What's so special about 2025? 🔢 - cont'd

After looking at sectors and debt last week, we now focus on geography and quite an encouraging upward trend...

Last week we explored two of the trends that have characterised 2025 so far: 1️⃣ fintech and energy being neck-and-neck, at least if we take into account all types of funding (exc. exits), and 2️⃣ the growing share of debt, in part driven by energy ventures. For more, check out the full post:

This week, we’ll look at two other trends worth keeping in mind for anyone following what’s happening in the start-ups ecosystem in Africa:

3️⃣ 📈 Things are looking up 📈

I did resist including this trend last week, because in my opinion it really outshines the other three. When we closed 2024, it was hard to ignore a certain disappointment from many as the ecosystem registered its second consecutive year of YoY decline in funding. But 2025 will be different: for the first time since 2022, start-up funding is going to grow YoY. Indeed, Q3 closed at $2.21 billion, vs. $2.3 billion in the whole of 2024. And at the time of writing (October 26), start-ups in Africa have roughly raised an extra $450 million in October - courtesy of Spiro’s $100m raise and Moniepoint’s $90m Series C top-up, but not only. So $2.21b + $450m = $2.66b >> $2.3b. QED.

Now the question really is whether the final 2025 tally can also top 2023 numbers i.e. $2.98 billion. Start-ups would need to raise at least $320m in November and December. Is that realistic? I would say Yes for at least 4 reasons: (1) so far in 2025, they’ve raised on average $265m a month; (2) since 2022, Nov+Dec numbers combined have always been above $350m as start-ups and investors rush to close and announce rounds before the year ends; (3) even if Nov+Dec were to represent ‘only’ 15% of the Jan-Oct funding like it did in 2022 and 2023 (in 2024, it was 32%), that would still mean $400m; and (4) we’re still hoping moove might close its latest equity round this year, rumoured at $300m, on top of which they could be raising as much as $1.2b in debt.

Of course, the naysayers might look back at the second trend and argue the good performance is attributable only to debt. Well, as of today, start-ups in Africa have raised at least $1.45b in equity specifically, which is only $100m short of the $1.55b raised in 2024, and not too far from the $1.75b of 2023. By the time we reach the end of 2025, there might not be much room to naysay anymore…

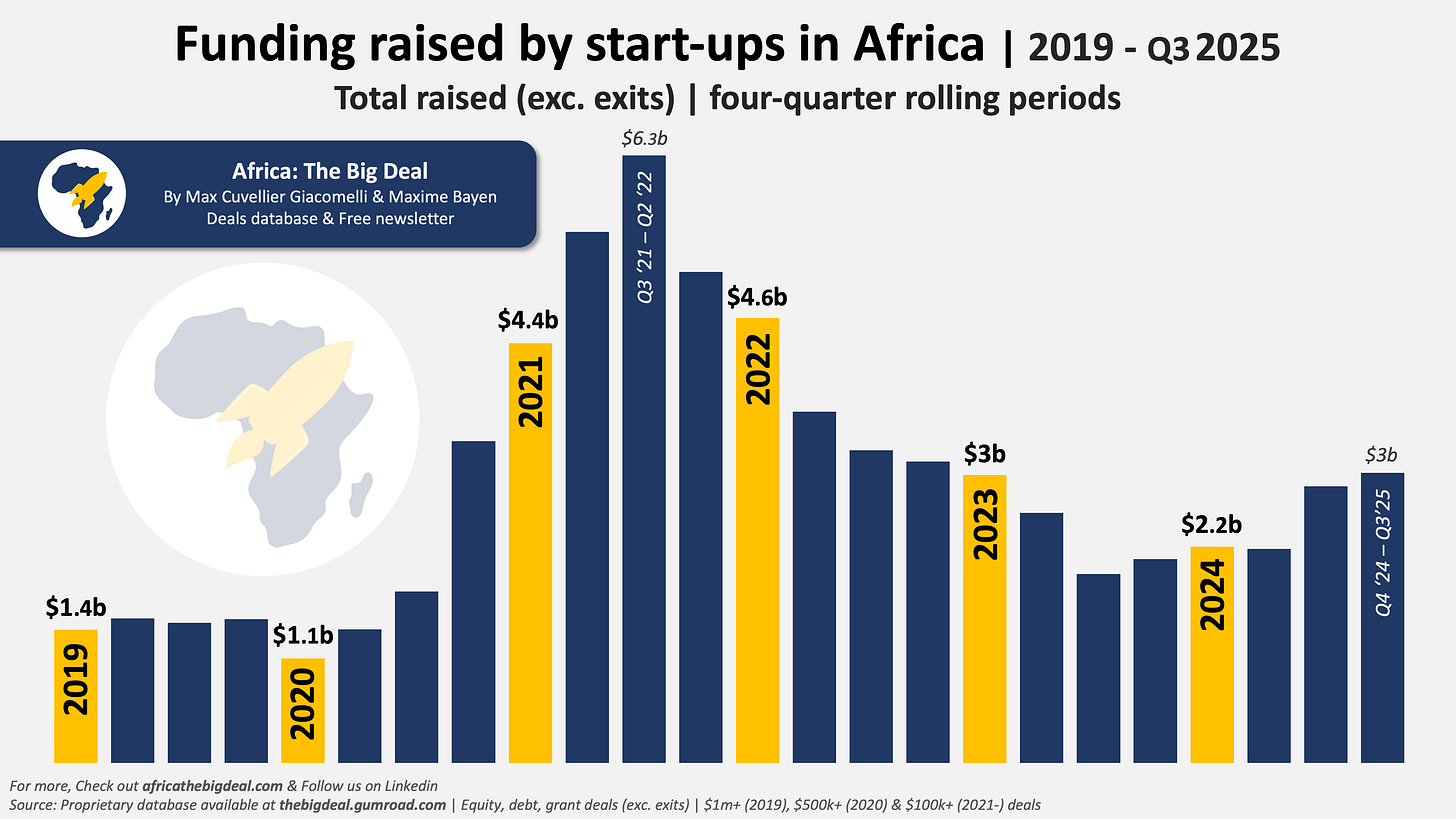

I would also like to insist that this is a trend, and not just due to a handful of large deals inflating the numbers. In fact, if instead of looking at calendar years, we focus on four-quarterly rolling periods (see graph), we can clearly see that numbers have now been on an upward trend for about a year and a half, after two years of decline.

4️⃣ 🔎 Start-up funding “in Africa” 🔎

As we talk about how much start-ups “in Africa” are raising, it is important to acknowledge that this funding is far from equally distributed. The dynamics have certainly evolved, yet the headline remains the same: the Big Four continue to attract the vast majority of the funding on the continent. While we don’t track the data at a city level, we could even pretty confidently say that at least three quarters of the funding go to just five cities: Cairo, Cape Town, Jo’burg, Lagos, and Nairobi.

This hyper concentration of funding is not new per se (neither is it a specifically African reality: over 2/3 of funding in the US in 2024 went to California-HQ’ed start-ups). The of the Big Four has hovered between 83% and 86% since 2019 (except in 2022 went it went ‘down’ to 80%). In 2025 so far, it is at 83%. In contrast, we have not recorded any significant funding activity since 2019 in 20 markets.

What has changed are the dynamics between the Big Four. I remember one of my first posts back in 2021 being about Nigerian fintech ‘eating the world’. This is not true anymore today. Funding is much more balanced between the four key markets, and as a result, between the four main regions (unfortunately Central Africa is barely represented in the numbers in 2025). In terms of total funding raised (exc. exits), Kenya is in the lead, followed by South Africa, Egypt and Nigeria. If we look specifically at equity - which is probably more relevant in this case - then South Africa leads, followed by Egypt, Nigeria and finally Kenya. And if anything, the share of the Big Four in equity funding raised is even higher than for the overall funding, at 86% in 2025 so far…

Next week, we’ll be bringing you the full October numbers, though we’ve teased them quite a bit already in this post. If you want to make you receive the monthly update of the database as soon as it’s ready, make sure to subscribe - with your reader discount - here. Cheers from Chengdu (don’t ask 🐼)! Max