What's so special about 2025? 🔢

Taking stock of key trends in terms of start-up fundraising in Africa as we enter the last quarter of 2025

Initially, I was going to write about Q3 only… But in the end, I thought it was much more relevant to focus on 2025 YTD (Jan-Sep), how it compares to previous years, and what it might mean for the future. And I’d say there are four key trends that stand out from looking at the data:

1️⃣ 💵 No, it’s not just about fintech… 💵

OK, Yes, it is still a lot about fintech: in 2025 so far, 33% of the funding raised has gone to fintech start-ups (exc. exits). We’re talking $725 million out of $2.2 billion. More specifically, fintechs have attracted 33% of the equity funding and 29% of the debt funding. This is on the low side, relatively speaking: the average over the 2019-2024 period is around 45%; only in 2020 did the share of fintech fall as low as 33% (in 2021, it had reached 56%). Out of the 11 start-ups that raised more than $50m this year so far, 5 are fintech: Wave raised $137m in debt, Bokra $59m also in debt, Stitch and LemFi both closed their Series B ($55m and $53m respectively), and Tasaheel (MNT-Halan) issued a $50m corporate bond.

But in that same Top 11, you also find four ventures in the energy space, including the two largest raisers this year so far (d.light and Sun King who respectively secured $300m and $156m in debt), Burn who raised $90m in total - also in debt -, and PowerGen who secured $55m in equity. All in all, 33% of the funding raised also went to energy start-ups. It is the first time since we’ve started tracking the numbers in 2019 that another sector is so close to overtaking fintech. That said, this is mostly because energy start-ups have raised a lot of debt in 2025: $585m so far, almost as much as all sectors combined in the whole of 2024. Indeed, 63% of debt funding has gone to energy ventures (vs. 29% for fintech) in 2025YTD. Energy tech’s share of equity funding in comparison is much lower (11%), and very far from fintech (33%)

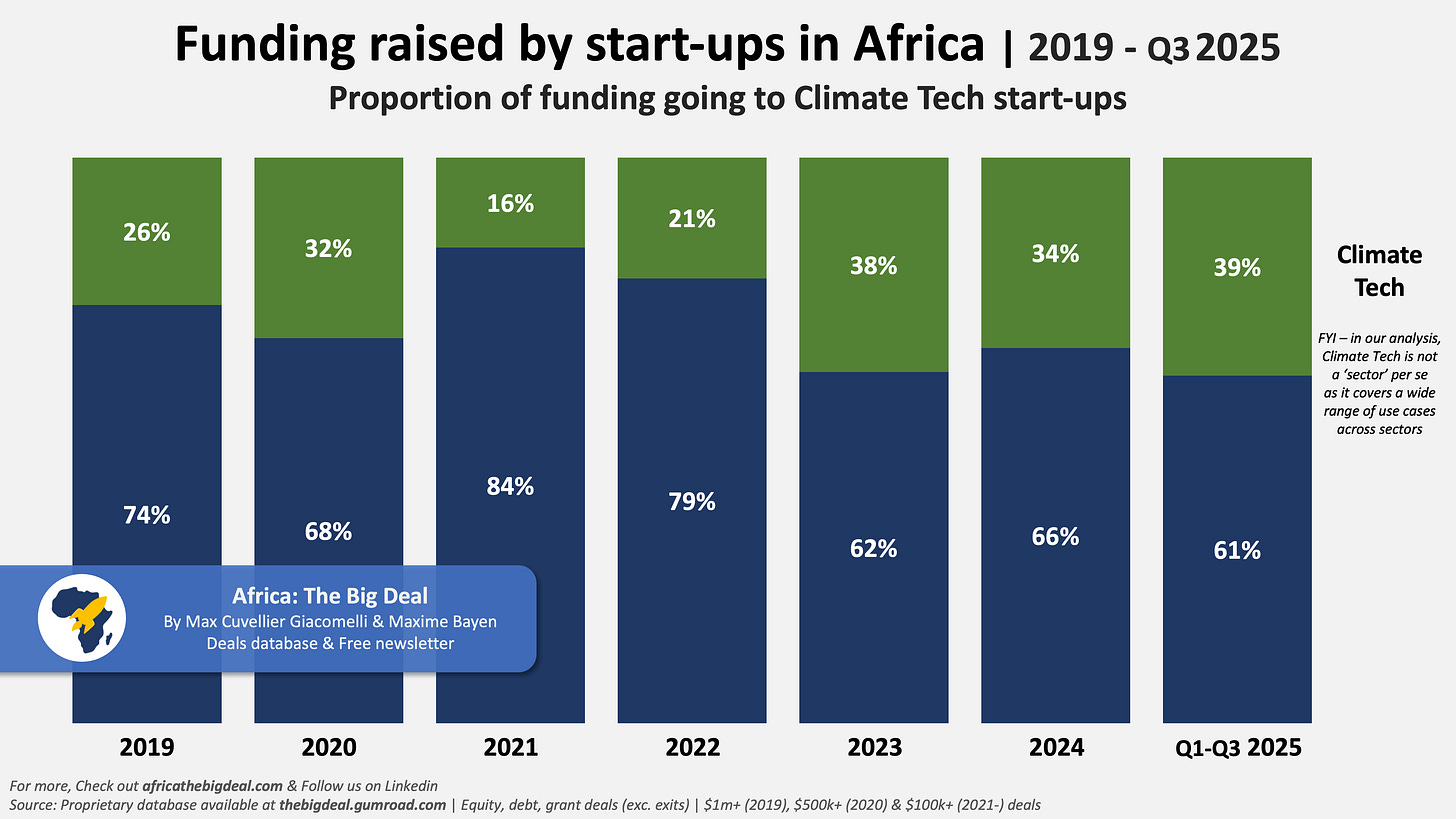

Owning to the good performance of the energy sector in terms of fundraising - but not only - the share of funding going to start-ups with a ‘Climate Tech’ focus is trending at its highest in 2025 so far, with 39% of the funding. This is overall aligned with the trend we had first identified in 2023. All in all, over $5b have been invested in Climate Tech start-ups on the continent since 2019, including $2.7b in the past three years alone.

2️⃣ 💸 It is more and more about debt… 💸

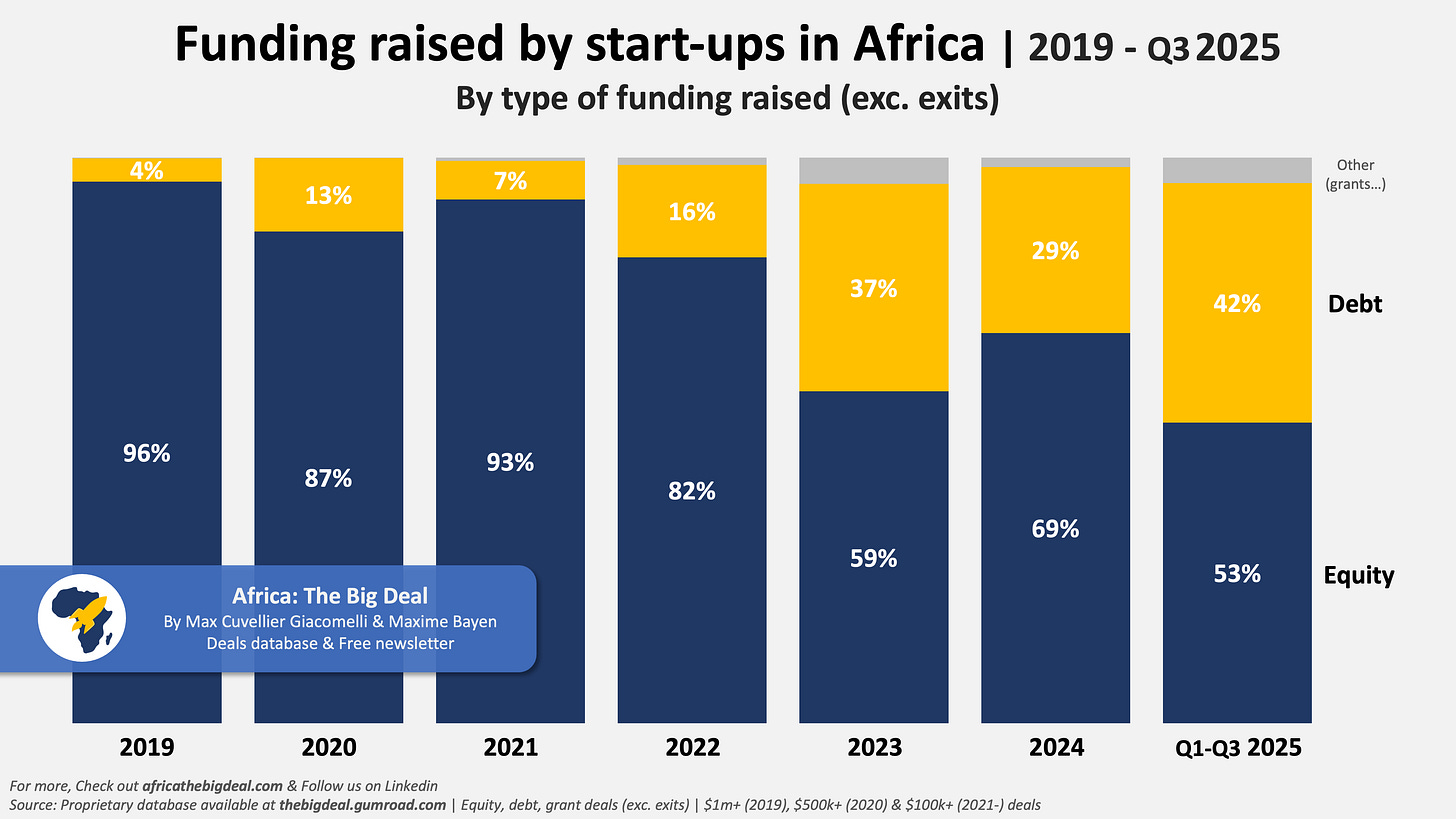

Another trend we have first highlighted back in 2023 and keep getting stronger is the growing share of debt in the total funding raised and announced. In 2025 so far, $935m worth of debt have been raised on the continent. In absolute numbers, this is more than the debt raised in the whole of 2024 or 2022, and the ecosystem could well be on track to top the record amount of debt raised in a calendar year: $1.1b in 2023.

In terms of share of funding raised, debt represents 42% of the total in 2025 so far. If the trend continues in the remaining three months of the year, it would be the highest share we ever recorded since we started tracking the numbers in 2019. We’ve discussed in the past the why behind this growing proportion and as a reminder, here are a few considerations to keep in mind: (1) as the ecosystem keeps maturing the debt offering grows, while (2) start-ups turn to debt as their needs evolve, especially if their revenue becomes more stable and predictable; (3) some sectors also get hungrier in debt with time - see below -; as funding activity slowed down after the heatwave, (4) start-ups become more likely to communicate about the debt they raised, (5) and media to report about it; etc.

As we were just discussing in the previous section, the energy sector has been a key driver of debt fundraising on the continent since 2019: of the $3.9 billion of debt we’ve tracked, $1.9 billion (49%) were raised by energy start-ups alone. The share has never been as high as it’s been in 2025 so far (63%) though it always hovered around 50%, except in 2022 (26%) when more fintech debt was raised. In comparison, since 2019, 32% of debt has gone to fintech, and an extra 11% to logistics & transportation ventures.

Our commitment to you is not to overload you with information, so we’ll let you absorb this, and we’ll be back early next week with the second half of this analysis. If we’ve left you wanting more, check out our previous in-depth analysis of Africa’s Top 100 most funded start-ups. Wait, you’ve read that one already? Then you’re a pro and can maybe play directly with the underlying data in our deals database, and see if you can identify trends we haven’t? We’re very curious to hear what you’ll come up with… In the meanwhile, Bonne journée! Max