🌇 Wrapping up the Q3 Round-Up [3/3]

Kenya and Egypt come out on top. Investments in female-founded and female-led businesses continue to lag.

Wait a minute. Have you read parts 1 and 2 of our Q3 analysis already? If not, we strongly suggest you do before you proceed any further👇

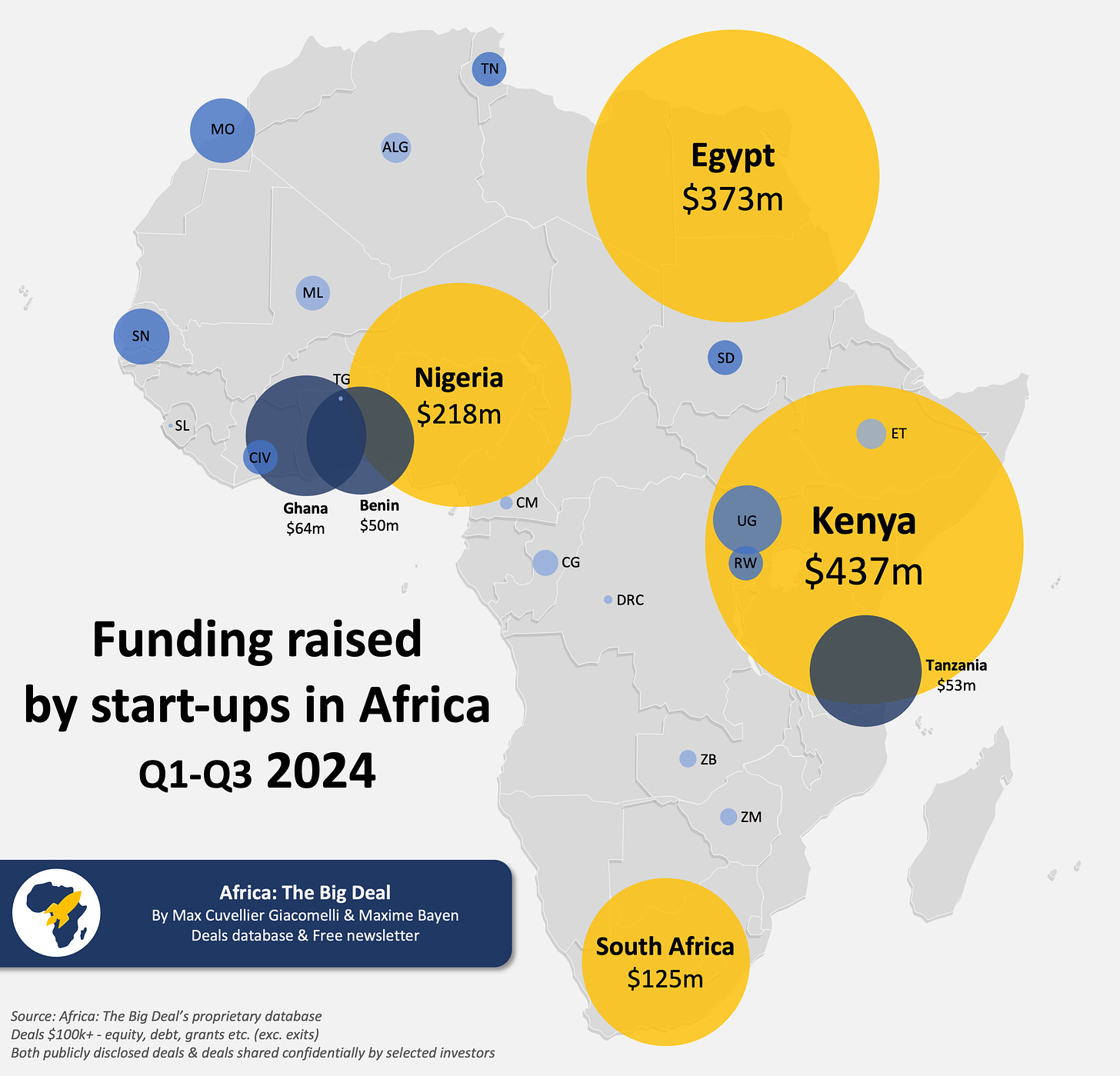

So, we have looked at overall numbers and trends, equity vs. debt, sectors, and now’s the time to look at the geographical split… If we focus on Q3 first, as you can imagine the d.light and MNT-Halan deals (which, as a reminder, represented more than half of the funding raised last quarter) are skewing the numbers heavily. As a result, Egypt ($272m, 43%) topped the charts, followed by Kenya ($201m, 32%), which also means that three quarters of the funding raised in Africa in Q3 went to these two markets alone. What’s happening on the rest of the continent? Four other markets attracted $10m of more in funding during the period: Tanzania ($43m), South Africa ($40m), Ghana ($35m) and Nigeria ($26m); ten additional countries attracted at least one $100k+ deal. 38 markets however registered no significant start-up funding activity during the period.

If we zoom out and focus on 2024 numbers to date - therefore looking at longer-term trends -, we do find our Big Four usual suspects in the lead.

Kenya ($437m, 31%) and Egypt ($373m, 27%) come out on top again with a combined 58% of all the funding raised on the continent in 2024 so far. For both of them, it is their highest share of funding on record since 2019, whether we compare to full years or Q1-Q3 periods. On the opposite side, it means that their other two ‘Big Four’ peers are rather underperforming. Actually, Nigeria’s share (15%, $218m) is comparable to what it was last year (14%). However - as you may remember - 2023 had seen quite a dramatic shift for Nigeria compared to previous years when the country had represented a much bigger share of the funding (35% between 2019 and 2022). With 9% ($125m) of the funding raised in 2024 so far, South Africa is at the moment recording its worst performance since 2019 in terms of its share of continental funding (6%), much below its average share in the past few years (18% between 2020 and 2023).

So far this year, only 18% of the funding has gone to the ‘rest of Africa’ with 23 markets recording at least one $100k+ deal since January 1st. Only five of them have claimed at least 10 such deals since the beginning of the year: Tanzania, Ghana, Morocco, Uganda and Rwanda. For the three markets where at least $50m were raised this year so far, one deal tends to drive the numbers: Spiro in Benin ($50m out of… $50m), Nala in Tanzania ($40m out of $53m) and to a lesser extent Fido in Ghana ($30m out of $64m). The latter two are showing encouraging signs of growth and maturity.

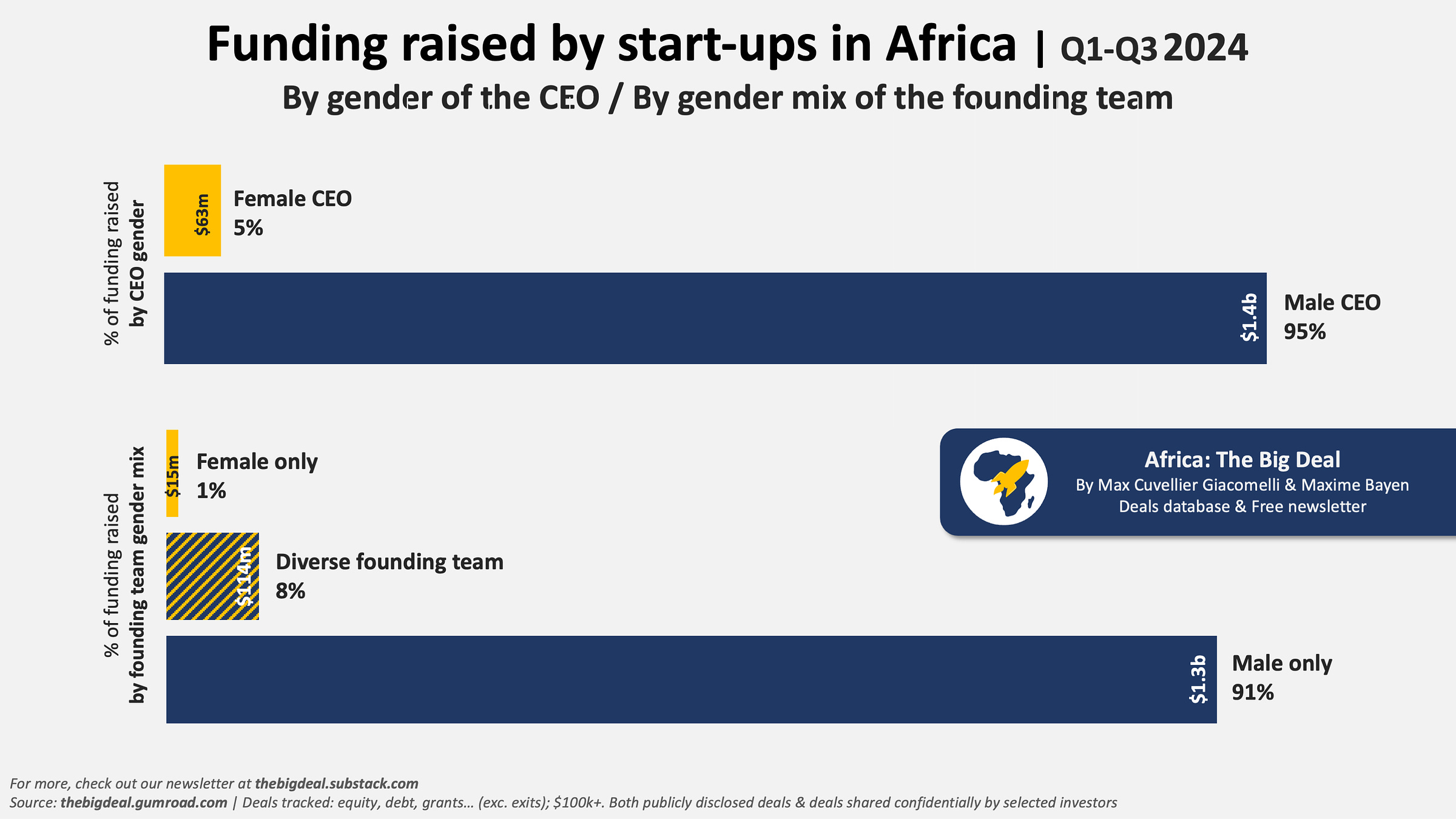

Last but not least, we always look at numbers with a gender lens, hoping that we’ll find signs of improvement. Unfortunately, there aren’t any reasons to celebrate here. In 2024 so far, less than 5% of the funding has gone to start-ups with a female CEO, vs. 5.6% between 2019 and 2023, so no improvement... If we look at the gender make of the founding team: less than 1% of the funding went to funding teams with only women (vs. 2.1% in 2019-2023) and 9% to founding teams with at least one woman (vs. 17% in 2019-2023), so no improvement here either, quite the opposite. To try and end on a positive note, we can celebrate the few women who still manage to make it, despite the headwinds:

Carrol, Cikü, Anu, Belinda... and the 96 male CEOs

·

This concludes our tour of the Q3 and 2024YTD numbers. I think that’s quite a bit of food for thought, but if you have questions, hit us up! Though the answer is probably already in our database and its 3,400+ deals worth over $18.4 billion. Don’t miss our discount code! Oh, and of those of you who took our little survey last week, 83% indicated they would like a deck, so we’ll oblige and share that soon. In the meanwhile: Take care! Max

![🌅 Here comes the Q3 Round-Up [1/x]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd7901e53-3984-400d-b46a-58f88b9a6803_3300x1856.png)

![🌄 The Q3 Round-Up continues [2/x]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F31c03e12-60be-4725-8179-6ac6a474bebc_3300x1856.png)