🌄 The Q3 Round-Up continues [2/3]

Debt seems to be here to stay. And so does Climate Tech.

Before you proceed, make sure you have checked part 1 of our Q3 Round-Up:

🌅 Here comes the Q3 Round-Up [1/x]

Last quarter start-ups in Africa raised over $600m in funding (equity, debt, grants; exc. exits), more than twice as much as in Q2; the best quarter this year so far; and on par with Q3 2023 numbers...

After we published the first part of our analysis on Q3 2024 and 2024YTD numbers last week, the most common question we were asked was what ‘type’ of funding start-ups had raised in Q3… So, let’s have a look at this first. Of the $636m that were raised in Q3 through $100k+ deals on the continent (exc. exits), 62% (almost $400m) were raised in the form of equity, a little over a third (35%) in debt, and the rest (2.5%) in grant funding. It is worth noting that the d.light $176m securitisation multi-currency facility we already mentioned last week alone made up close to 80% of all the debt raised in Q3 ($176m out of $223m). If we consider all the funding raised this year so far, two thirds of it has been raised as equity, and a third as debt:

These proportions are overall aligned with what we’d seen in the same period in 2023, which marked a significant change from previous years. We have covered this at length in the past, but as a reminder, we pin this trend on three main factors: (1) the increased offering in terms of debt capital for start-ups in Africa, (2) the maturity of an ecosystem where start-ups don’t always raise equity by default when what they really need is debt, and (3) a greater propension for ventures to communicate about debt fundraising compared to previous years. That said, debt numbers are most likely still underestimated as start-ups don’t always publicise the ‘split’ between equity and debt when announcing a round... The downside though is that if we focus exclusively on equity, 2024 actually doesn’t compare too favourably to recent years:

In 2024 so far, start-ups in Africa have raised around $920m in equity, which is the equity funding they had raised in the whole of 2020, but far behind 2021 and 2022 levels, and also not quite at the level of the first three quarters of 2023 (-32% YoY). Nearly $800m of equity would need to be raised in Q4 for 2024 numbers to eventually reach the same level as 2023; and the ecosystem hasn’t seen such levels of quarterly equity fundraising since Q2 2022…

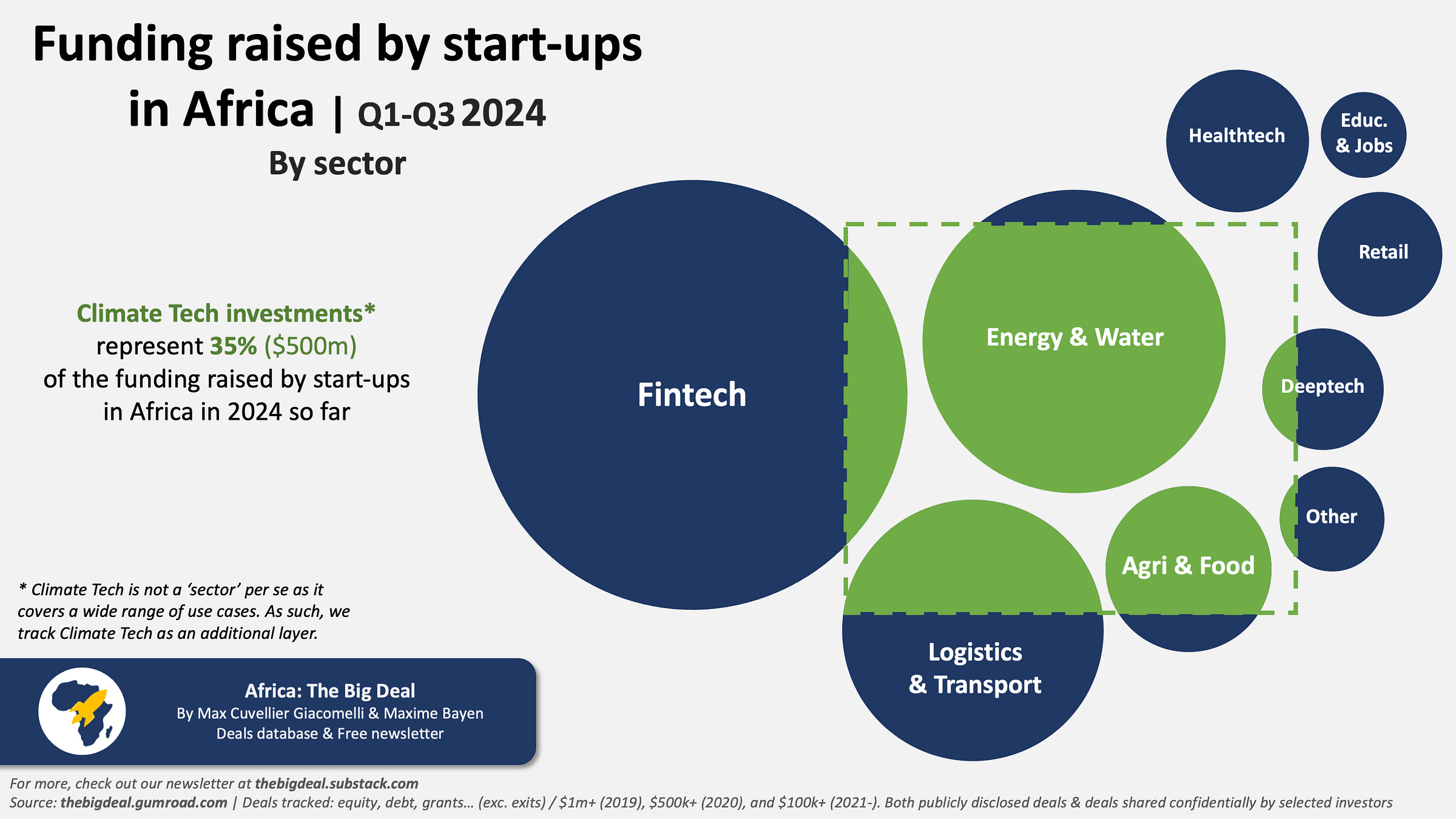

Now, what sectors are attracting most of this funding? In Q3, Fintech ($363m, 57%) and Energy ($199m, 31%) alone attracted almost 9 out of every $10 invested in start-ups in Africa. The numbers are highly skewed by the d.light deal for Energy and the MNT-Halan’s $157.5m raise for Fintech (though five other fintech ventures raised $20m or more in Q3: Nala, FlapKap, Fido, valU and Paymob). If we now look at all the funding raised since the beginning of the year, the view is slightly more balanced:

Fintech remains in the lead ($600m, 43%), followed by Energy (~$300m, 21%), though combined they ‘only’ represent 64% of all the funding invested in start-ups on the continent. Logistics & Transport comes third, driven by the moove ($110m) and Spiro ($50m) deals of the first half of the year. Finally, if we focus on investments that can be tagged as ‘Climate Tech’, we find about 35% of the amount invested in Q3 going to the space. This is in line with overall 2024 numbers to date, with more than half a billion already invested in climate-related ventures in Africa this year so far. This is also in line with the proportion we’d recorded in Q1-Q3 2023.

That’s all Folks! For today, I mean. You’ll be getting the third part of the analysis later this week, where we’ll focus on the geographical split in particular. By the way, do you think you can guess which country is in the lead?👇👇👇 If you want it to be an educated guess, you can already find the information in our dataset which you should access here actually, to get a discount… A bientôt! Max.

![🌅 Here comes the Q3 Round-Up [1/x]](https://substackcdn.com/image/fetch/$s_!NZKp!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd7901e53-3984-400d-b46a-58f88b9a6803_3300x1856.png)