Ouch 🤕

Number of deals and Amount raised continue to be low in April

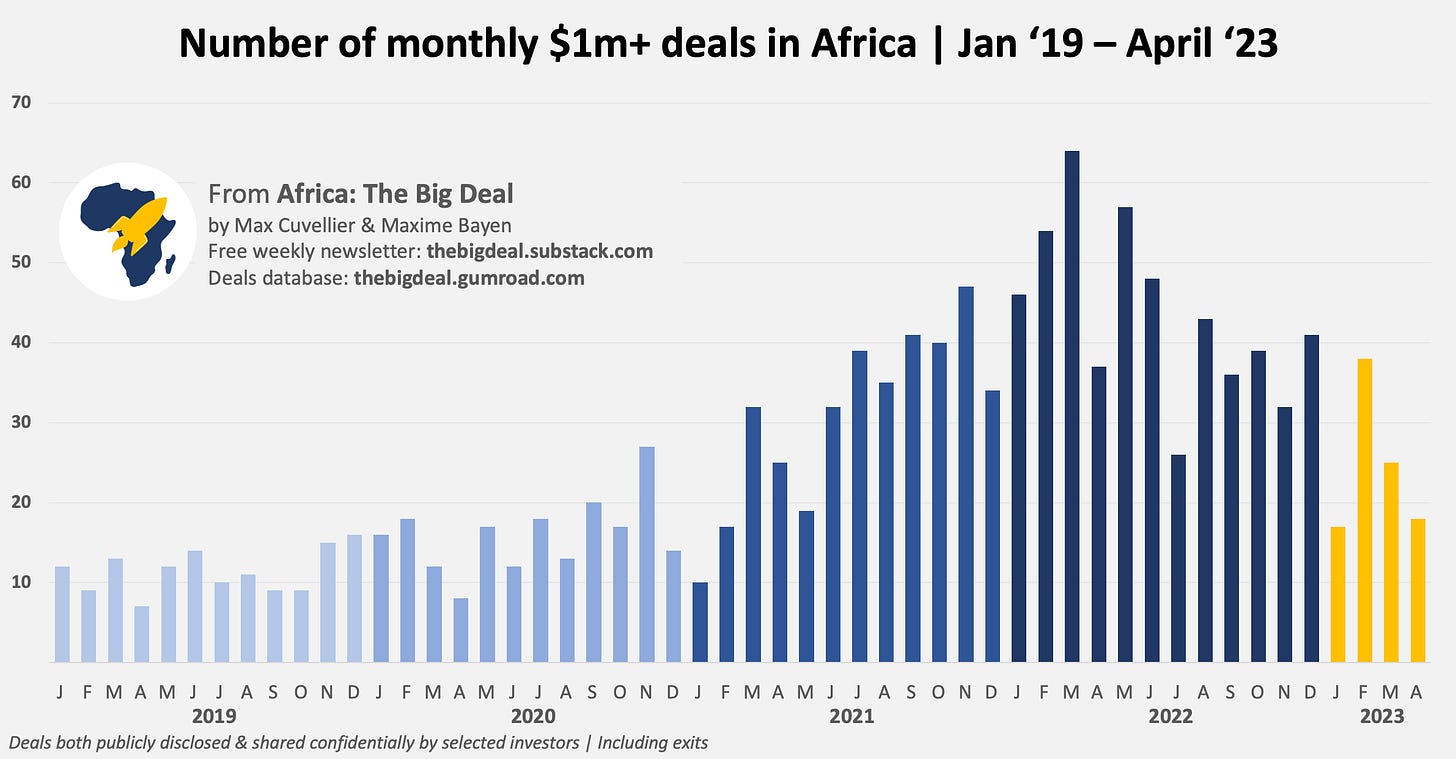

You know we like a good story - like last week’s focus on Launch Africa’s extraordinary track record -, but in all honesty, they’re becoming harder to come by these days, especially if we look at the bigger picture. Indeed, as we shared our database’s April update on Monday, we couldn’t help but notice that deal activity remains very low: with less than 20 $1m+ deals, April was a very quiet month, almost as quiet as January. We’re talking less than half the numbers recorded in April 2022. This is confirming a trend as the number of $1m+ deals YTD (Jan-April) is also just half of what it was in 2022. And similar trends can be observed for $100k+ deals.

How does this translate in terms of amount raised? Just under $130m were raised on the continent in April, 3.5x times less than in April 2022, and also less than in April 2021. YTD, the poor performance in March, and now April is somewhat balanced by February numbers and InstaDeep’s January exit. That said, the amount raised still tracks well below 2022 levels (-36% YoY). If we consider the total excluding exits (basically excluding InstaDeep), the amount raised by start-ups in 2023 YTD is less than half of what it was at the same time back in 2022.

We know a lot of you are working hard to drive these numbers up, and deliver value for the ecosystem, but the context is pretty tough… That said, we remain confident we’ve only scratched the surface in terms of what start-ups can deliver on the continent, and hopeful this will translate again in growth in number of deals and amount of funding raised (though we all know these are only some of the metrics that need tracking). If you do your own analysis on the database, and find more silver linings, please don’t hesitate to report back!