🚛 Who drives growth in Logistics & Transport? (pun intended)

What Brian Njoroge and Zach White learned diving into our Logistics and Transport sector data

This week’s article is brought to you by Brian Njoroge and Zach White, as part of our Guest Post series. Follow Brian, Zach and GSMA Mobile for Development on Linkedin for more insights.

« As part of our new report on the rise of digital transportation in Africa outlining the landscape of the transport sector in African cities and the opportunity of digital innovation to transform the sector, the GSMA Digital Utilities team explored funding and financing trends in transport using data from The Big Deal database. Here are some highlights:

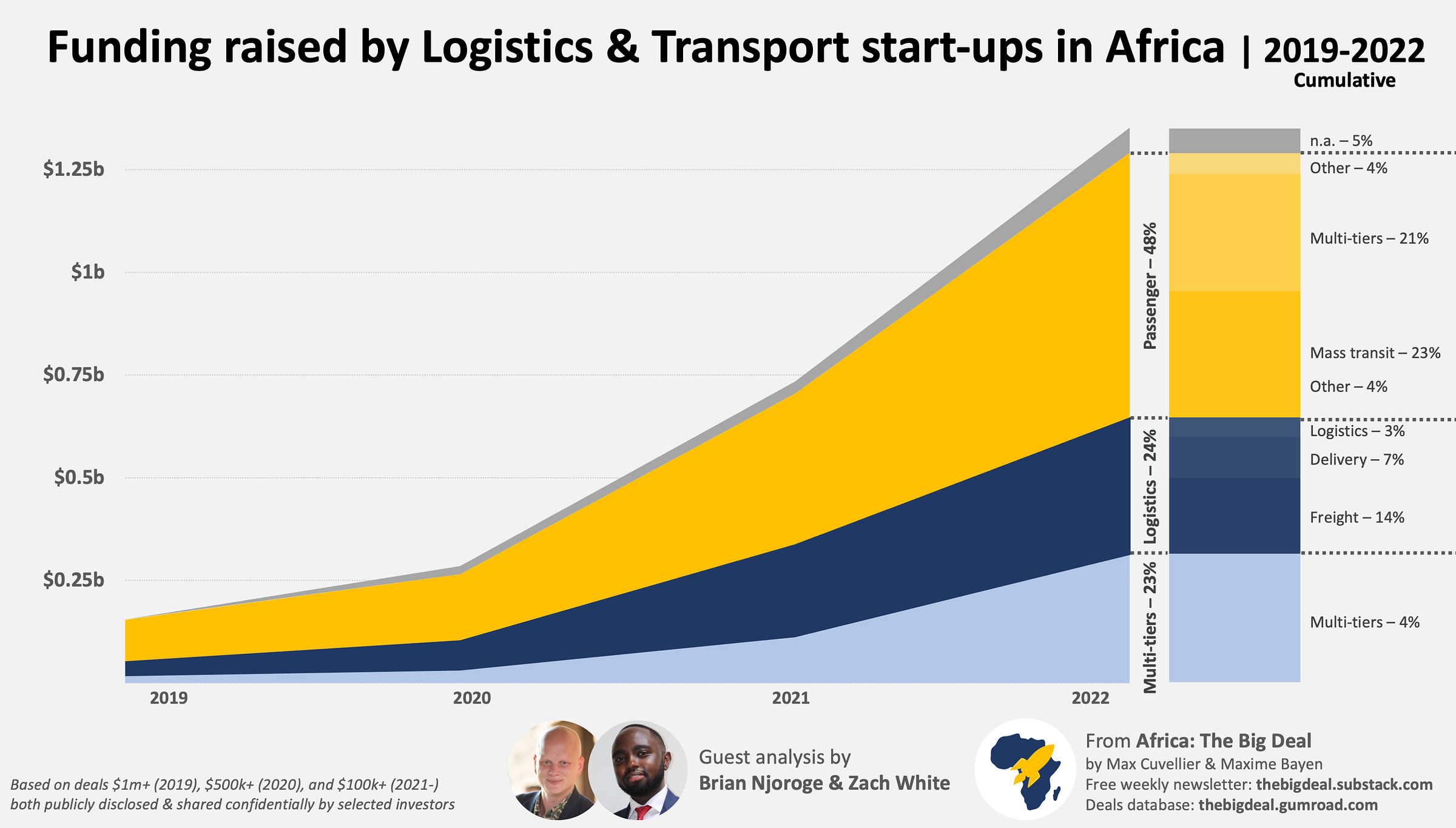

The Logistics and Transport sector is moving forward: nearly $1.4 billion dollars has been tracked in the last four years, making it the third largest sector by deal value behind fintech and energy. Between 2019 and 2022, the sector saw strong growth YoY with a CAGR of 78% (with +38% in the last year). This funding was channeled into 161 companies through 255 deals.

48% of the sector funding went to passenger transport ventures, such as ride-hailing platforms, mobility and financing platforms. Moove, Swvl, and Yassir raised a combined ~$700 million during the period. With the push for sustainable transport, we expect to see the acceleration of electric vehicles on the continent, backed by financing especially from climate funds, and incentives from governments. The logistics sector on the other hand raised 23% of the sector’s total funding with the majority supporting digital platforms for freight and delivery. B2B platforms in the cargo and trucking services unsurprisingly raised the most funding, with the top three companies - Kobo360, Trella, and Lori Systems - raising a total of $135m. The rest of the funding in the sector went to multi-tiered business models that cut across both passenger and logistics. Across the broader sector, the platform market is already disrupting the space through formalisation (e.g. of the taxi and paratransit industry), and the increasing growth of e-commerce and delivery services.

While the funding numbers are skewed by large deals from the players listed above, there is also a strong pipeline of early-stage funding rounds (45 deals $100k-$1m in 2021; 43 in 2022), hinting at an increasing interest from funders in the sector. Additionally, the growth of debt financing in the sector suggests that many companies are on a firmer financial footing. Behind these numbers are start-ups changing the face of the logistics and transport sector, especially in African cities. They are bringing tailored offerings that address some of the most pressing needs: access to finance for individuals, coordination in a fragmented sector and accelerated adoption of electric mobility. One question that arises though relates to the ability for these solutions to meet the needs of low-income urban populations…

Finally, it is worth noting that while this analysis covered the four years to the end of 2022, the recent global slowdown in tech investment seems to also be impacting the transport and logistics. For instance, in Q1 2022 there were over $220m in deals tracked in the transport and logistics (thanks, in part to a $115m raise by Moove in that quarter) while in Q1 2023 only $25 million in deals were tracked. It is clear the sector has not escaped the investment winter; less clear are the longer term implications… »

You should really have a look at the report that inspired Brian and Zach this post, and I’m not just saying this because it is part of the great work the GSMA Digital Utilities programme does (part of the portfolio I manage in my ‘real job’ at GSMA). We love it when people take our dataset, apply specific sector knowledge, and go deep into the data. We look forward to this happening again and again in other fields. In the meanwhile, Thank You Brian and Zach for this collaboration!