A not so chilly funding winter for Kenya ⛰️

Sharing our full Q3 Round-Up deck, and a quick zoom on Kenyan numbers

First of all, you can find the link to download the deck behind the three-part Q3 2024 Round-Up we published in the past couple of weeks 👉👉here👈 👈 . We’re always very happy to see our content pop up all over your decks and social media; we’re just asking you to make sure you quote us when you use it, just so others can know how to find more…

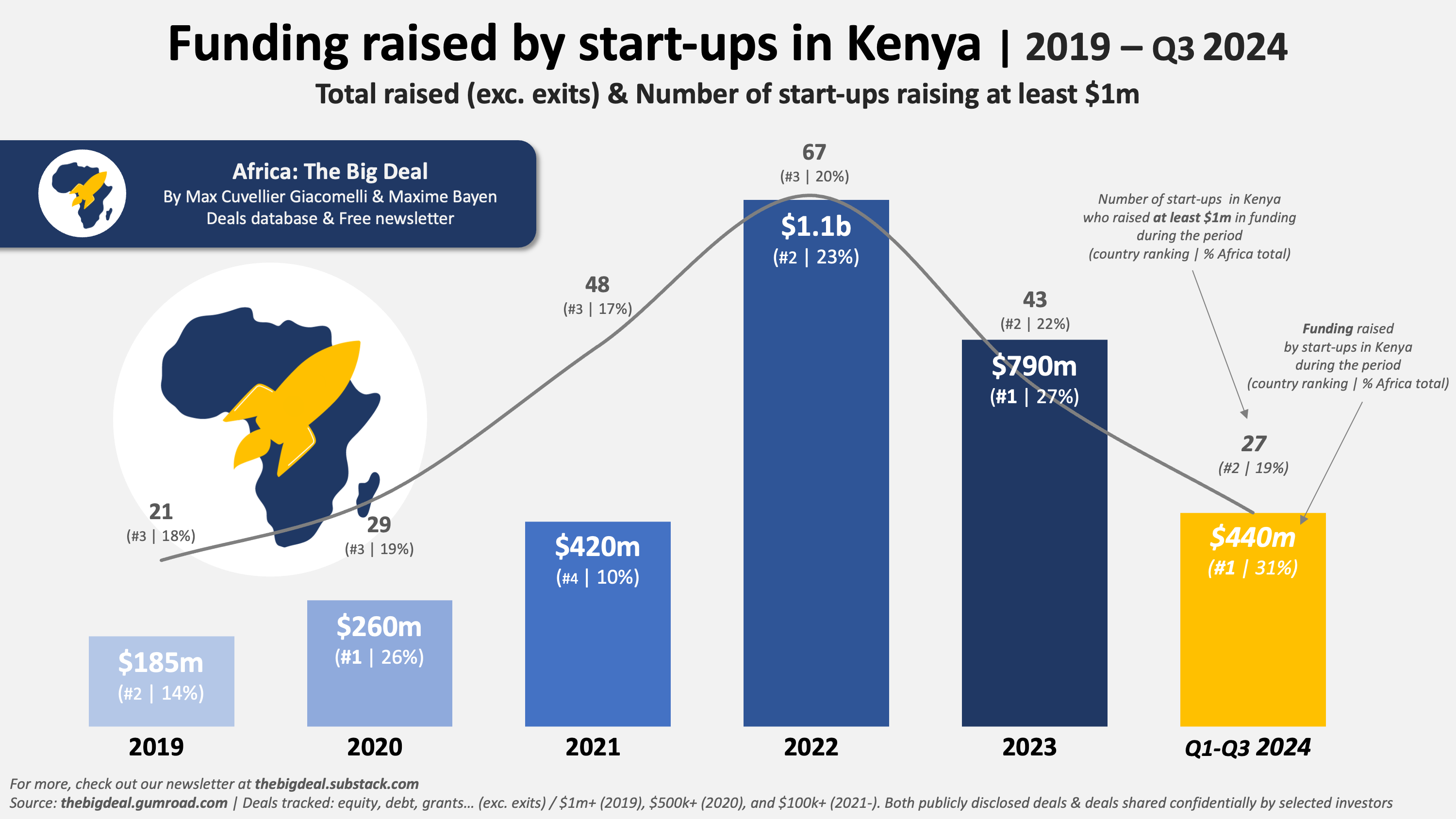

Also, I am actually in Nairobi this week for a bit of a last-minute trip and I was looking at our database on the plane to get a sense of the trends in start-up funding in Kenya, and I couldn’t resist putting together a quick graph and analysis to share with you all.

Overall, the trend we can observe when it comes to start-up funding in Kenya in the past 6 years is very much in line with the overall dynamics at continent level. But I was mostly curious to see how Kenya was faring compared to its ‘Big Four’ counterparts (who together have attracted more than 80% of all the funding since 2019). And the short answer is: Kenya’s doing pretty well. Indeed, in both 2023 and 2024 so far, Kenya ranks number 1 as the country on the continent that has attracted the most funding over both periods. With 27% of all the start-up funding in 2023 and 31% in 2024YTD, it is punching above its weight compared to its share of Africa’s population and nominal GDP (~4%, #7). Apart from 2021, it has been at either #1 or #2 since 2019, but its share of total funding (31%) is currently at its highest over the whole period. Another indicator which is usually quite telling is the number of ventures in the country who raise at least $1m in the period. Here again, the dynamics are positive: while Kenya’s share has always hovered around 20%, since 2023 it is ranking second (to Nigeria in 2023, and to Egypt in 2024TD).

Overall, it feels like Kenya is doing pretty well relatively to its peers in the funding winter in particular. Indeed, during the funding heatwave (mid-2021 to mid-2022), the country attracted about 18% of the staggering $6.3 billion raised by start-ups on the continent during the 12-month period, ranking second behind Nigeria, but a very distant second as start-ups in Nigeria had raised twice as much as in Kenya then. Since the end of the funding heatwave and the beginning of the consecutive ‘funding winter’ in mid-2022, Kenya is now #1 with 26% of the funding, attracting 1.5x the amount raised in Nigeria (now #3, with Egypt at #2). In terms of number of ventures raising at least $1m during each period, Kenya went from #3 (18%) during the funding heatwave to #2 (20%) since, with Nigeria retaining the lead.

Voilà! That’s it for today, but we’ll be back soon, before you get a chance to miss us. Thanks again for your ongoing support here on substack (11k+ followers) but also on Linkedin (14k followers). And a special shout-out to those of you who are subscribed to our database and using the data to ensure Africa gets the attention - and funding! - it deserves. Have a good week and See you soon. Max

And in case you’ve been living under a rock and missed our Q3 Round-Up, you can bring yourself up to speed here:

![🌅 Here comes the Q3 Round-Up [1/3]](https://substackcdn.com/image/fetch/$s_!NZKp!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd7901e53-3984-400d-b46a-58f88b9a6803_3300x1856.png)

![🌄 The Q3 Round-Up continues [2/3]](https://substackcdn.com/image/fetch/$s_!9lJl!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F31c03e12-60be-4725-8179-6ac6a474bebc_3300x1856.png)

![🌇 Wrapping up the Q3 Round-Up [3/3]](https://substackcdn.com/image/fetch/$s_!i6sZ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa0ddf831-82f1-4da7-b1bd-903c24ede9de_3000x2882.png)

Happy to note about these start-up venture capital.