Slow and steady wins the race - August '25

August was relatively quiet, but the yearly outlook continues to look strong

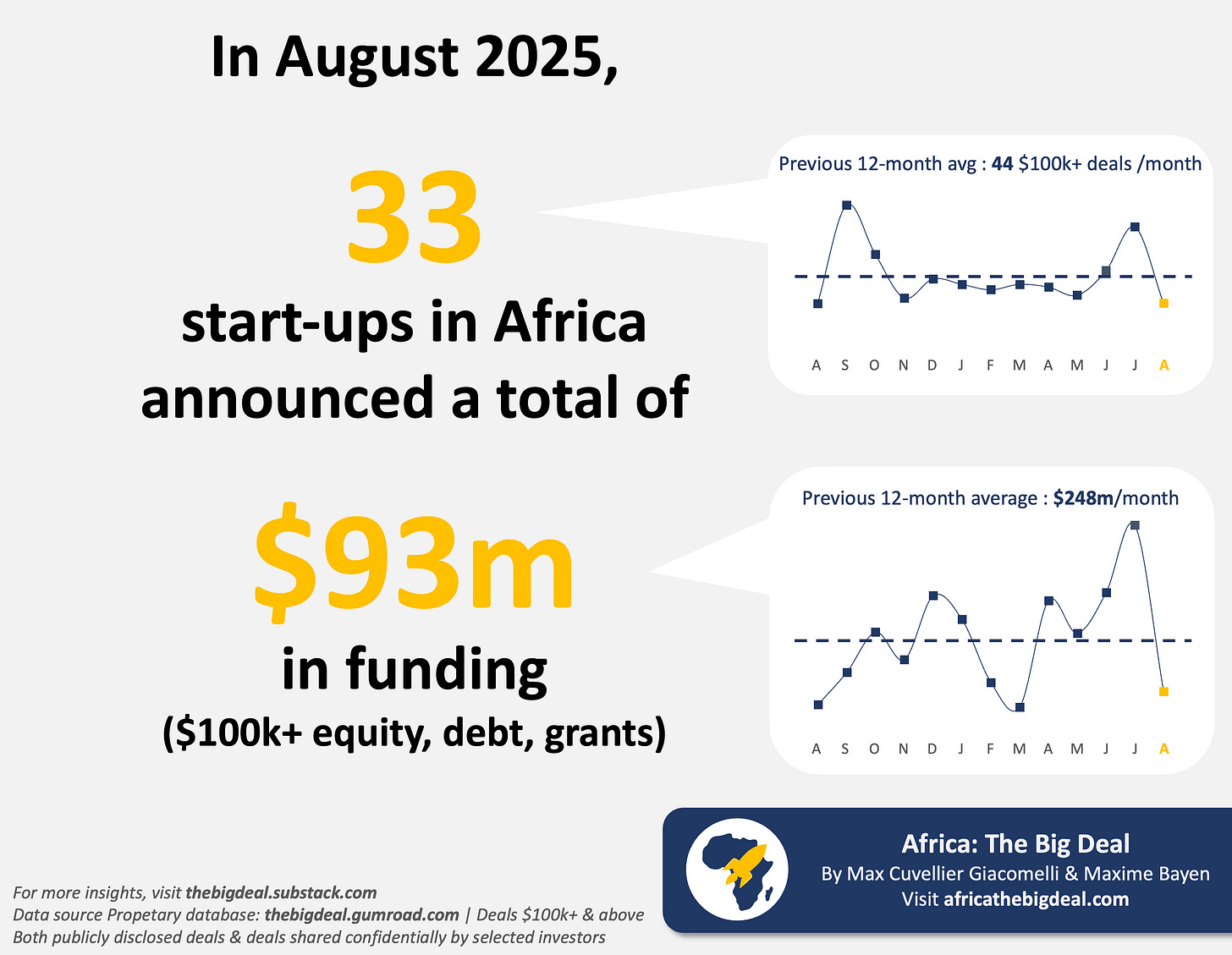

August was a relatively quiet month on the fundraising front for start-ups in Africa, especially if we compare it to July, which was extraordinarily busy. In fact it is the second-most quiet month this year so far, after March. But this is not really a cause for concern: the amount raised is still higher than what was raised in August last year; and the number of start-ups who raised is comparable to the same month in 2024 and 2023. Plus, the 2025 numbers to date continue to look strong (more on this below).

33 start-ups raised $93m in funding through $100k+ deals (exc. exits) on the continent last month. Three quarters of this amount were raised as equity; the rest was debt, and also includes a $9m+ securitised bond issuance by valU in Egypt. The other largest rounds announced - all equity - were Koolboks’ $11m Series A (which I’m particularly excited about because they’re an alumni of our GSMA Innovation Fund (my day job)), Hewatele’s $10.5m raise, Breadfast’s $10m Series B2, Chowdeck’s $9m Series A, as well as Ampersand’s new round (probably 8-digit). Overall, the markets that attracted most funding last month were Egypt, Kenya and Nigeria, who claimed 75% of the total tally. From a sectoral point of view, things were quite balanced with 5 sectors claiming at least 10% of the funding, driven by the larger deals listed above. There was also a handful of exits, the most notable being Nedbank’s acquisition of iKhokha for $93m+ in South Africa.

The African Angel Academy Cohort 12 is still accepting applications, but the Friday, September 12 deadline (11:59 PM EAT) is fast approaching! The programme is designed to equip aspiring investors with the skills, network, and insights they need to make informed investment decisions. You can choose from two tailored tracks(Mechanics of Angel Investing or Advanced Angel Investing) or take the Full Program Experience, designed to take you from beginner to confident angel investor in just 12 weeks. Don’t miss this opportunity:

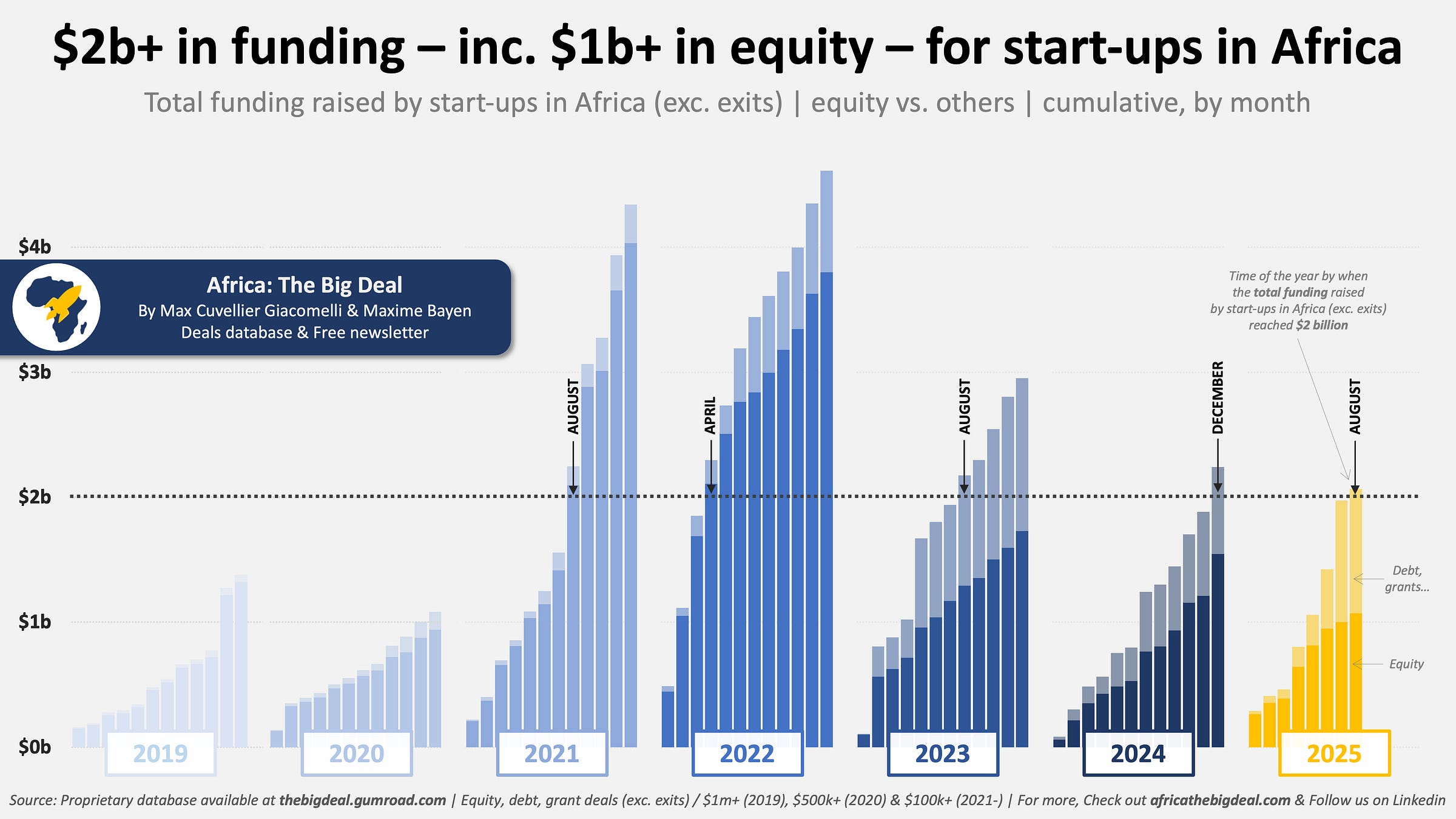

As I mentioned above, the continent continues on a very good dynamic. Start-ups on the continent have already raised $2 billion in funding this year so far, including $1 billion in equity. We can now be pretty confident that the ecosystem will raise more in 2025 than it did in 2024, and that we’ll finally see positive YoY growth after two consecutive years of YoY decline. 2025 numbers so far look quite comparable to 2023, and make us hopeful we could finish the year closer to $3b than to $2b, especially if the rumoured mega deals materialise…

We’ll stop here for today. If you want to learn more about specific deals, or do your own cut of the data, we encourage you to download our database, which now contains all 4,000 deals we’ve been gathering since 2019, worth nearly $19b (over $21b if you include exits). If you’re not already subscribed, use this link for a little discount. Have a good week! Max

Hey.. I’m trying to reach you via messages.