🍕 H1 2024 🍕 Who got the biggest slice?

79% of all funding in Africa was raised by start-ups HQ'ed in one of the Big Four; a third of the total went to Kenya-based ventures alone

Previously on Africa: The Big Deal: Start-ups in Africa raised $780m in H1, a significant drop compared to previous periods. Debt continued to represent a third of the funding raised, and Transport & Logistics claimed the most funding…

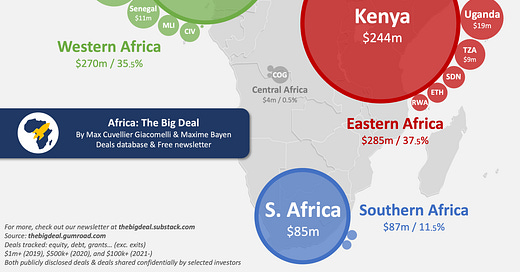

After looking at high-level trends in terms of start-up funding in Africa in the first half of the year last week, today we’re focusing on the countries that have attracted most of that funding:

Unsurprisingly, the vast majority (79%) of it went to start-ups with their HQ in one of the Big Four. This is slightly below the 5-year average (83%), and not nearly as high as a year ago in H1 2023; that semester still holds the record - at least since we’ve started collecting the data in 2019 -, as the Big Four made a clean sweep and attracted 92% of the region’s funding then.

Kenya - with $244m raised - took the lead for the 3rd consecutive semester, attracting almost a third (32%) of all funding raised by start-ups on the continent in H1 2024. Its share of the total funding even grew by 5pp compared to 2023. 86% of all the funding raised in Eastern Africa went to Kenya (vs. 89% in 2023). The region also ranked first, attracting 37.5% ($285m) of the funding on the continent. Only one other country in the region claimed more than $10m in H1 - Uganda ($19m) - though Tanzania ($9m) narrowly missed the mark. All other markets that did attract funding - Sudan, Ethiopia, and Rwanda - raised less than $5m each.

The second most attractive market in terms of funding was Nigeria, with $172m raised. At 23% of the total, it saw its share bounce back significantly compared to 2023 (14%) as it climbed from the fourth to the second spot (not quite all the way to the first spot it had held in 2021 and 2022 though). Western Africa as a region was a close second to its Eastern counterpart ($270m, 35.5%), though the big difference with Eastern Africa was the relatively low share of Nigeria (64%, even lower than in 2023 (68%)), the lowest across all four key regions. Three markets in the region attracted over $10m in funding: Benin ($50m, through one deal though: spiro), Ghana ($29m), and Senegal ($11m).

💌 More than 1,000 of you (yes, one thousand) have registered to our Linkedin Live event on 23 July 💌 We look forward to seeing you all then! 💌

Next came Egypt ($101m), which share dropped significantly compared to last year (13% in H1 2024 vs. 22% in 2023). The country attracted 87% of the funding in Northern Africa, a share comparable to last year’s. Only Morocco registered over $10m in start-up investments ($14m). After a relatively good performance in 2021 and 2022 (carried mostly by Yassir in Algeria’s case), activity in both Tunisia and Algeria has been very limited since 2023.

Finally South Africa fell to the fourth spot with less than $100m raised ($85m) and 11% of the continent’s total start-up funding in H1 (vs. 21% in 2023). The country continued to claim almost all the funding invested in the region (98% in H1 2024, up from 96% in 2023), which overall claimed 11.5% of all the funding.

As 22 countries registered at least one $100k+ deal in H1 2024, it also means that the majority of countries - 32, i.e. almost 60% of all markets - registered no significant start-up funding activity during the period…

By the way, do I need to remind you of these two very important pieces of information i.e. that (1) as a subscriber to this newsletter (that’s free), you get a discount if you want to subscribe to the database (that’s not free), and that (2) we’re expecting you all on 23 July for our Linkedin Live lollapalooza extravaganza? I guess not ;)