🫰 The most active investors in H1 2024

5 investors have done at least a deal a month on average in H1 2024, not far from H1 2023 (7) but much behind H1 2022 (33!)

Before reading on, you might want to refresh your memory with our previous post on the most active investors of 2023…

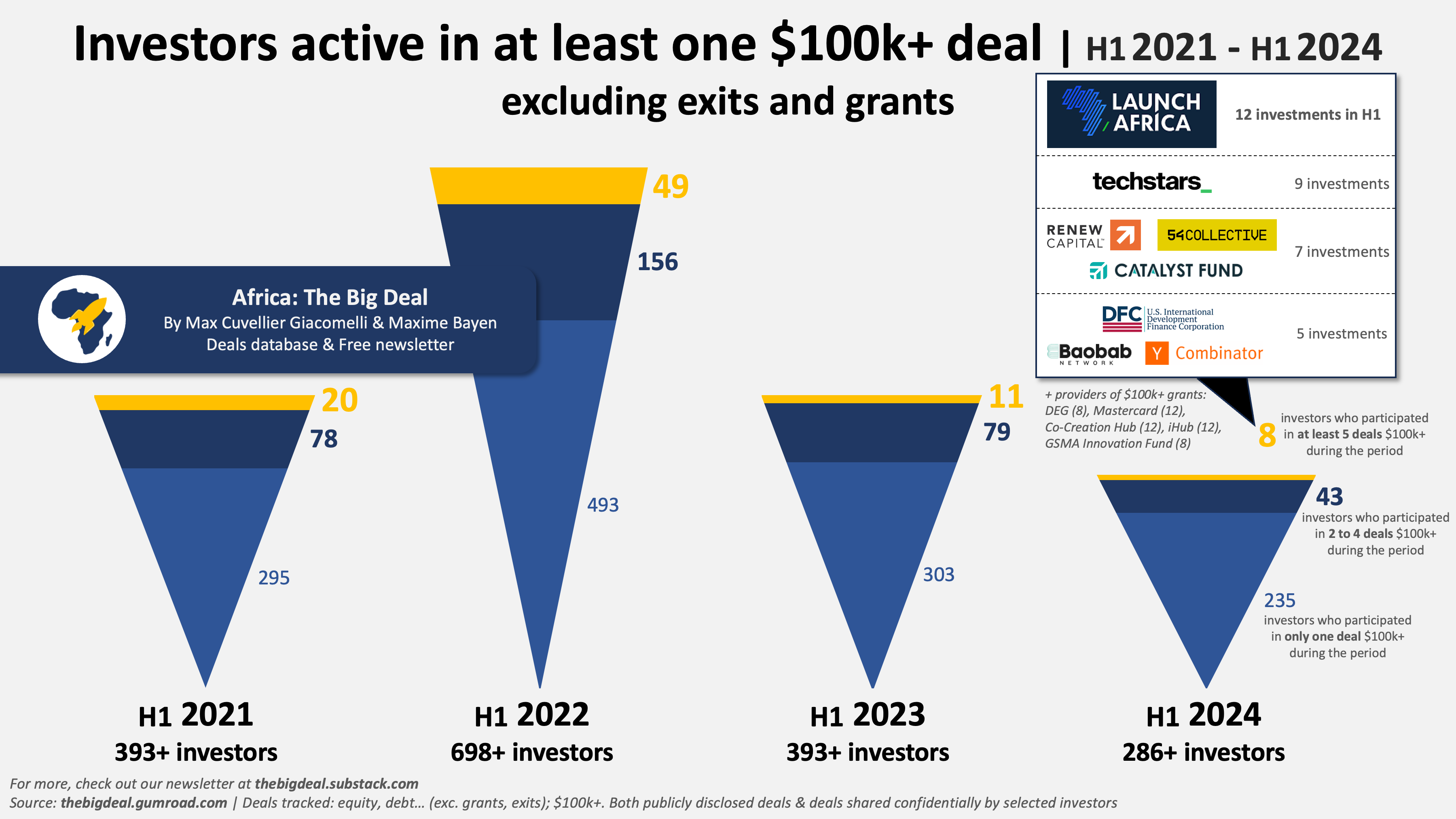

As we covered briefly in our H1 2024 presentation back in July, close to 300 investors have been active in at least one $100k+ deal in H1 2024, a number below H1 2023 levels (~400, -27%), and nearly 2.5x times less than in H1 2022 (~700). Notably, the percentage of investors who have been active in more than one $100k+ deal in H1 stands just below 18%, behind previous periods (23% in H1 2023, 25% in H1 2021 and 29% in H1 2022).

At the top of the list we find Launch Africa*: after a relative lull in 2023 between the time the team finished allocating their Seed Fund I and finished raising their Seed Fund II, they signed a deal almost every other week on average in H1. If they continue at this rate, they are well on track to do at least as many deals as they had in 2023 (19 in total).

As we can only track deals publicly announced or shared in confidence by investors, there is sometimes a lag, especially as some investors prefer to wait and do batch announcements. It explains why some of the numbers in this analysis are higher than those presented in mid-July, as we constantly update the data. We encourage investors who are not already sharing deal activity with us to get in touch. We will treat your data confidentially!

Techstars was the second-most active investors on the continent in H1. After a stratospheric 2023 with 56 deals in total (more than one a week on average), it will be pretty tricky for the investor to match last year’s performance though, as they ‘only‘ announced 9 deals in H1 2024 (vs. 28 in H1 2023).

With 7 investments each in H1, 54 Collective (previously known as Founders Factory Africa), Catalyst Fund* and Renew Capital are a tie. 54 Collective and Catalyst Fund seem on track to match their 2023 performance (16 and 13 deals in total respectively) if they can keep up the pace. Renew Capital is the most active investor to have already done more deals in 2024 than they had in 2023 (7 vs. 5). Two of the three investors who have done 5 deals in H1 (DFC and Baobab Network) have also already done more deals than they had in the whole of 2023. Y Combinator might still be able to match the 12 deals they did in 2023.

Some names notably absent from the list of most active investors - i.e. VCs who had all done more than a deal a month on average in 2023 and did less than 5 in H1 2024 - are Ventures Platform and Norrsken. Other past serial investors who have also been more quiet recently are Flat6Labs and LoftyInc, though both have both been actively raising new funds and will probably be back in the news quite soon.

Believe it or not, we’re already not too far from the end of Q3, and the year will be gone before we know it. If you want to be sure that you’re not missing any deal activity and have access to the latest up-to-date investment data on the continent, you can use this link to access our database at a discount. See you soon! Max

* Full disclosure: Africa: The Big Deal’s co-founders are LPs in Launch Africa, and Maxime is an operating partner of Catalyst Fund.