🌅 Here comes the Q3 Round-Up [1/3]

Funding raised in Africa in Q3 compares pretty well to previous quarters :)

Last week we guided you through the September numbers - which were quite decent -, and it’s now time to zoom out and have a look at Q3 and 2024 so far. We won’t be doing a Linkedin Live this time around; the next one will be in January to cover the full year. But instead you’re getting a multi-part graphics-heavy written update, and maybe even a deck (see poll below). If you really want to hear our voices, you can always rewatch the H1 round-up…

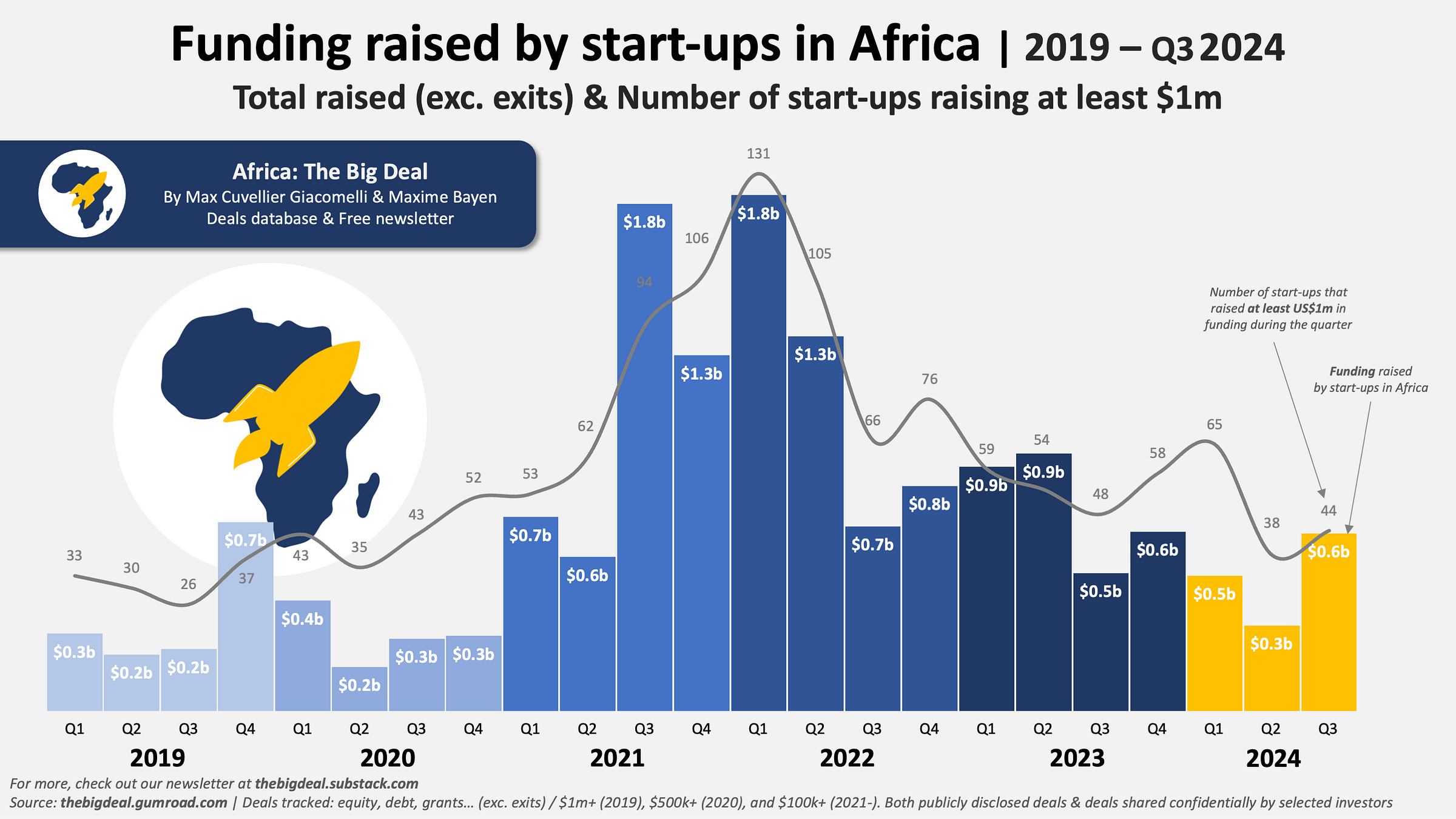

Now let’s look at Q3 first, shall we? Last quarter start-ups in Africa raised over $600m in funding (equity, debt, grants; exc. exits), more than twice as much as in Q2; the best quarter this year so far; and on par with Q3 2023 numbers. These numbers were boosted by two announcements in particular which represented more than half of the amount raised during the period: d.light’s $176m securitisation multi-currency facility and MNT-Halan’s $157.5m funding round. Overall, 44 start-ups raised $1m or more during the period, better than Q2 (which was at a four-year low), but lower than the 2023 quarterly average for instance (55/quarter).

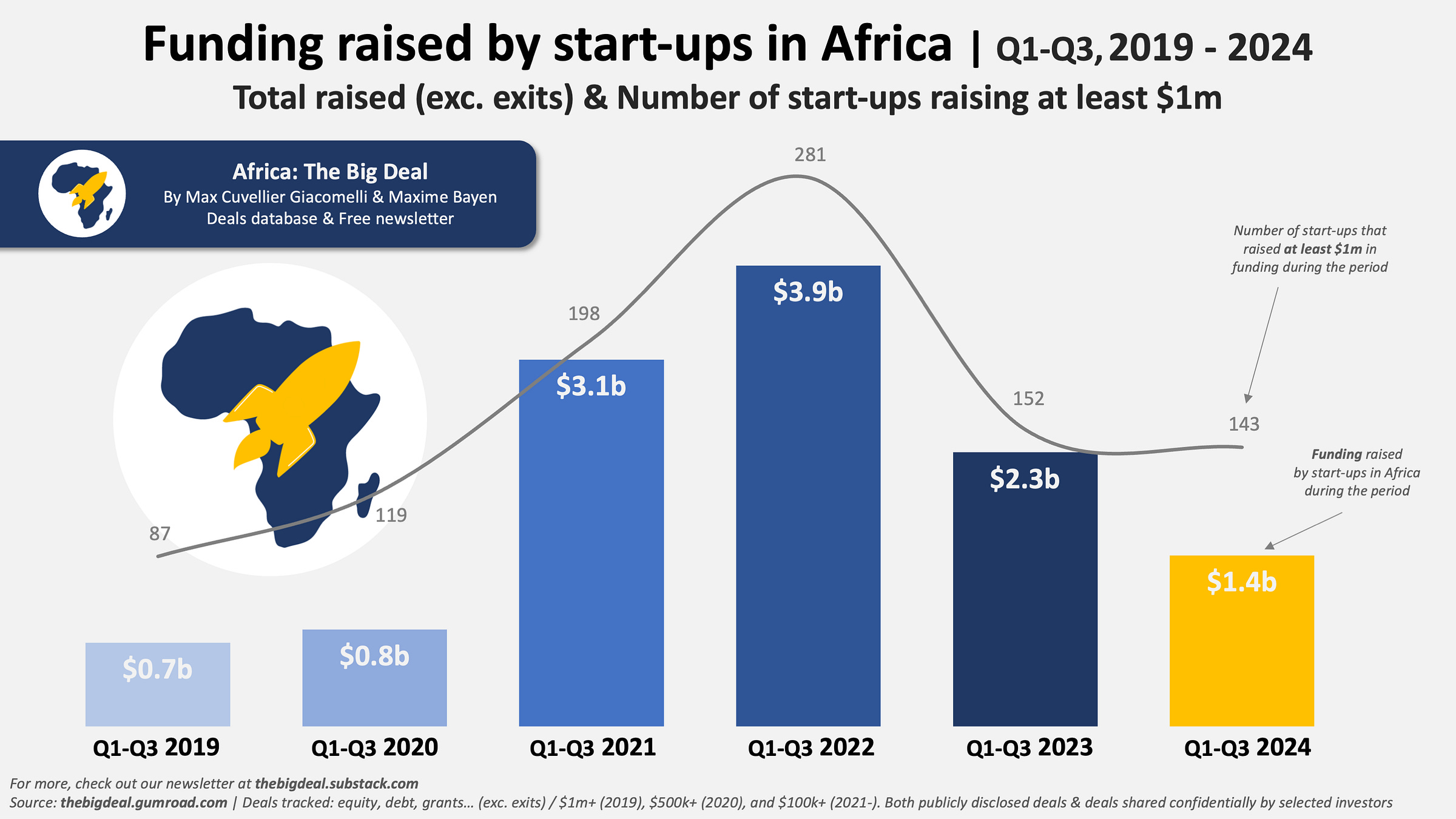

How do things look like if we consider numbers for the year so far (‘2024YTD’)? In terms of total funding raised ($1.4b), they definitely compare favourably to pre-heatwave levels (2020, 2021), but not so much if we focus on the past three years. Indeed, so far this year start-ups in Africa have raised 38% less funding than they had at the same time last year. On the positive side however, the number of start-ups raising $1m or more hasn’t really gone significantly down (-6% YoY).

SuperReturn Africa is back and bigger than ever this December!

Meet the leading names shaping the future of African private capital and join 700+ attendees including 200+ LPs and 350+ GPs for three days full of invaluable networking and unmissable content focused on fundraising, infrastructure, creatives, credit, crisis control and more…

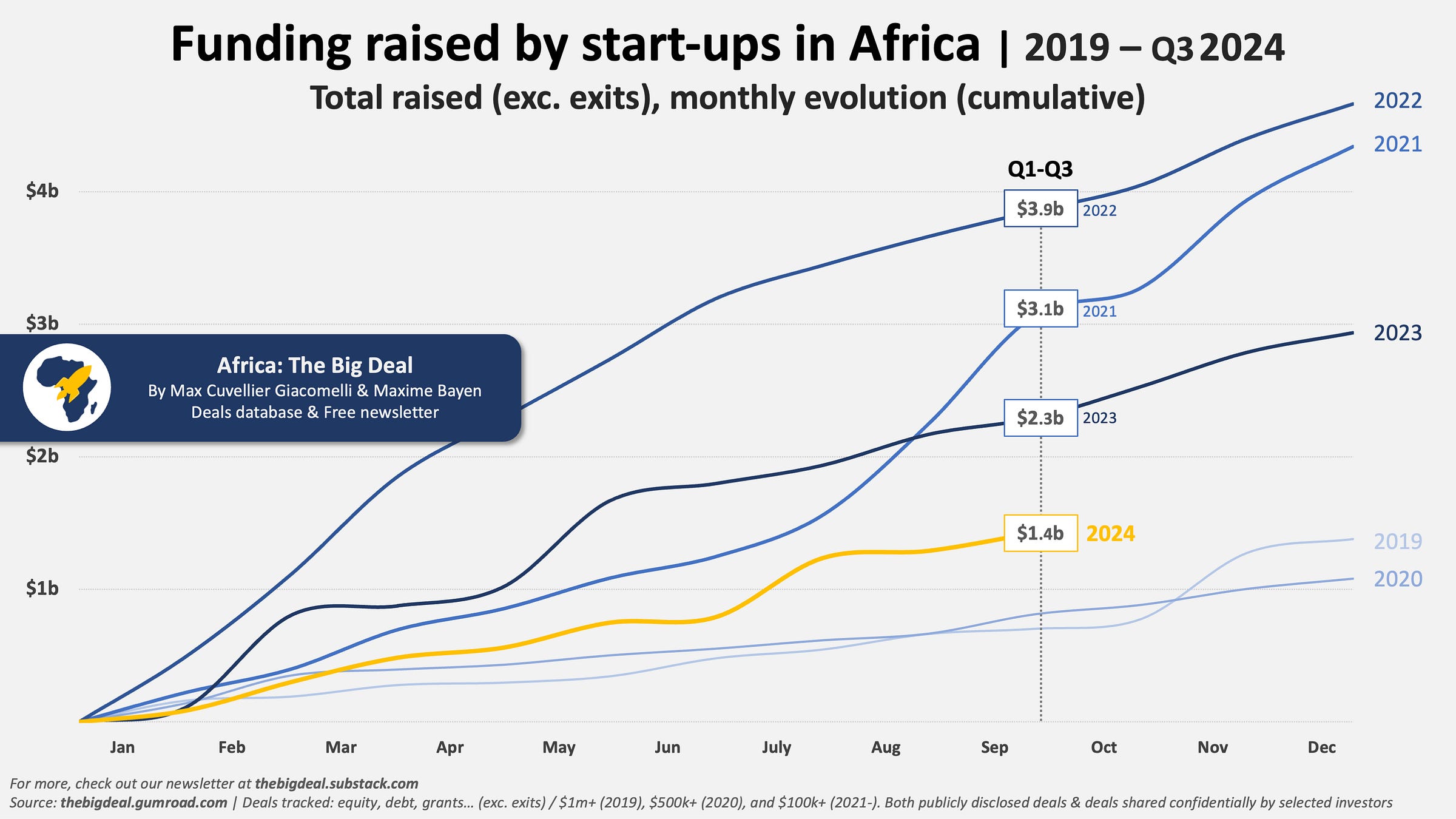

The good news - as you can see on the graph below - is that start-ups in Africa have already raised more funding in 2024 than they had in the whole of 2019 and 2020. On the not-so-positive side though, it is now very unlikely that start-ups will be able to raise more in 2024 than they had in 2023… Indeed, that would require them to raise more in Q4 than they have in the first three quarters of the year combined. To be fair, it almost happened in 2019, but this is not a pattern we have seen repeated since.

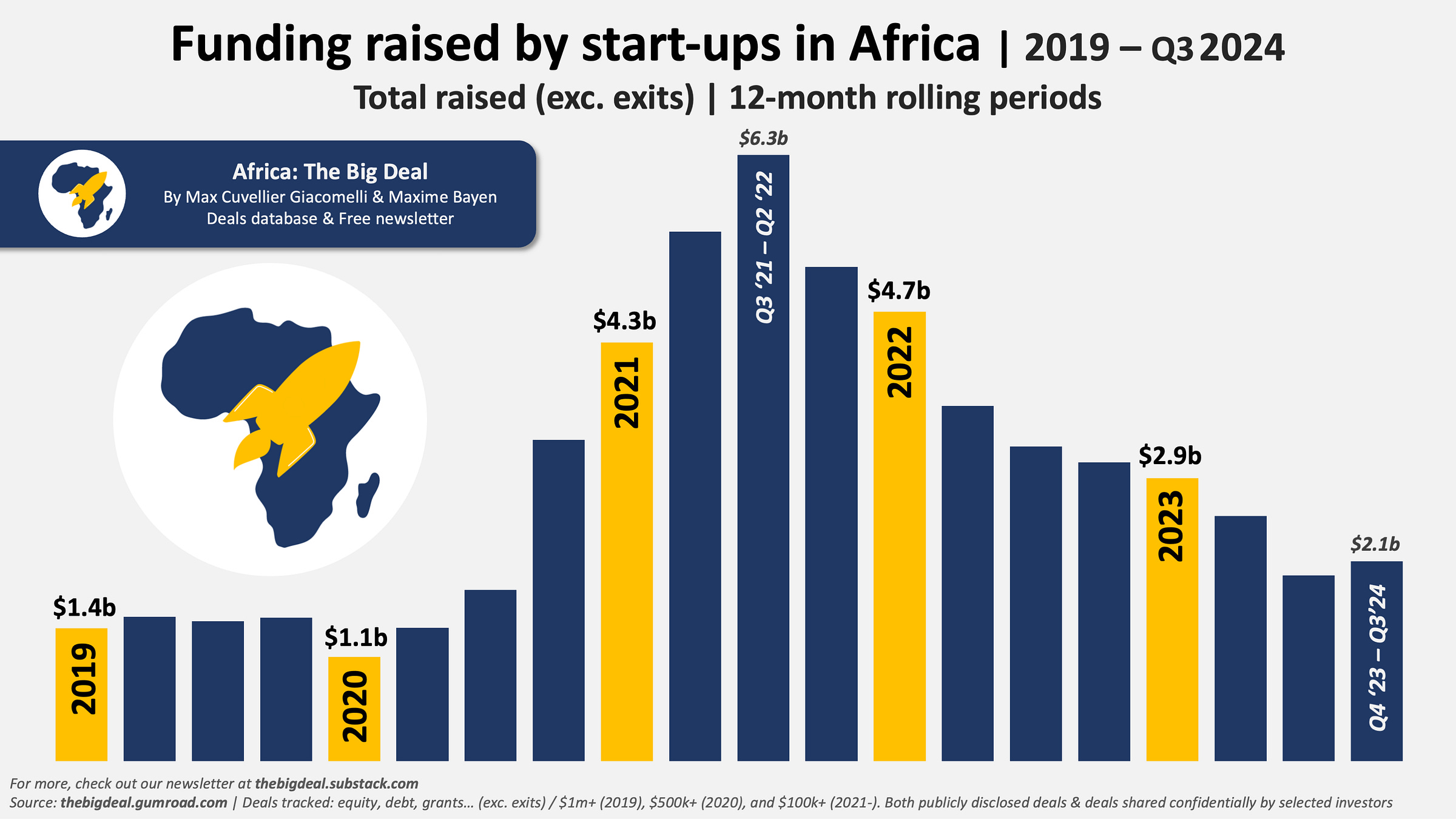

To finish the first part of this analysis on a glass-half-full note, let’s look not at 2024YTD, but at the past 12-month period. And here the numbers are more encouraging. Indeed, for the first time since mid-2022, start-ups have raised more funding in the past four quarters than they had in the previous period. While the growth is modest, we can hope it is an early indication of future growth for the ecosystem…

OK, let’s stop here for today, as it’s already quite a bit of information for you to digest, but we’ll soon be back with additional analysis (debt vs. equity, geographies, sectors, gender…), so don’t worry if we’ve left you hungry for more. And as always, there is a discount code for you to use if you want access to the full dataset with all the underlying data. Oh, and one last thing:

Hi Max!

I really appreciate the content you provide to us on a regular basis. It goes a long way in keeping us apprised on the VC ecosystem in Africa. As a suggestion, would you please compile data on VC exits in your future updates?

Thanks.