🪙 H1 2024 🪙 A slow start of the year

With $780m raised, H1 has been the quietest semester in terms of start-up funding in Africa since late 2020

We’ll have many opportunities to look more closely into H1 results in the coming weeks - including during our live event on July 23 -, but let’s start with a high-level summary of the first half of the year, based on the latest data all our database subscribers have received on Monday:

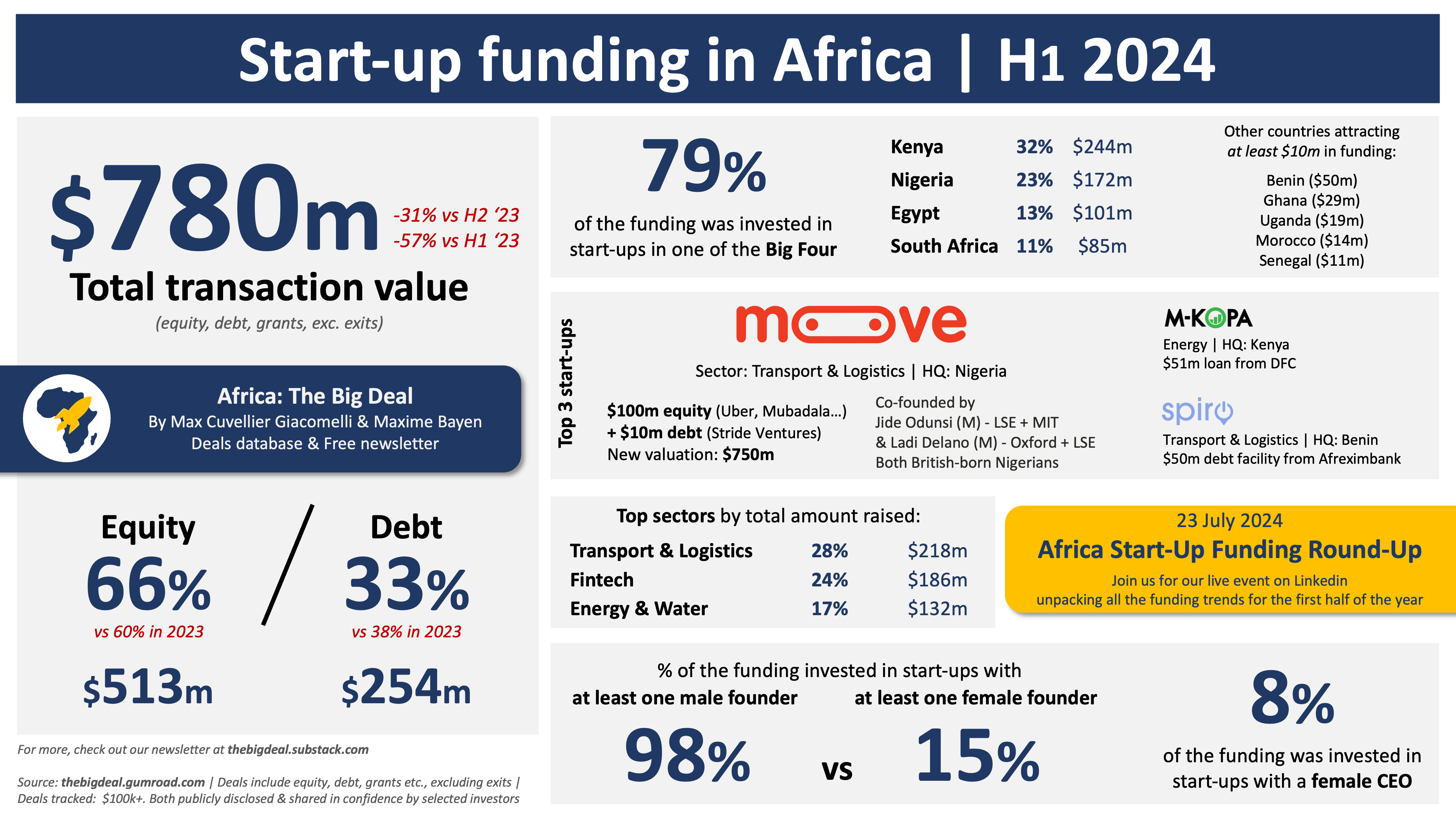

Overall, start-ups in Africa have raised $780m (exc. exits). This represents a -31% drop compared to H2 2023, and an even starker -57% decline compared to H1 2023 if we want to account for seasonality.

Two thirds of this funding was in the form of equity, and a third was debt. As for 2023, this is a much higher share of debt than what we’d been seeing in the past (17% on average since 2019).

4 out of 5 dollars invested in start-ups in Africa went to ventures based in the Big Four. This is high, but not the highest we’ve seen (92% back in H1 2023). A third of all the funding went to Kenya alone.

The sector to attract most funding was Transport & Logistics (28%), with two of the three largest deals announced in H1 (moove and spiro). While Fintech came only second in amount raised, it stayed in the lead in terms of number of start-ups raising $1m or more during the period (30).

Only a fraction of the funding continued to go to female-founded and female-led start-ups with 85% of the funding going to ventures without a single female founder and 92% to companies with a male CEO.

Let me stop here for now before we overload you with data. We’ll dig into some of these points in the next couple of weeks, and we’ll see you all I’m sure on 23 July for our Linkedin live event 😜 In the meanwhile, you can of course run your own analysis on our database. Don’t forget to use this discount if you’re subscribing for the first time… A bientôt, Max