To continue with our series of deep dives on H1 2025 numbers and trends (if you missed the earlier episodes they’re here, here, and here), this week we’ll have a closer look at sectors…

100+ joined live and nearly 1,000 more have already watched our Linkedin Live! What!? You’ve not see it yet? Don’t worry: you can rewatch the presentation, download the deck, and of course subscribe to the database here:

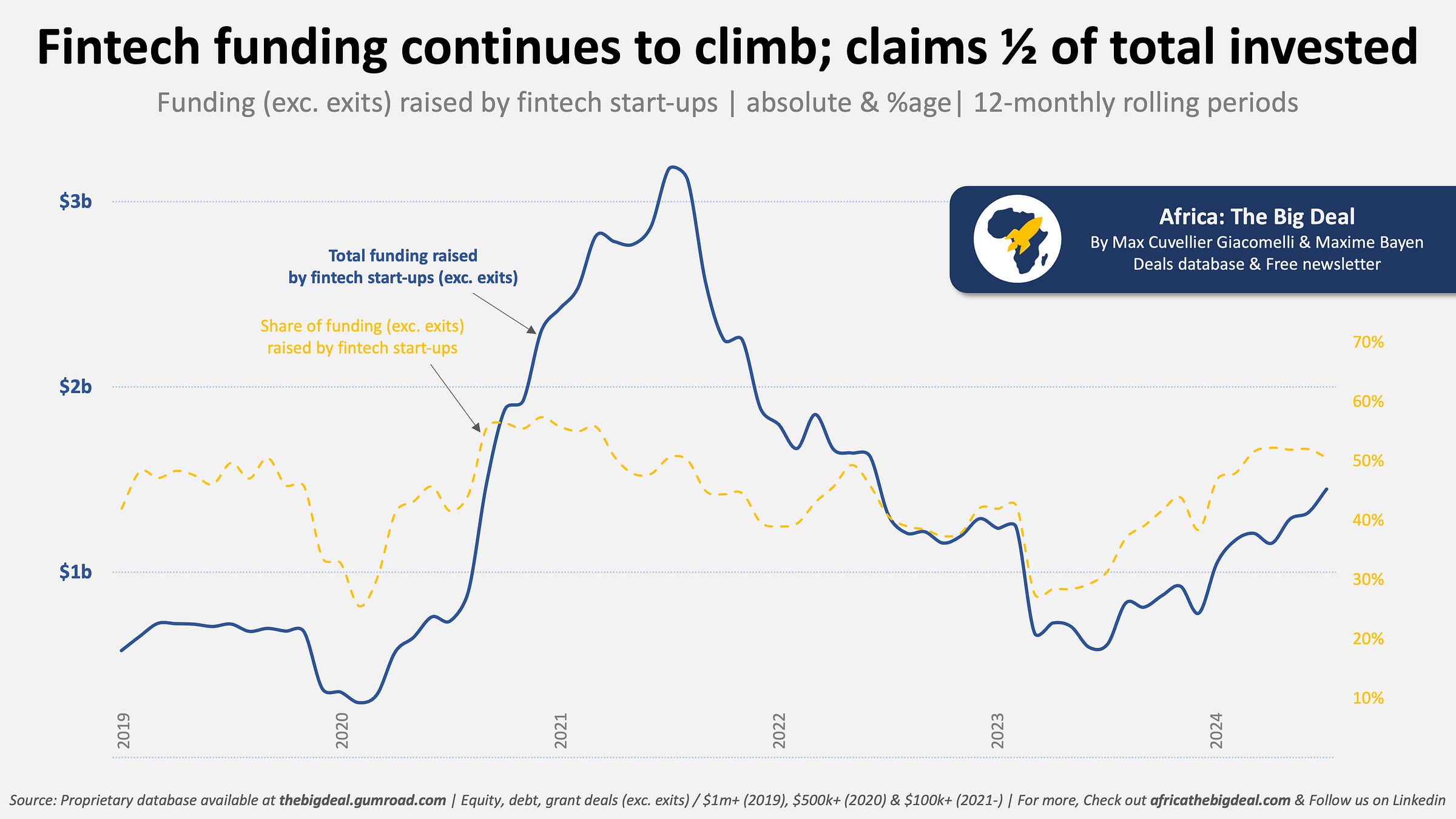

We will start with fintech of course, because the sector alone attracted 45% of all funding (exc. exits) in H1, bagging around $640m. This is in line with what we’d seen in 2024 (47%) but higher than in previous years. If we look at the longer-term trend, - moving to 12-month rolling periods - we clearly see that after 2-2.5 years of relative decline (the share went down to 28% about a year and a half back, almost an all-time low), fintech is gaining serious ground again (51% of all funding in the past 12 months), not too far from its all-time high in terms of share of funding.

The five largest fintech transactions in the first half of the year were of course Wave Money’s mammoth $137m debt deal, followed by Bokra’s $59m sukuk raise (Egypt), Stitch’s $55m Series B (South Africa), LemFi’s $53m Series B (Nigeria), and the $50m bond issued by MNT-Halan’s Tasaheel (Egypt). Kenya continued to be an outlier in the Big Four with only $23m raised in H1 2025, compared to $100m+ for each of its peers. Actually since 2019, the share of funding claimed by fintech start-ups in South Africa, Egypt and Nigeria is around three fifths (61%, 57% and 56% respectively), while it is just 10% in Kenya. Why is that? Most probably because the strength of the mobile money ecosystem in Kenya is simply unparalleled with 95% of adult Kenyans owning a mobile money account and 82% using it at least once a week (source: GSMA).

Fintech deals remained significantly bigger on average ($1.7m median, $10m average in H1 2025) than non-fintech transactions ($0.5m median, $4.8m average). As such, in terms of share of deals, fintech seems a little less hegemonic, representing ‘only’ 27% of the deals in H1 2025. The share climbs up to 31% if we look only at $1m+ deals, and 46% (17 out of 37) for $10m+ deals. Just 21% of the smallest deals ($100k-$1m) though were raised by fintech ventures.

But what does life look like beyond fintech? Energy ($220m, 20%) comes at number two, unsurprisingly as it has consistently been in the top 3 for a few years now. The two most notable deals were Burn Manufacturing ($85m) and PowerGen ($55m), both in Kenya, where 50% of the funding raised since 2019 has gone to the energy sector, vs. 7%, 6% and 2% in South Africa, Nigeria, and Egypt respectively (and 16% on the continent overall).

Third comes healthcare ($160m, 11%), boosted by the $100m secured by hearX through its merger with US-based Eargo (South Africa). We then find logistics & transportation - usually in the top3 - at number four ($116m, 8%), and proptech at number five thanks to a single company, Nawy, who raised $75m ($52m Series A + debt) in Egypt, by far the largest-ever proptech deal on the continent.

Finally, if we group all the deals we can tag as ‘climate tech’ together (most energy deals, but also some some in logistics, agri & food, or even fintech), we come to 21% of the funding in H1 2025 ($300m) and 28% of all $100k+ deals. While this is relatively low compared to about a year ago when those shares had peaked, it is hopefully a missed opportunity some savvy investors will know to seize… Beyond energy and the Big Four, we can mention promising deals such as watertech Kumulus Water’s $3.5m raise in Tunisia, or battery-swapping Kofa’s $8.1m pre-Series A in Ghana for instance.

That’s all for today. For those of you who need access to all the underlying data behind our analysis, you can access it at a discount here. Though if you (re)watch the July 22nd Linkedin Live, you might catch a promo code with a juicier discount there… #justsaying. In any case: Have a good day! Max