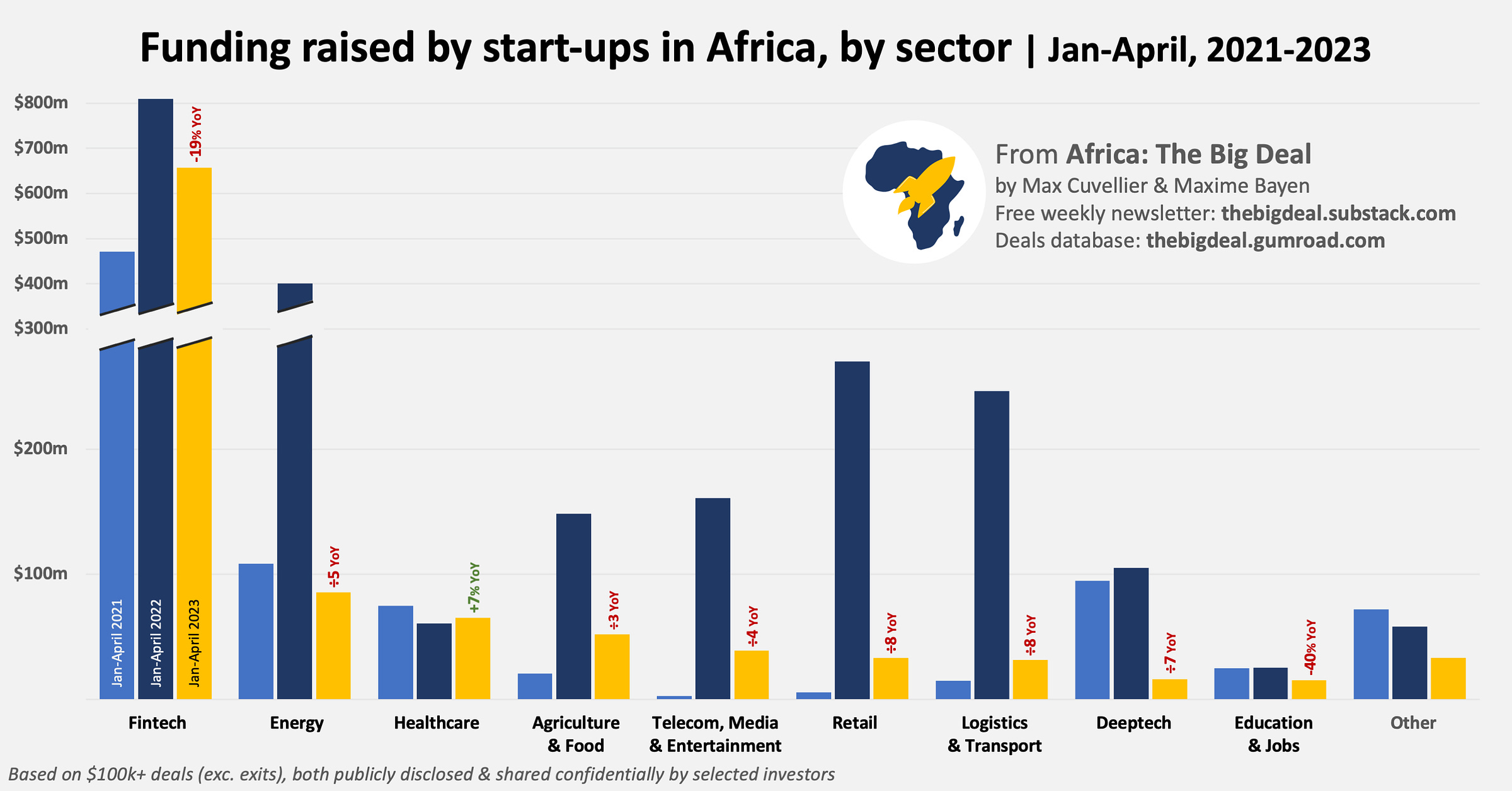

Everybody seems unwell. Save for healthtech maybe.

Apart from Healthcare, all other sectors are recording funding levels significantly lower than last year

This week we continue to analyse the VC slowdown in 2023 so far (Jan-April) characterised by a YoY halving of both the number of $1m+ deals and amount raised (exc. exits), and mounting pessimism: three quarters of readers who took our little poll consider things will either stay grim… or get grimmer. Last week, we saw how things are looking better for some markets (South Africa, Egypt), not so much for others (Nigeria, Kenya). Now let’s dig into the numbers with a sector lens:

Fintech’s doing better than average from an amount raised perspective (-19%YoY) - thanks to MNT-Halan’s $400m raise mostly - and represents 64% of all funding raised in Africa in Jan-April (vs. 35% in the same period last year). With only 36 $100k+ deals announced this year so far though, it tracks well below the same period last year (107, -66%) and in 2021 (73, -50%) in terms of deal activity.

The amount raised by Energy start-ups in Jan-April is 5x times lower than what it was in the same period last year (and also lower than J-A 2021) - though M-KOPA’s $250m+ raise announced yesterday will certainly sway these numbers once it’s accounted for… It is the sector that’s doing best in terms of YoY evolution of number of $100k+ deals (+50% YoY, 12 deals in J-A 2023 vs. 9 in J-A 2022).

Despite ‘only’ recording a +7% YoY rise in funding in 2023 so far, Healthcare takes third spot (up from eighth position at the same time last year), being the only sector recording positive YoY growth, contrasting with the steep decline almost everywhere else. The number of $100k+ deals is down 50% YoY though.

Deeptech is failing to maintain funding levels from both 2022 and 2021. That said, InstaDeep’s acquisition back in January (an exit, therefore excluded from this analysis) will no doubt remain one of the top stories of 2023.

Logistics & Transport and Retail have taken a beating with funding levels 8 times lower than J-A last year, yet still much higher than what they were at the same time in 2021. Number of deals in J-A 2023 for both sectors are tracking below J-A 2022 and J-A 2021 levels.

Agriculture & Food and Telecom, Media and Entertainment are also recording much lower funding levels than in J-A 2022 (3-4x times less), yet higher than in J-A 2021. In terms of number of deals they aren’t doing as bad as other sectors: -25% YoY for TM&E, and even a slight growth (+6% YoY) for Agri & Food.

The decline in amount raised for Education & Jobs is less acute than average (-40% YoY) yet both funding raised and number of deals in Jan-April are lower than 2022 and 2021.

Thanks to all of you (7.5k subscribers as of last week: Sweet!) for reading this newsletter - “newsletter de référence” according to Jeune Afrique - every week, and for sharing it with your networks. Now, I’m going to be off for a little while (“maybe” getting married and going on our honeymoon), but don’t you worry: first of all, Maxime and Elodie will keep updating the database of course. And when it comes to the newsletter, we’re leaving you in very capable hands with guest posts from esteemed readers. Who?, you wonder. Well, you’ll find out soon!…