🇿🇦 South Africa: the (quiet) equity leader

For the third year in a row, South Africa is topping the charts in terms of start-up equity funding on the continent

I’ve been in Cape Town for a week now, so obviously I couldn’t resist opening our database to look at the country’s numbers more closely. I was a bit surprised at first by what I saw, and then I realised why…

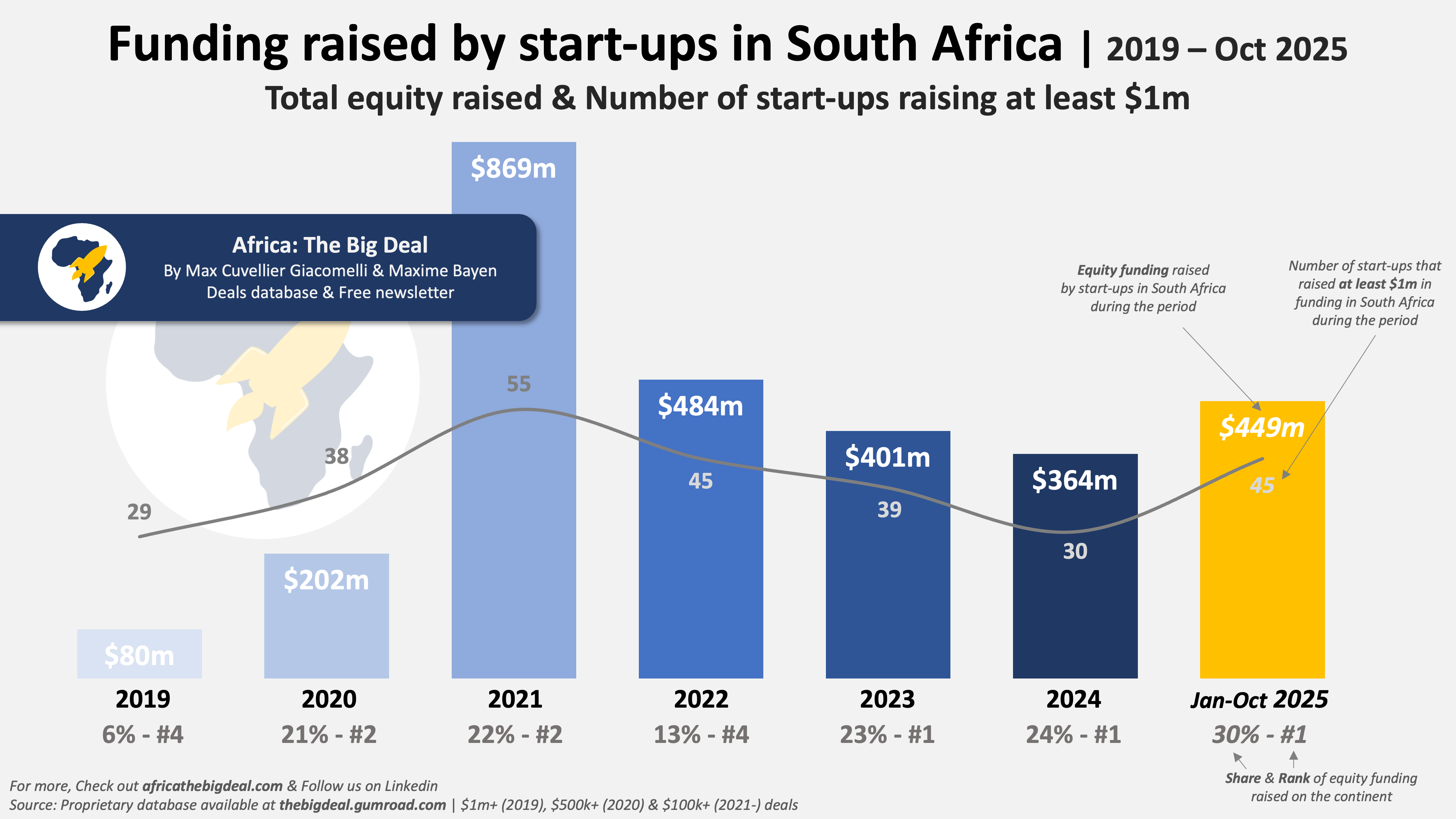

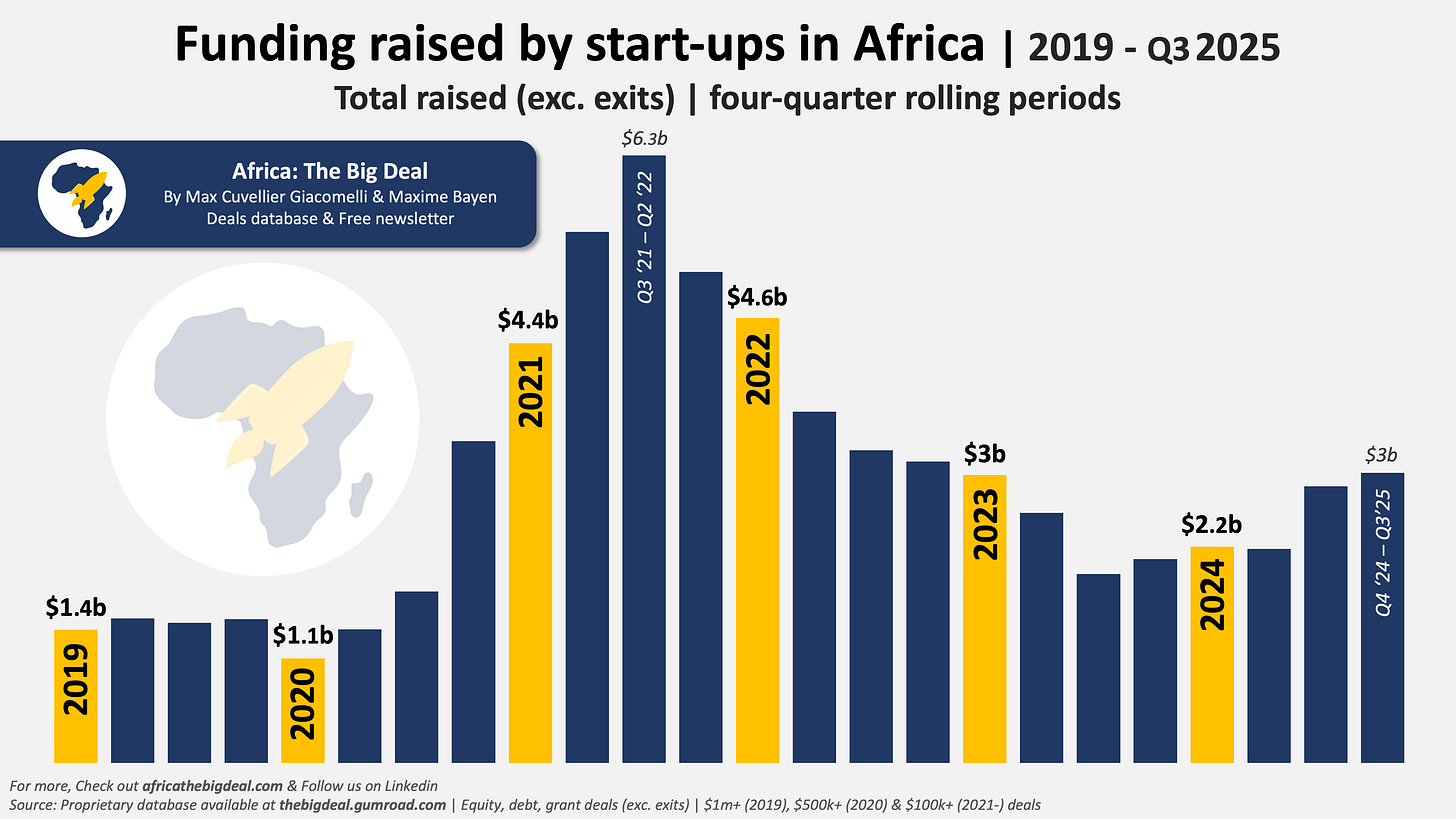

As one of the so-called Big Four, South Africa has consistently been one of the top four markets in terms of start-up funding raised on the continent since we started tracking the numbers back in 2019. From $80m in 2019 (all types of funding included, except exits), it went up to $869m in 2021 at the top of the funding heatwave, and has been hovering around the $400m/year mark since then. As of the end of October, start-ups in South Africa have raised $484m in 2025 so far. In terms of ranking, the country peaked at #2 in 2021, but has otherwise been holding either the #3 or #4 spot. Yes, that’s right, it somehow never held the top spot. And this is the part that felt a bit off, considering how mature the ecosystem feels on the ground, and the number of announcements coming out of the market…

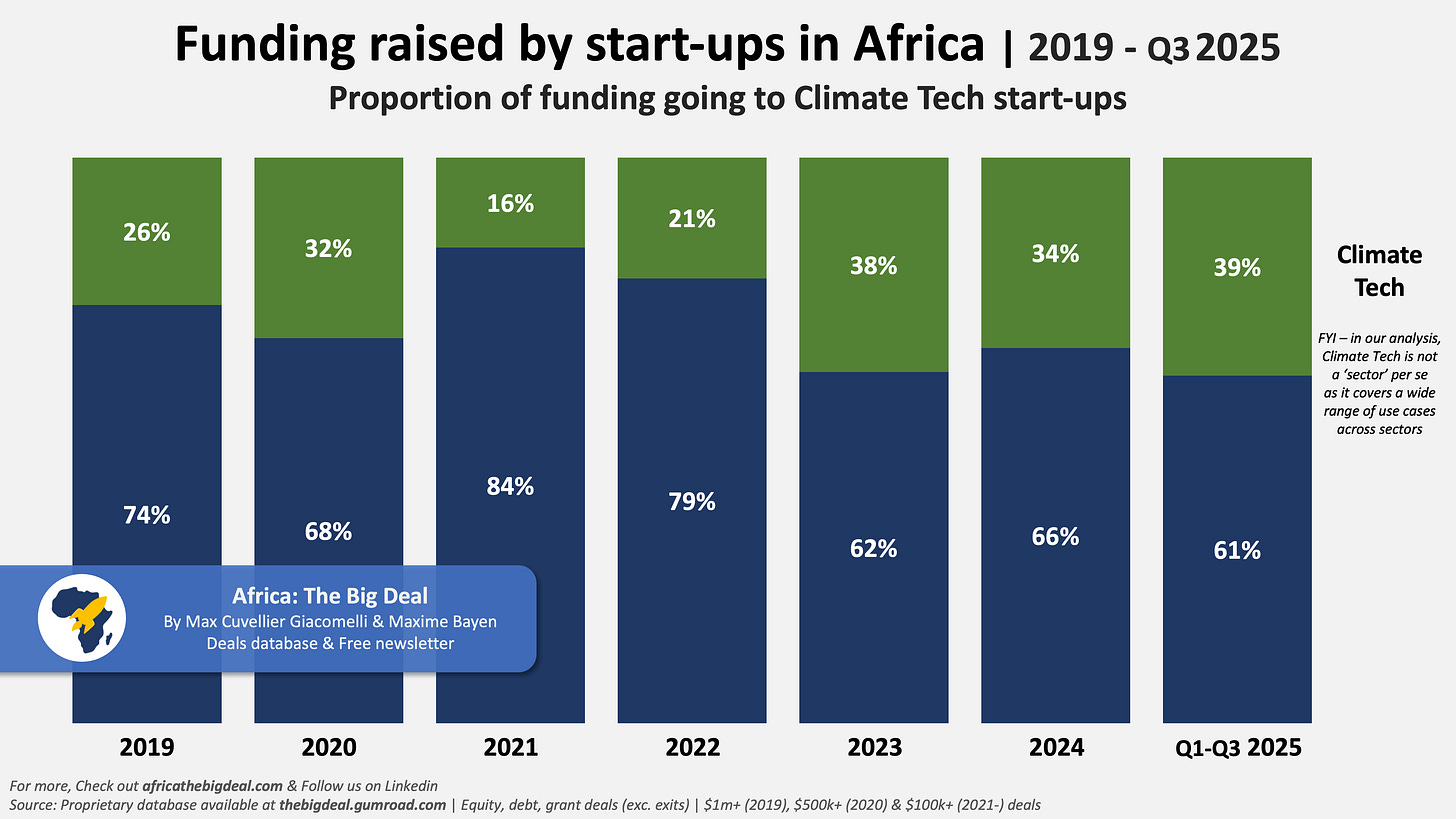

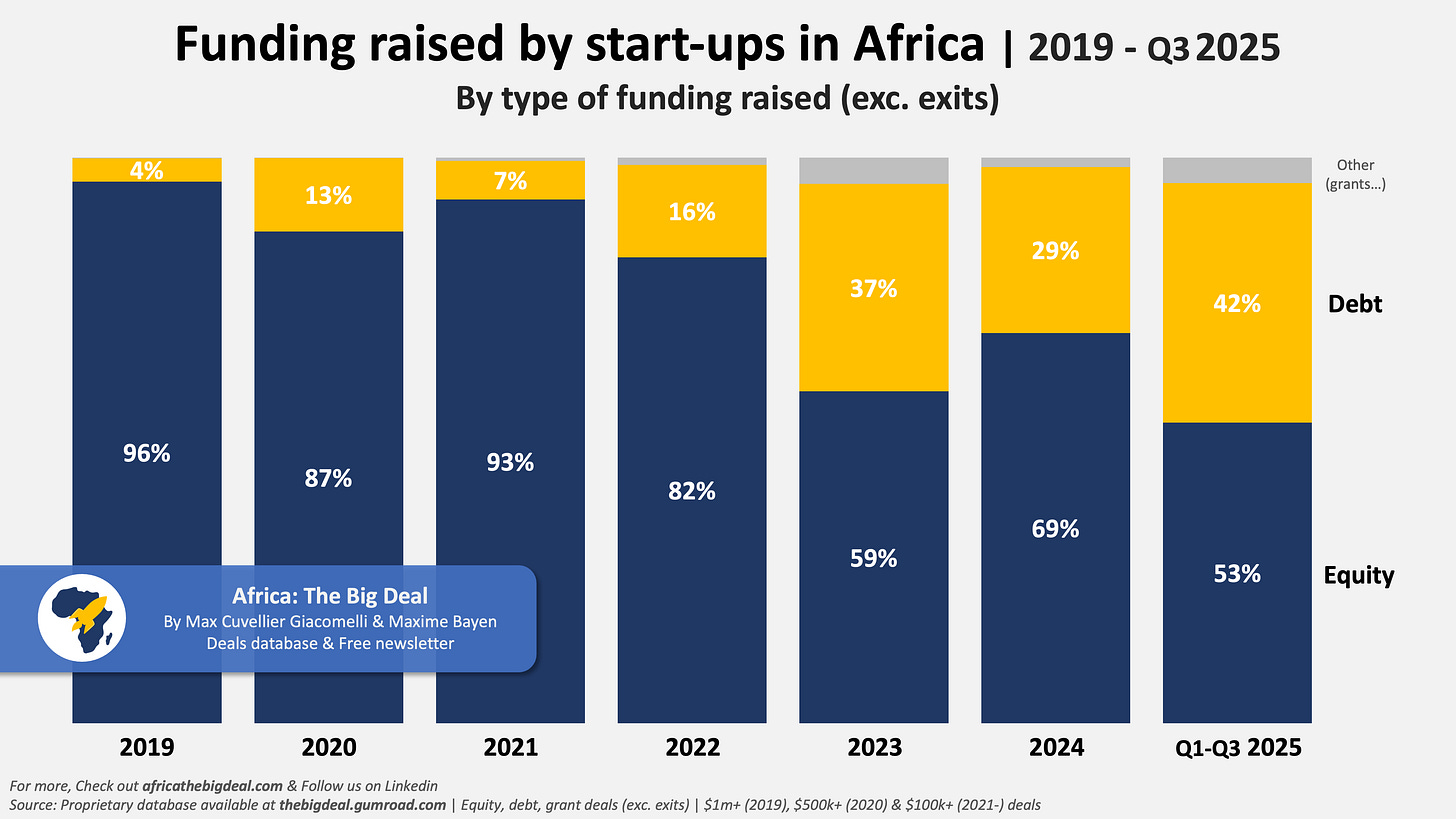

And that’s for one specific reason: similarly to Nigeria, the vast majority of funding raised/announced in South Africa is equity funding: 90% and 88% of the total raised since 2019, respectively. In Egypt, the proportion falls to 76%, and to 55% in Kenya. This has been particularly true since the beginning of 2024, when the share of equity in the total raised (exc. exits) has reached 92% in South Africa and 86% in Nigeria, versus 2/3 in Egypt, and 1/4 in Kenya. As a result, if we compare markets based not on total funding raised, but on total equity funding raised, the story looks very different:

As a matter of fact, South Africa has been the leading market in Africa in terms of equity funding since 2023. As of the end of October, start-ups in South Africa had raised 30% of all the equity funding raised on the continent in 2025 (vs. only 2% of the debt). With $449m raised so far, not only has the ecosystem raised more than in 2023 and 2024, but it might also be on track to raise more than in 2022 ($484m). $449m is also the equivalent of the amount of equity funding raised in Nigeria+Kenya or Egypt+Kenya. Some of the largest venture rounds this year have involved hearX, Stitch, Naked, wetility, Enko Education, Ctrack, and Paymenow, all with deals over $20m each.

South Africa is also the market where we have tracked the most exits since 2019 with 56 in total, versus 48 in Egypt, 34 in Nigeria, and 24 in Kenya. Some of the latest ones include the acquisition of ikhokha by Nedbank for ~$93m (R1.65b) in an all cash deal last August, and Lesaka inking a ~$61m agreement to acquire Bank Zero in July (R1.1b).

Finally, I was curious to see what sectors South Africa had a strong foothold in, and therefore looked at its ranking by sector in terms of funding raised since 2019. In this instance, whether we consider equity only or all funding (exc. exits), the results are exactly the same. South Africa comes out on top when it comes to Healthcare; Telecom, Media & Entertainment (by quite a margin for both sectors); but also Deeptech. It comes second when it comes to fintech ($1.9b raised since 2019, vs. $2.8b in Nigeria). In the other two largest sectors in terms of funding on the continent - Energy and Logistics & Transportation - South Africa ranks at #3 and #4 respectively.

As usual, you can find the details about all these deals in our database for less than R300 a month (~$17) if you use this discount code. And of course, if you’re attending Africa Tech Festival, feel free to join the session I’m moderating on Unlocking Capital for Africa’s Early-Stage Founders at noon on the AfricaIgnite main stage. Have a good week everyone! Max