Seeing the wood for the trees: Africa has a good story to tell...

How Africa might have benefitted more from the start-up investment boom than the rest of the world. At least relatively.

As you may remember, in last week’s post we addressed the misconception that things have been going downhill for start-up investments in Africa since the funding heatwave, and actually revealed that a new period of stability started about a year ago, and that the gains of the heatwave frenzy were not completely erased as some might have thought. If you need to refresh your memory, check this out:

Out of the woods? Looking at what could well be a 'new normal'...

As of March 2025 we have pretty much been in a year-long period of stability again. Something we could be tempted to call a ‘new normal’. And the good news is: with a minimum of $2b raised over any 12-month period, a maximum of $2.4b, and an average of $2.2 billion, this ‘new normal’ establishes itself about 60% over the last period of pre-heatwave/winter stability...

Today, I’d like to address another misconception we hear too often: that Africa didn’t do as well as the rest of world, and in particular that it didn’t benefit as much from the boom, and was hit harder by the slowdown that ensued. For

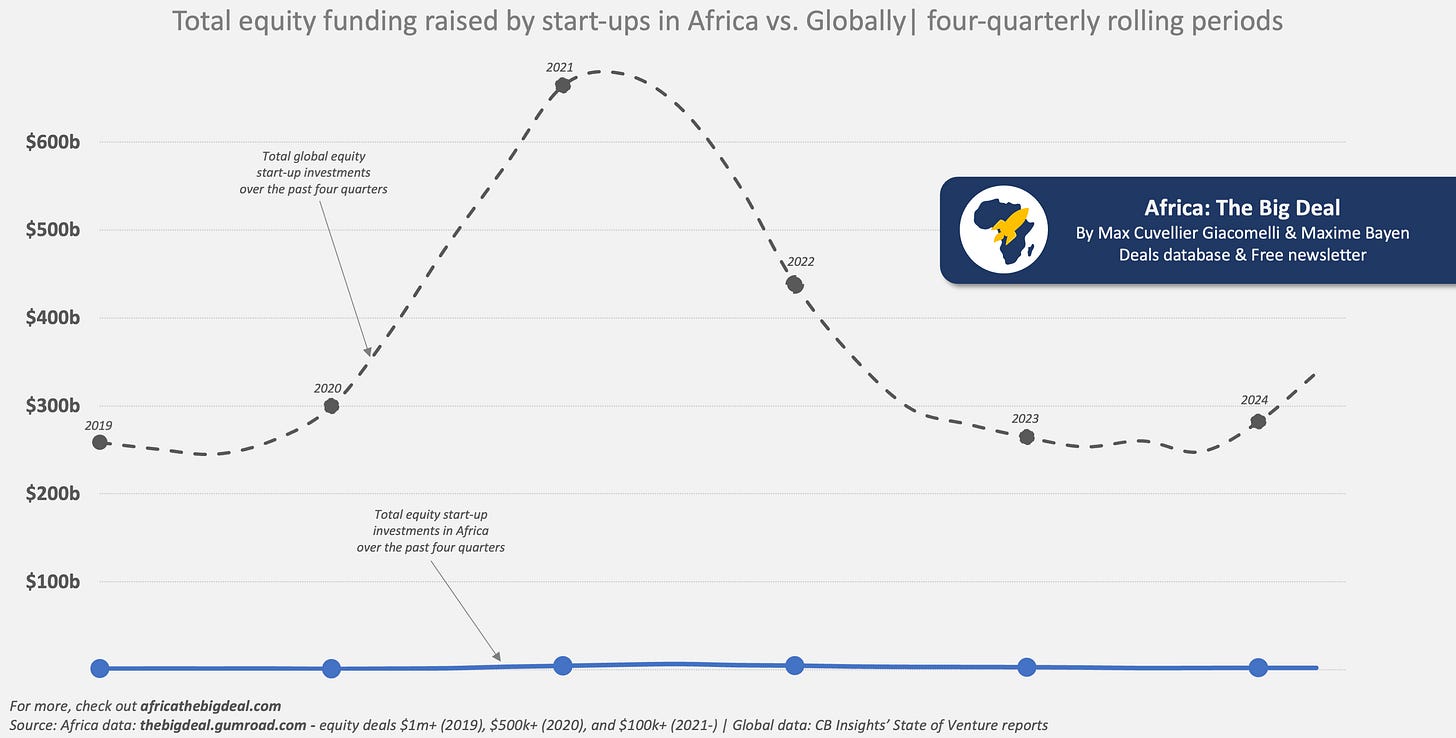

this, I’ll be using CB Insights’ State of Venture data for global numbers, and our data for Africa of course. The granularity of the CB Insights data is quarterly, and they only capture equity deals, so we’ll look at four-quarterly rolling periods and focus on equity investments for comparability’s sake. Here is what it looks like:

Not the most helpful view, I know. But a reminder that overall Africa represents less than 1% of total start-up equity investment flows globally, which is a massive missed opportunity if we compare to the continent’s share of global GDP, let alone population. But that’s not what we’re focusing on today, so let’s adjust the scale to see things a little clearer:

And what is striking is how similar the curves look. Emerging out of a period of stability, you see a steep acceleration of investments over a one-year period, followed by a decrease that is initially also quite steep but quickly becomes more gradual, lasting more or less two years, before a new period of stability begins. The main difference is that there is roughly a 6-month lag in Africa compared to the rest of the world, something we’d noted in the past. It is a little busy, but let me try and show it on the graph, in case you don’t see it.

Now, it could be tempting to think that to look at Africa’s future, you need to look at the world’s present… However, the encouraging bump you see at the end of the global line is entirely attributable to Open AI’s $40-billion round announced at the end of March. Which means one of Africa’s unicorns or soonicorns would need to be announcing a $400m round in Q3 to see the same effect on the African curve. That’s not impossible, and we’d love to see it. But to come back to today’s analysis, I want to show you one last thing:

What have I done here? I have set 2019 as a base (100) for both the Africa and global curves, in order to better apprehend the scale of the changes in the past six years. Two things are clear from this view: that the ‘funding heatwave’ got much hotter in Africa (up to a 4.3x jump) compared to the rest of the world (2.6x at the peak). But also that the ‘new normal’ for both is basically back at pre-heatwave/winter levels as far as equity investments are concerned i.e. that relatively, Africa didn’t ‘suffer’ more than the rest of the world (and remember what we saw last week: this new normal in Africa is roughly 60% higher than the pre-heatwave/winter period of stability if we include other types of funding beyond equity).

In short: Africa benefitted more from the start-up investment boom than the rest of the world. At least relatively.

That’s all, folks. As always, your support in sharing, liking, commenting on our content on social media (on Linkedin in particular: ATBD, Elodie, Maxime, Max) is much appreciated, to make sure the content reaches as many eyeballs - and hopefully some brains in the process - as possible. And remember that as faithful readers, you continue to get access to our database at a discount. Ci vediamo! Max

Fascinating read! I’m Harrison, an ex fine dining industry line cook. My stack "The Secret Ingredient" adapts hit restaurant recipes (mostly NYC and L.A.) for easy home cooking.

check us out:

https://thesecretingredient.substack.com

These are really interesting and convincing insights.