African investors fuelling African growth

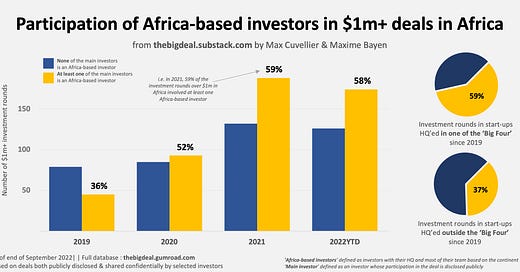

Since 2020, the majority of investment rounds over $1m on the continent have had at least one Africa-based investor as one of the main investors

A healthy ecosystem should be able to attract both local and foreign capital, yet the involvement of local investors is particularly important. So this week we’re looking at the participation of ‘Africa-based’ investors (defined as investors with their HQ and most of their team based on the continent) as ‘main investors’ (defined as investors whose participation in the deal is disclosed publicly) in deals over $1m in Africa. Of course, ‘Africa-based’ might not mean that all LPs are themselves African. Yet, it is a decent proxy. Then, what does it tell us?

More than half of $1m+ deals in Africa since 2019 have had at least one Africa-based investor as one of the main investors. And this percentage has grown quite a bit since 2019 (36% then vs. 58% this year so far). Participation of Africa-based investors as a main investor is comparable - if a little lower - for the subset of larger $10m+ deals (53% in 2022YTD). However, they are still less represented in the [$100k-$1m] range (39%).

Africa-based investors are more active in deals with start-ups HQ’ed in one of the Big Four (involved as a main investor in 59% of $1m+ deals since 2019) compared to those HQ’ed elsewhere (37%). They are particularly active in Egypt (67%), South Africa (65%) and Nigeria (59%); less so in Kenya (47%). In terms of sectors, they play a strong role in Education & Jobs (involved as a main investor in 66% of $1m+ deals since 2019), Healthcare (63%) and Fintech (58%) but not so much in Agriculture & Food (34%), Energy & Water (36%) or Logistics & Transport (31%). They are slightly more active in deals involving a start-up with a female CEO (they participated as a main investor in 59% of such deals since 2019) than a male CEO (53%), and start-ups with at least a female co-founder (58%) vs. all-male founding teams (53%). They are particularly well represented in the deals with start-ups with an all-female founding team (one female founder or an all-female founding team) where they are involved as a main investor in more than two thirds (68%) of the $1m+ deals since 2019.

For more on investors - especially those more active below the $1m mark - make sure you didn’t miss our recent post “Fertilising Africa's start-up seeds 🌱“. As soon as CB Insights’ Q3 State of Venture report is out, we’ll be updating our comparison of Africa and other ecosystems. Stay tuned! And in the meanwhile, we’d love to hear more about the type of analysis you are doing with our deals database, so don’t be shy ;)