💚 Green, how I want you green...

$2.8 billion in funding have been invested in 'climate-related' start-ups in Africa since 2019

First of all, we believe data - in this context and others - should always be presented with the right caveats: for this analysis, we have put a 'climate tag’ on start-ups active in the energy, water, sanitation, agri & food spaces. It is obviously not a prefect exercise, as one could argue about the climate impact of some of the start-ups in these sectors, or point out that the Logistics & Transportation space for instance surely has a couple of EV deals that could justify a climate tag. Yet it gives a sense of how things are evolving.

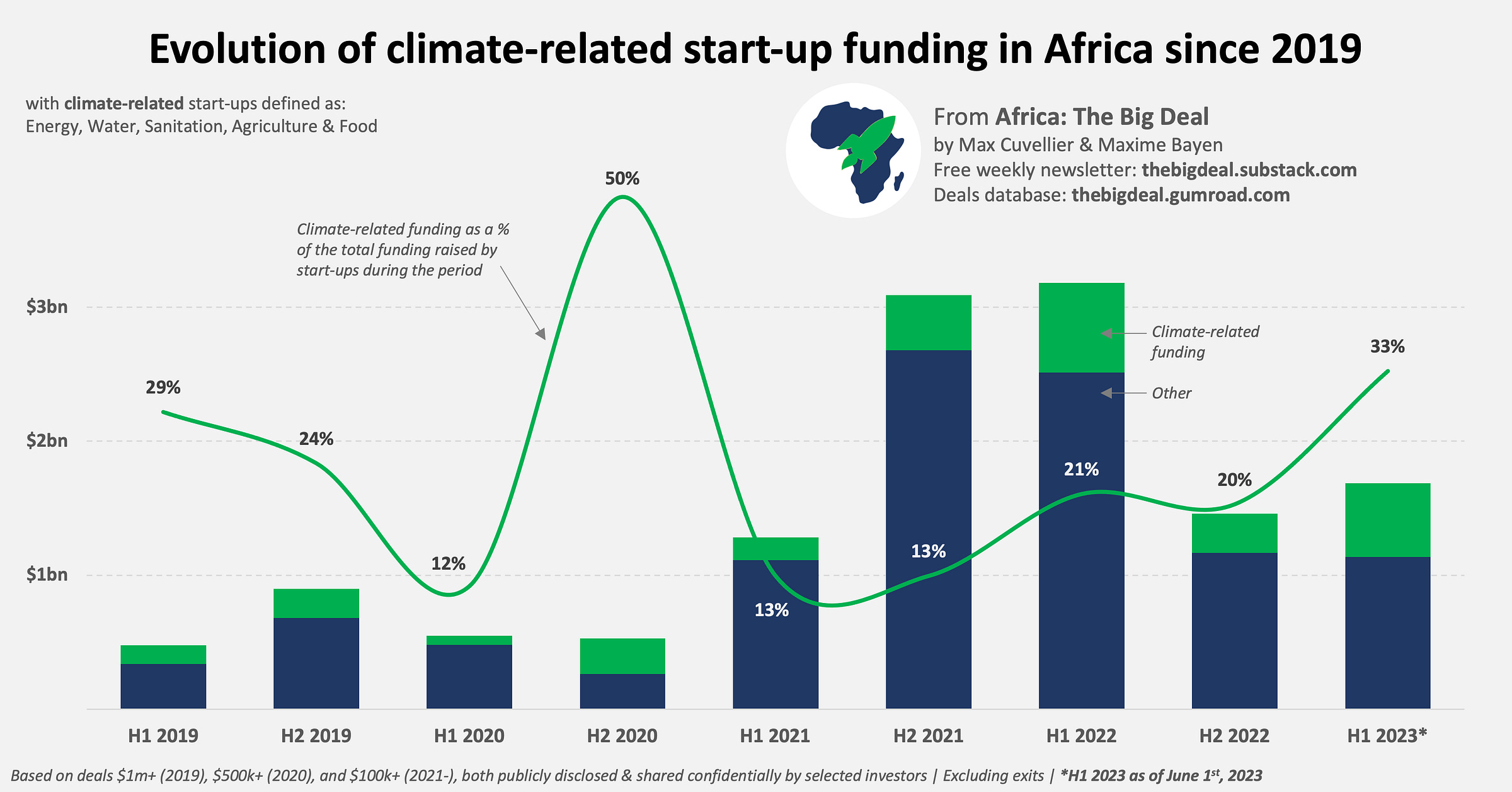

A total of $2.8bn in funding have been invested in climate-related start-ups in Africa since 2019, which represents 21% of all the funding raised by start-ups on the continent over the period (excluding exits). In 2023 so far (Jan-May), the percentage is significantly higher (33%), the second-highest half-year after H2 2020. At least 230 deals over $1m have been signed in the space since 2019, just over 20% of all the deal signed on the continent; this percentage is also higher for 2023 so far (27%), the highest of any half-year since 2019. The reality though is that Energy still represents the vast majority of the funding raised in the space: $2bn out $2.8bn (73%). Given the two large announcements in May 2023 by M-Kopa ($200m debt + $55m equity) and Sun King ($150m), this proportion currently stands as high as 89% for 2023 so far. Three out of five $1m+ climate-related deals since 2019 have been in the energy space. The proportion is much lower though (a third) if we look at smaller deals ($100k to $1m), which is encouraging. Indeed, while the Energy sector - and more specifically pay-as-you-go solar scale-ups - is driving the numbers up, the space is getting broader with start-ups addressing a range of issues from bridging the environmental data gap (e.g. Amini), tackling food waste (e.g. Figorr) or building low-carbon homes (e.g. Kubik).

What is also encouraging is to see things evolve fast on the supply side, with plenty of funds being announced since the beginning of the year that are aiming to focus on climate-related investments, including AfricaGoGreen Fund’s second close ($47m), the launch of Oxfam Novib and Goodwell’s Pepea fund ($20m), Novastar’s Africa People + Planet Fund (up to $200m?), Equator’s initial close of its first fund ($40m), as well as E3 Capital and Lion’s Head climate fund first close ($48M). All of which are purely focused on Africa. Other VCs and initiatives are also making sure there is support for earlier-stage ventures, in return helping to build a strong pipe of investable projects for the above funds. We could mention Katapult for instance. And at the risk of sounding slightly biased, we could also reference the work Catalyst Fund and the GSMA Innovation Funds are doing in the space…

We hope you find this analysis insightful; it is certainly a topic that occupies most of Maxime’s and my time these days, and it is great to see things moving there. In any case, we’re now 10 days away from the end of Q2 and H1 - and a year into the ‘funding winter’ -, and I can’t wait to crunch the numbers to see how things are really going. I’m also curious to hear your thoughts, if you can spare 30 seconds for this Linkedin poll for instance. One last thing: I appreciate the quote in the title might have been lost on quite a few of you, so here is the link to García Lorca’s beautiful poem ‘romance sonámbulo’ (original in Spanish here). Hasta pronto!