📌 How does location impact valuation?

What Temi Ransome-Kuti learned analysing 200 African start-up valuations

This week’s article is brought to you by Temi Ransome-Kuti, as part of our Guest Post series. For more content from her, follow her on Twitter and on Linkedin.

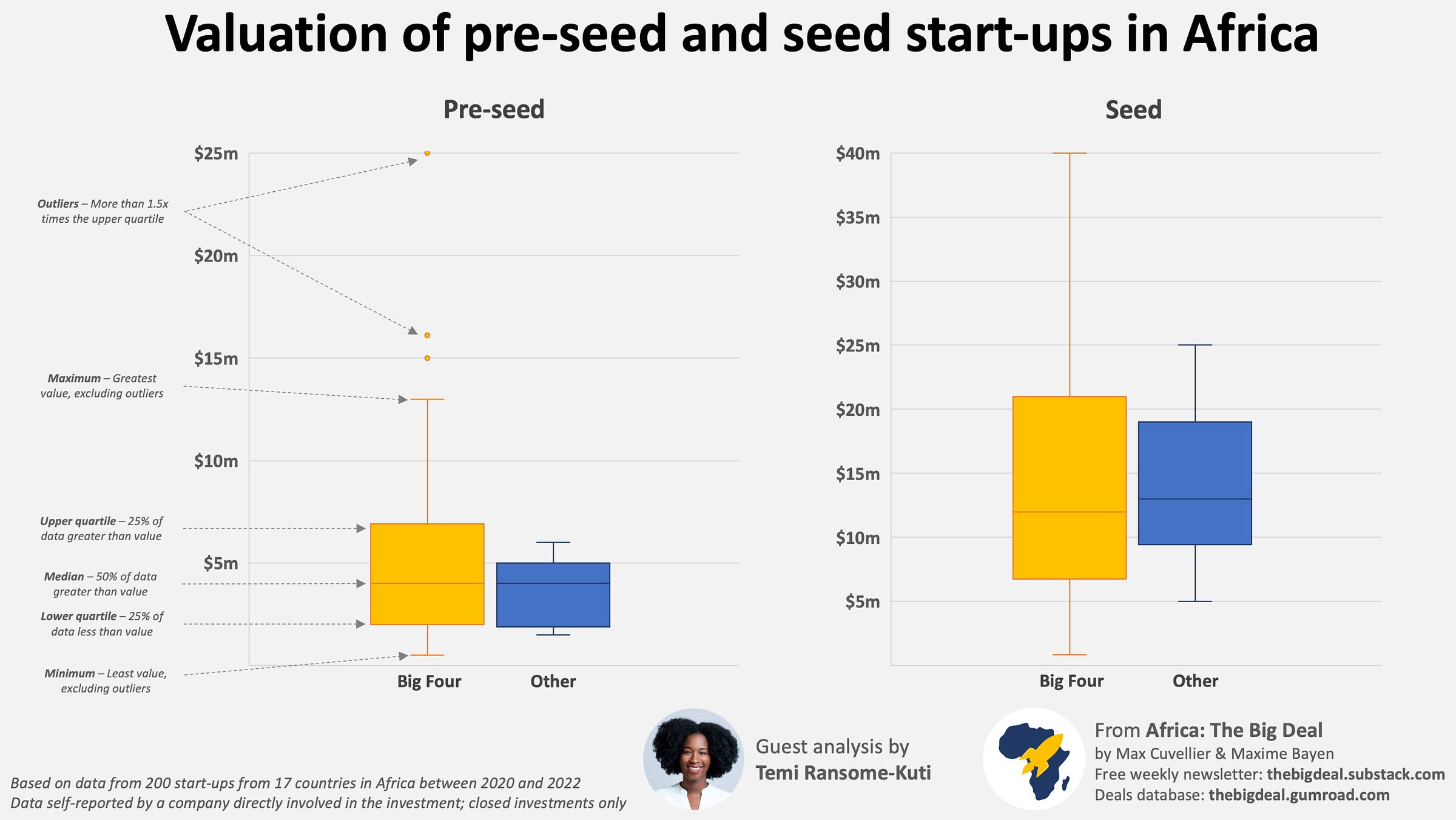

« Over the past year, I collected 200+ valuations from early-stage start-ups that secured venture capital funding from 2019 to 2022. According to my research, where a start-up is primarily located could have an impact on its valuation. One of the interesting observations was the difference in valuations between start-ups based in Nigeria, Egypt, Kenya, and South Africa (the ‘Big Four’) and start-ups based in other African countries.

At pre-seed, the first graph shows that of the sample collected, there were differences in valuations. Start-ups in one of the Big Four had a wider range of valuations, primarily between $1m and $13m with some outliers valued between $15m and $25m. The middle 50% of the valuations were between $2m and $7m. For start-ups in other African countries, the range was narrower between $1.5m and $6m, and the middle 50% of the valuations were between $2m and $5m.

At seed stage, a similar trend emerges. Countries in the Big Four had a wider range of valuations between $835k and $40m and the middle 50% of valuations were between $7m and $21m. Countries in other African countries had valuations between $5m and $25m, and the middle 50% of the valuations were between $8m and $19m.

The differences in valuation, especially on the upside, are likely due to market size, strength of the entrepreneurial ecosystem, and VCs’ familiarity with the country. Thankfully, we are starting to see more local funds and start-up stars emerge from underrepresented markets. Ideally, this will encourage more VCs to strongly consider and seek more exciting investments beyond the Big Four. For more insights from the research - including analysis by country, by year and by sector - you can read the full article here. »

We really encourage you to read Temi’s piece in full, as it provides unique insights into valuations, an area for which data is very scarce. Though we do include valuation data in our database when it’s publicly available, it very seldom is. The raw data Temi collected is confidential - I’m sure you can see why! - but the analysis she provides is a precious contribution to the conversation on start-up funding on the continent. Thank You Temi for this collaboration!