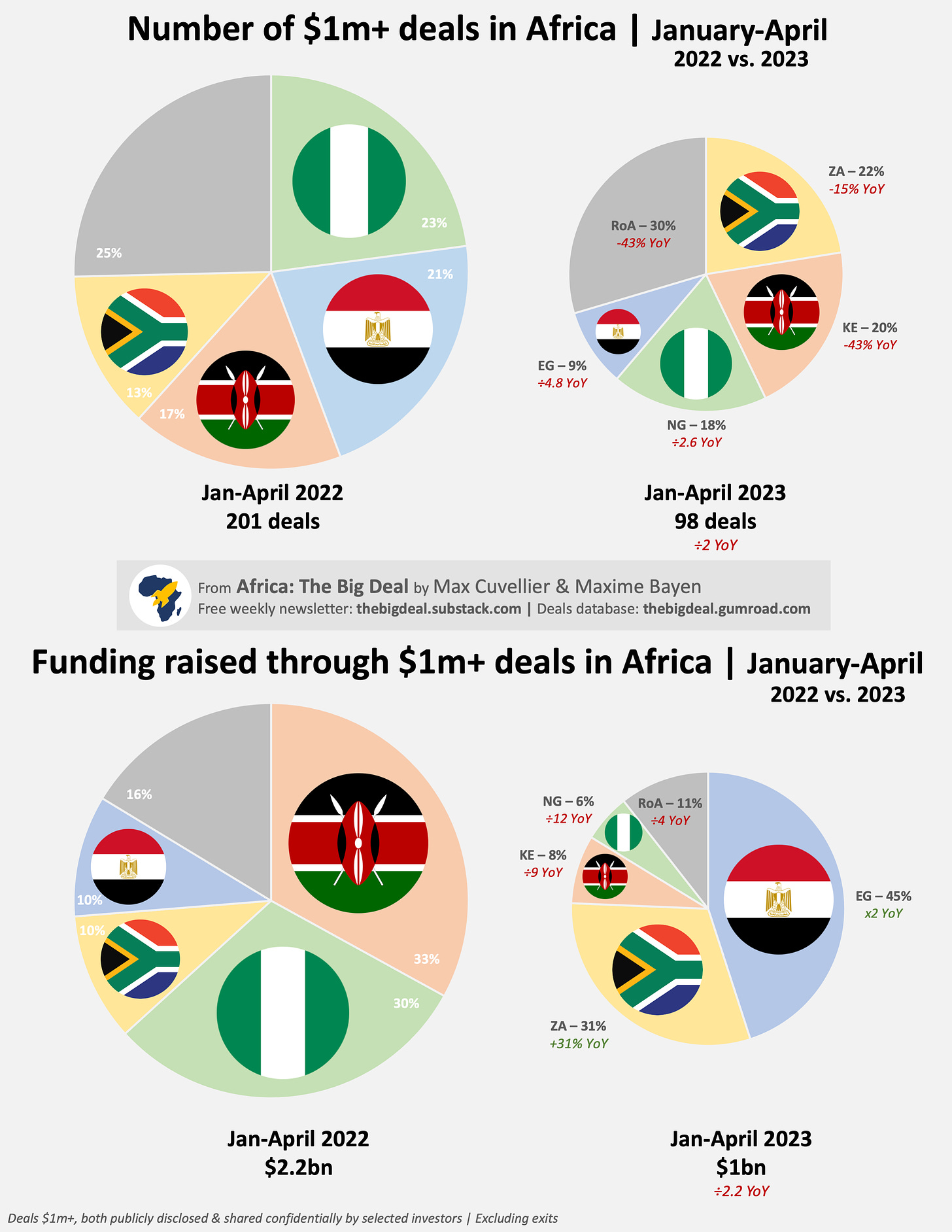

Last week we covered the fact that both the number of $1m+ deals and the total amount raised through those deals (exc. exits) in 2023 so far (Jan-April) represent less than half of what they were during the same period back in 2022. And then we thought: are all countries feeling the heat - or the cold, rather - in the same way? Let’s see:

As far as $1m+ deals are concerned, each of the Big Four is experiencing a YoY decline, but this ranges from a little step back for South Africa (-15% YoY) to a steeper decline in Kenya (-45%) and Nigeria (-61%) and a serious fall in Egypt (÷4.8). As a result, South Africa, which was bringing up the rear last year, is now technically leading with 22% of $1m+ deals in 2023 so far, though Nigeria and Kenya are at comparable levels (around 20 each). With only 9 $1m+ deals, Egypt lost ground YoY (from a 21% share to just 9%), while the share of ‘Rest of Africa’ grew slightly. If we look at deals $100k+ - therefore including smaller transactions - YoY trends are pretty similar. That said, Nigeria’s stronger lead in Jan-April 2022 (31% of all $100k+ deals then) means that the country is still leading in 2023 so far with 28% of $100k+ deals, followed by Kenya (23%) and South Africa (14%).

Looking at the amount of funding raised through those $1m+ deals tells a slightly different story: funding in Egypt has doubled YoY, taking the country from fourth to first place. South Africa also registered good levels of growth (+31% YoY), taking second spot. Combined, Egypt and South Africa have attracted three quarters of the funding on the continent so far (vs. 20% in the same period last year). A caveat though: these numbers are heavily influenced by ‘mega deals’ ($100m+), which have been harder to come across in 2023 so far (only two so far: MNT-Halan in Egypt ($400m) and Planet42 in South Africa ($100m), both a mix of equity and debt), compared to 4 in the same period last year. A caveat in the caveat if I may: while the MNT-Halan deal represents 89% of the funding in Egypt, Planet42 is ‘only’ a third of the South African total, pointing to much healthier growth in South Africa. The country actually accounts for almost half (9 out of 20) of $10m+ deals in 2023 so far (vs. 10%, 5 out of 48, last year). In the meanwhile, funding in Kenya and Nigeria is about a tenth of what it was in the same period last year, making their share of the total tumble down from 33% and 30% to 8% and 6% respectively. The share of funding raised outside of the Big Four also shrank from 16% in Jan-April 2022 to 11% in 2023 so far (÷3.4 YoY in absolute terms)

Can you access all the fantastic data behind this analysis? Of course, love! And as you asked so kindly, here’s a discount for you ;) And thanks to those of you who have subscribed to the database and taken the time to rate us on gumroad (4.93 out of 5. Not bad!). Have a good day :)