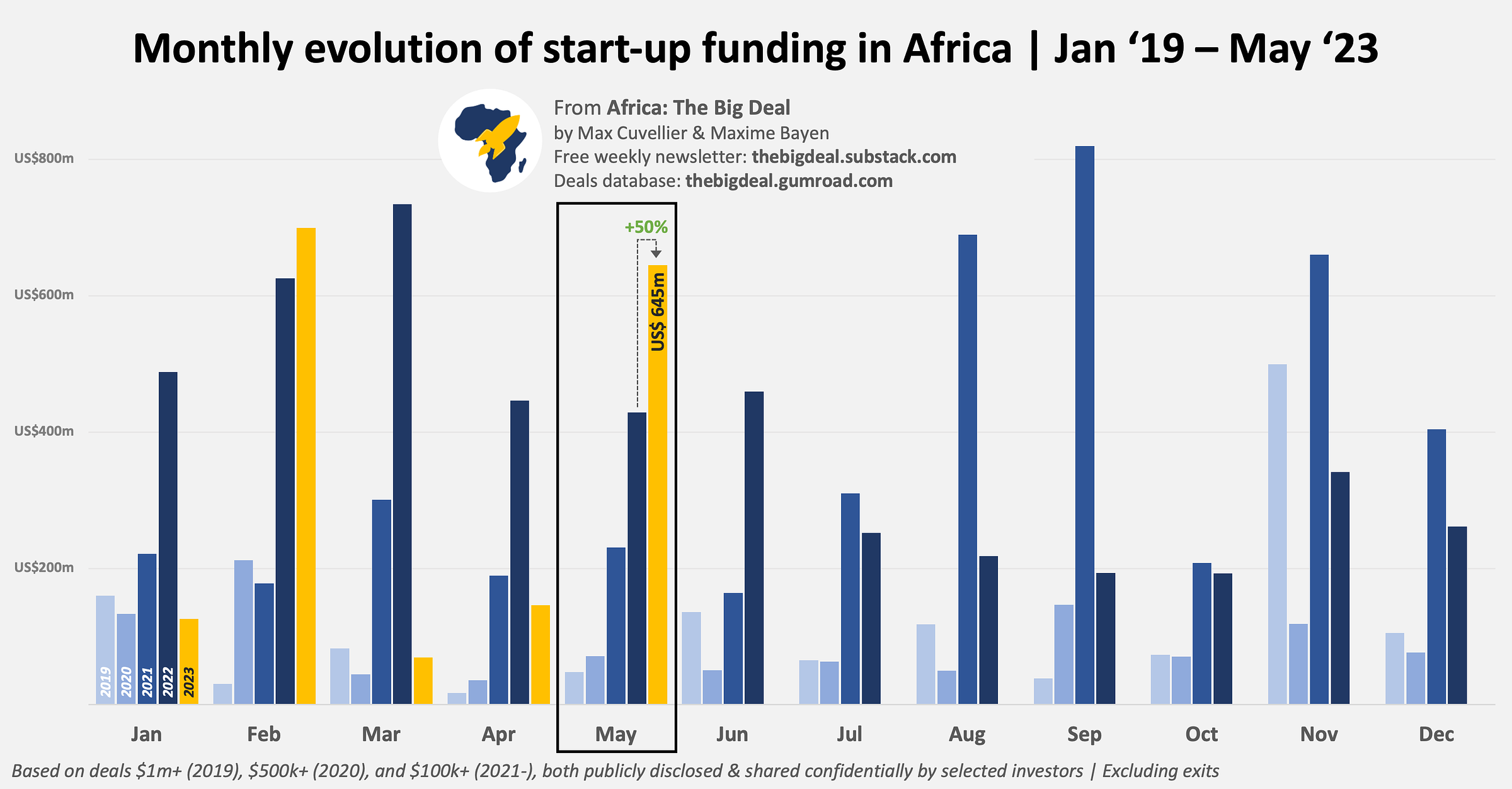

The ecosystem recorded strong funding numbers in May ($645m+, +50% YoY)

First of all, I’d like to thank again our guest contributors Temi, Jasiel, Brian and Zach for the great content they produced and that was published while I was off. If you’ve missed their pieces on valuations, diplomas and logistics & transportation respectively, it’s still time to right that wrong ;)

A few days ago, the subscribers of our database received their monthly update including a comprehensive list of $100k+ deals on the continent for the month of May. They were probably pleased to notice that the numbers were quite good. Some may even have thought that it was getting a bit warm for a ‘funding winter’… 😉

In May 2023, start-ups in Africa raised $645 million through at least 50 $100k+ deals (excluding exits - but there were no exits recorded last month in any case). In terms of amount raised, these numbers are much higher than in April (4.4x MoM), but also than in May 2022 (+50% YoY); May 2023 was actually the best month of May the ecosystem has ever had in terms of funding raised. The largest contributors to these numbers are two energy and one fintech companies (nothing too surprising): M-Kopa ($200m debt + $55m equity), Sun King ($150m) and TymeBank ($78m pre-Series C). From a number of $100k+ deals point of view, there was very decent progression compared to April (+61% MoM) through we’re still far from May 2022 levels (50 vs. 86, -42% YoY). A similar trend can be found if we look at $1m+ deals (+57% MoM, -51% YoY).

Now, is it the end of the tunnel? As always, it’s hard to say. And while the numbers are certainly encouraging, they could also bring false hopes, like in February. Actually, February was a ‘better’ month than May in terms of both funding raised ($700m vs. $645m) and number of $100k+ deals (56 vs. 50). Yet March then saw the amount of funding drop 10-fold month-on-month ($70m vs $700m). We know though that monthly trends can be quite volatile, especially as large deals influence these trends a lot: in fact 3 companies (MNT-Halan, M-Kopa and Sun King) represent nearly half (48%, $805m out of $1.7bn) of all the funding raised on the continent in 2023 so far; this percentage goes up to 58% ($983m) if we add Planet42 and TymeBank to the list.

In any case, here’s hoping that this is the beginning of an actually warming up!

India is the world’s fastest-growing consumer market with 23 unicorns and nearly 100k startups. Can an African start-up with global ambitions afford not to look at India, whether it’s for its expansion, recruitment or outsourcing? The Third India-Africa Entrepreneurship & Investment (EAIF) Summit will take place in Mauritius on 20-22 July and could be a great opportunity for you to access 450+ angel and VCs, network with Indian founders and investors, or meet your next co-founder or CTO! To find out more, and Apply to be a participant (attendance is free):

It feels good to be back! (well, let me be honest for a second: it also felt really good to be away 😉). And given the positive feedback we’ve received, we’ll explore doing more of those guest posts next time we want/need a break. If you think you have a unique angle our readers would enjoy, do get in touch! Oh, and don’t forget you get a discount as one of our readers if you subscribe to the database. Not sure it’s worth the (little) money? Our rating’s at 4.9 out of 5, so we might be doing something right here…