🔋2024🔋 Fintech & Climate Tech, in short.

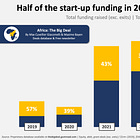

Fintech attracted nearly half of all the start-up funding in 2024, while Climate Tech claimed 32% of the amount, across multiple sectors

Previously, on Africa: The Big Deal: 2024’s top raisers - including Tyme and Moniepoint of course - raised more than half of all the funding… Full episode:

Well, I’m pretty sure few of you will fall off their proverbial chair when you read that Fintech is the sector that attracted most of the start-up funding in Africa in 2024 (over $1b). What’s interesting though is that the sector’s share even grew YoY from 42% in 2023 to 47% in 2024 and is at its highest since 2021. Four of the ten biggest raisers in 2024 were fintech players: ‘newnicorns’ Moniepoint and Tyme of course, but also MNT-Halan and M-Kopa (who we’re now considering a fintech since their historic SHS business has taken a back seat). If you remember though, it wasn’t always so obvious Fintech would come out on top in 2024: indeed, in the first half of the year, fintech wasn’t even the top sector in terms of fundraising and ‘only’ represented 22% of the total raised. H2 brought a lot of fintech deals though (including Tyme’s of course), which put the sector back on top.

The second sector on the list in terms of funding in 2024 was Energy - just like in 2023 -, with $440m in total, or 20% of the annual tally. This number was driven to a large extent by two of the year’s ten top raisers who made up nearly two thirds of the amount: d.light ($192m) and Sun King ($87m). YoY the total dropped -42% though, one of the steepest sectorial drops with Agri & Food (-44% YoY) and Healthcare (-61% YoY). Logistics & Transportation did much better though: not only did it hold its third spot, but it was also the only sector to attract more funding in 2024 ($288m) compared to 2023 ($271m, +6% YoY), therefore seeing its share of the total funding grow from 9% to 13%. Three of 2024’s ten top raisers were in this sector: moove, Basigo and Spiro; they attracted 75% of the funding that went to the sector in 2024.

All in all, 80% of the funding invested in start-ups in Africa in 2024 went to those top 3 sectors. All the other sectors suffered a loss in both absolute and relative terms in 2024, except for Deeptech and ‘Services’. For the latter, this was mostly thanks to Morocco-born travel infrastructure API solution provider nuitée which raised their Series A in December, one of the top 10 transactions of 2024.

🎙️ It’s coming! On Thursday we’ll be welcoming hundreds of you to our Linkedin Live event where we’ll aim to bring all these graphs and data to life. Make sure we save you a virtual seat by registering here. Have you invited all your friends yet?

Now if we look specifically at climate-related investments - therefore straddling multiple sectors -, Climate Tech represented 32% of the total invested in start-ups in Africa in 2024. This is a bit less than in 2023 (36%) and this decrease is actually mostly due to the drop in funding going to the energy sector (see above). Indeed, in 2023, while Energy made up 72% of all Climate Tech investments ($761m), its share dropped to 59% in 2024 ($423m). On the positive side, non-energy Climate Tech investments were almost stable between 2023 ($301m) and 2024 ($289m, -4% YoY).

Thanks to all of you who have been reading, sharing and reacting to our content in the past week and made it our best week ever with close to 27,000 unique post visits (!) .Your support and feedback means a lot to us! As for the underlying data, as you probably know by now, it is all available in our database, and you get a special discount as a reader if you click here :)… Ci sentiamo presto. Max.

👉UP NEXT👉 How do the numbers look like if we apply a gender lens? ‘Abysmal’ is the first adjective that comes to mind…

Hi Max, well done with this analysis. It seems the 'Waste Management' sector also grew in absolute and relative terms.