⚡ 2023 ⚡ Top Investors of the Year ⚡

Techstars was by far the most active investor in Africa in 2023, while the number of heavy hitters dwindled

Previously on Africa: The Big Deal: We recorded 619+ unique investors in $100k+ deals in 2023, a -38% YoY drop. 47% had not invested in either 2021 or 2022, while a group of 188+ resolute investors invested in 2021, 2022 and 2023.

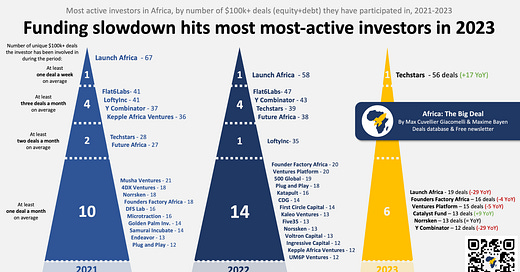

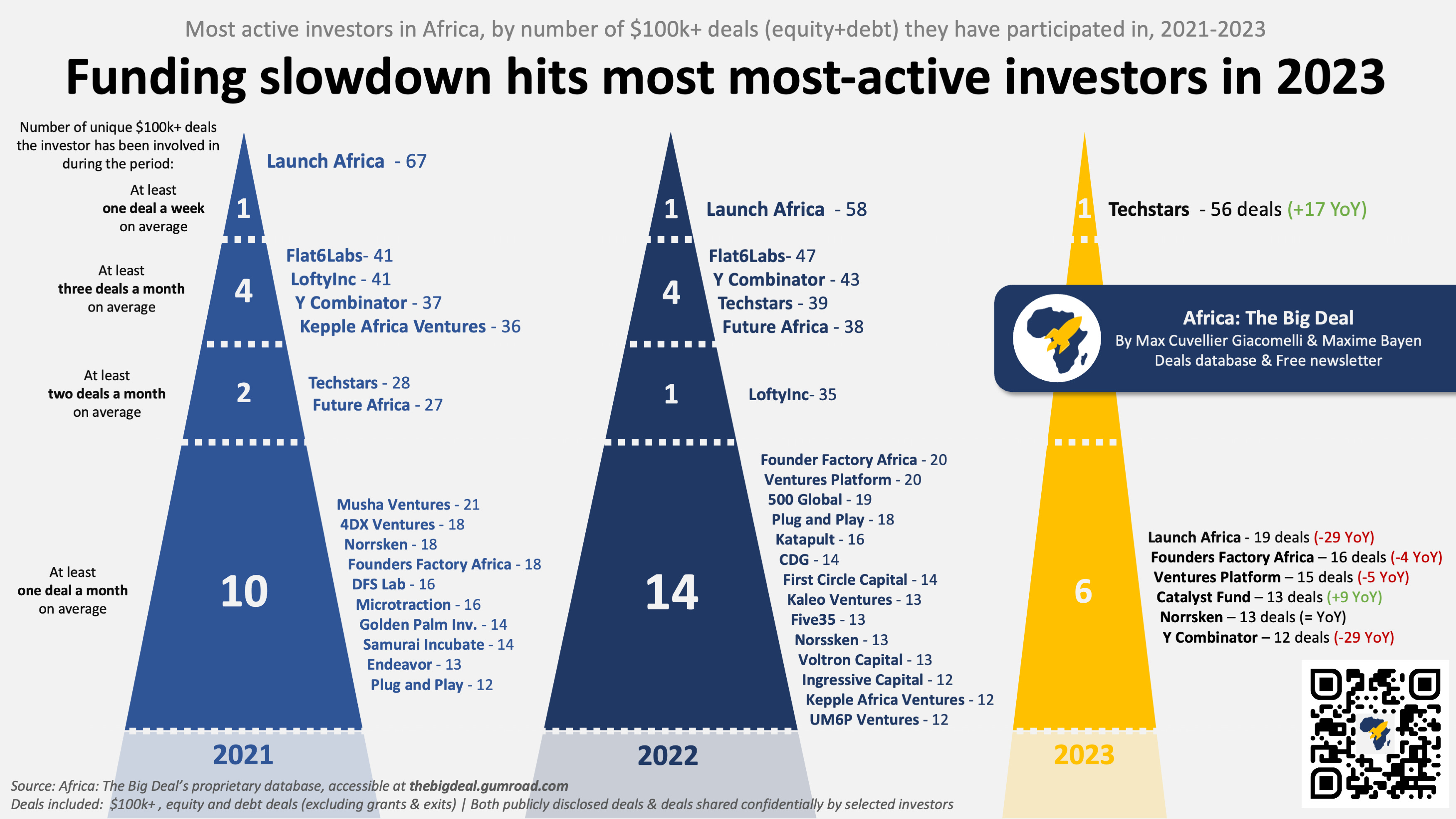

As you may remember from our last post, 83% of investors who were active in $100k+ deals in Africa in both 2022 and 2023 saw the number of deals they participated in either stagnate (36%) or go down (47%). While one might have hoped that this trend would have mostly impacted ‘smaller’ investors, it turns out that the most active investors on the continent have also been hit, as we had anticipated last summer.

Indeed, while there had been 17 investors in 2021, and 20 in 2022 who had been involved in more than a $100k+ deal a month during the year (excluding grant makers), there were only 7 of those in 2023 (+3 grants makers: Mastercard, DEG, and Google For Startups’ Black Founders Fund). The latter - though not being an investor per se - deserves a special mention for being particularly prolific with 139 ‘non-dilutive investments’ on the continent in the past 3 years, a prolificness only Launch Africa could top (144 over the same period). While Launch Africa had taken the lead in 2021 and 2022, it is Techstars who got in the driver’s seat in 2023 with 56 deals in total, more than one a week on average; the investor is also the one recording the biggest YoY progression (+17). No other investor has been involved in more than 20 deals last year.

Launch Africa (*) was the runner-up, its considerable drop of activity being justified by the full allocation of its Fund I in the first half of the year. Other familiar names made the list: Founders Factory Africa, Ventures Platform, Norrsken and Y Combinator. All but Norrsken - who was stable YoY - did less deals in 2023 than in 2022. In Y Combinator’s case, the reduction was quite dramatic as it only welcomed 12 African start-ups in its cohorts in 2023, compared to 43 in 2022 and 37 in 2021. The only newcomer on the list is Catalyst Fund (*), which formally started its climate-focused VC operations last year. 500 Global and Proparco barely missed this list with 10 deals each.

While 2023 numbers might come as a disappointment, it is important not to draw hasty conclusions: many investors remain heavily committed to investing on the continent (remember: at least 188 invested on the continent in 2021, 2022 and 2023), but many factors can impact levels of activity, starting with new fund raising activities…

If you’re an investor and think you should have made the list, do get in touch! While we leave no stone unturned to compile the most comprehensive database of $100k+ deals on the continent, if the deals were confidential and you haven’t yet shared them with us, we need your help :) Talking of the database, you guys deserve a discount for being such great supporters of our work. See you all on Wednesday morning for our LinkedIn Live event:

🎁 It's coming!

As you know, billions of dollars have been invested this year into hundreds of start-ups in Africa, despite a tough global climate. On January 17, Maxime and I (Max) will guide you through 2023 data and trends - and what they might mean for the future -, based on

(*) Full disclosure: Africa: The Big Deal’s co-founders are LPs in Launch Africa; Maxime is an operating partner of Catalyst Fund.

Incredible insights about the startup funding in Africa. I am particularly interested in the investment metrics and you guys are publishing accurate and never-seen-before data. Good work