🔎 Monthly highlights - August 2023

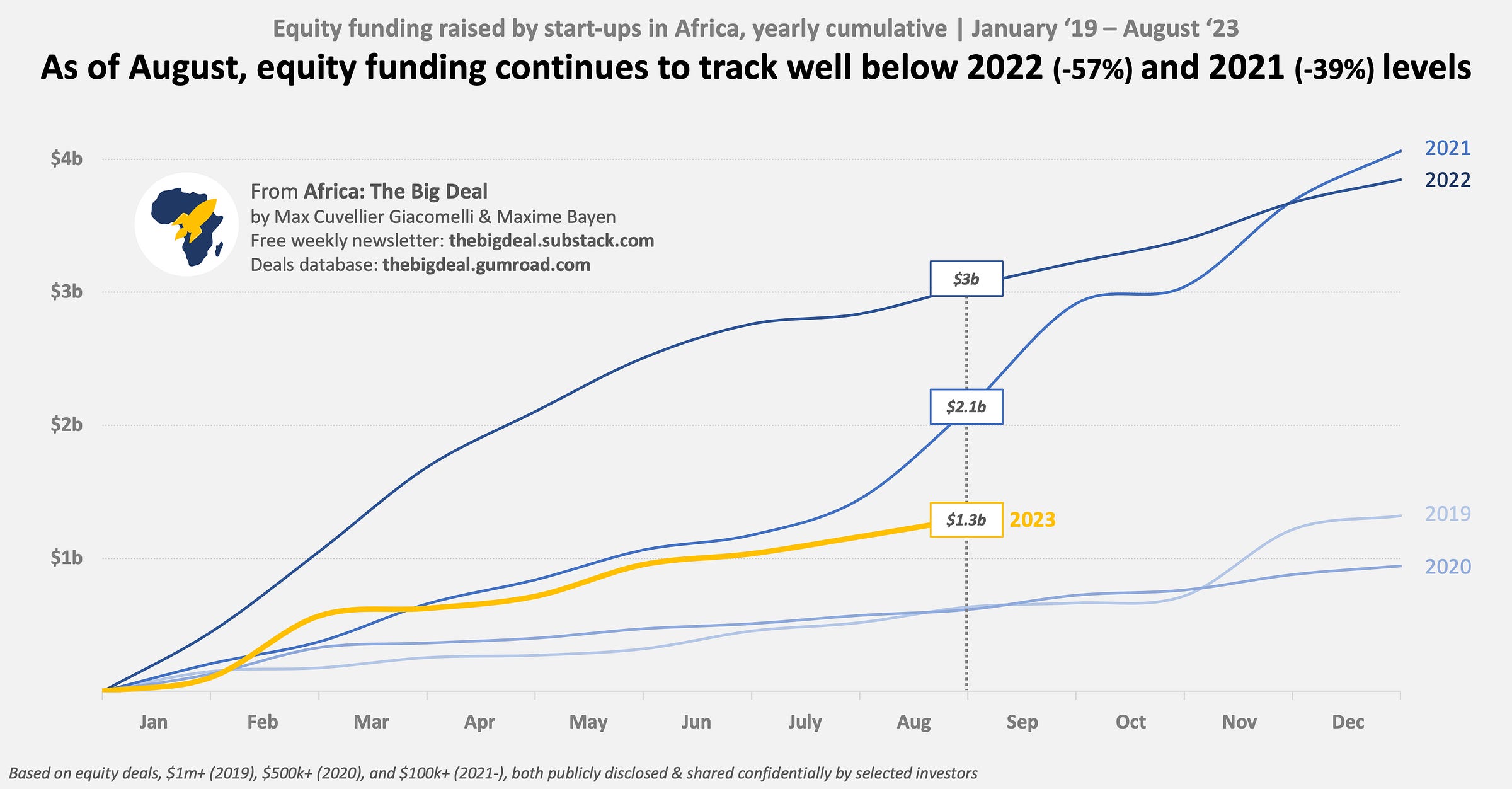

Equity funding grows MoM; continues to track much below 2022 and 2021 levels

Hey! The newsletter is back after a sunny and restful August hiatus. But of course, we continued to track deals on the continent and update our database. And here is what happened last month:

In August 2023, 30 ventures announced a funding round of at least $100k: 23 were purely equity, 2 were a mix of equity and debt, and 5 were debt only (including Spiro’s $63m and d.light’s $30m securitisation facility). To these, we should add two exits/M&A announcements: Moniepoint’s acquisition of Kopo Kopo (fintech, KE), and Grinta’s purchase of Auto-Cure (healthtech, EG). Overall, the total value of disclosed equity + debt transactions last month reached $244m ($135m equity + $109m debt), a +80% jump MoM, but less than in August 2022 (-24%) and far less than in August 2021 (÷3).

If we focus on equity investments - accounting for the fact that debt disclosure is a fairly recent trend - August numbers show a slight increase compared to July (+5%); however, they are still tracking below 2022 (-35%), and much below 2021 levels (-80% i.e. ÷5), when OPay had raised $400m and PalmPay $100m, taking the monthly total to a then-record-breaking $683m (before September 2021 set a new record). The two largest equity transactions in August 2023 were LemFi’s $33m Series A round led by Left Lane Capital, and Moove’s $28m in fresh equity funding (topping up $38m of previously-undisclosed equity investments, and $10m of debt).

As two thirds of the year are now behind us (that’s wild!), how is 2023 tracking versus 2022 and 2021? The level of cumulative equity funding raised by start-ups in Africa is so far much lower than the two previous years, and it would take a miracle (or more) for 2023 levels to eventually reach the $4b-ish mark as it did in the past. So far this year, start-ups have raised $1.3b in equity funding; in 2022, they had already reached this amount by February, and had bagged $3b by August, when the funding winter was starting. A year earlier in 2021, start-ups had claimed $2.1b by August but were just entering funding heatwave territory. At this rate - and if we do a quick rule of three -, equity funding in 2023 is on track to reach just under $2b.

First of all, if you’ve read until this point, you deserve to access our database with a little discount. We’ve tracked nearly 2,800 deals for a total value of almost $16 billion since 2019, so you didn’t have to!

Now, after 120+ weekly posts (!), we’re going to be making some adjustments to this newsletter. I know, change is scary, but it should be for the better. So, What do we have in mind?

Early in the month, you’ll now get monthly highlights, basically following a similar format to this week’s post

Then once or twice a month, you’ll get posts focused on a specific sector, or geography, sometimes on gender, or using another one of the database’s many data point

The biggest change is that a couple of weeks after the end of each quarter, we’re planning to produce a quarterly deck summarising trends, and provide a voice-over through a Linkedin Live presentation. We will try this in October, and see how it goes…

Oh, and Listening Mode - the audio version of the posts we trialled in July - is no more… Those who loved it really did, but many wanted to see it evolve into a podcast and as Dream VC recently built a list of 200+ existing podcasts on the African VC and start-up ecosystem, we don’t think that’s where we can add most value.