Fertilising Africa's start-up seeds 🌱

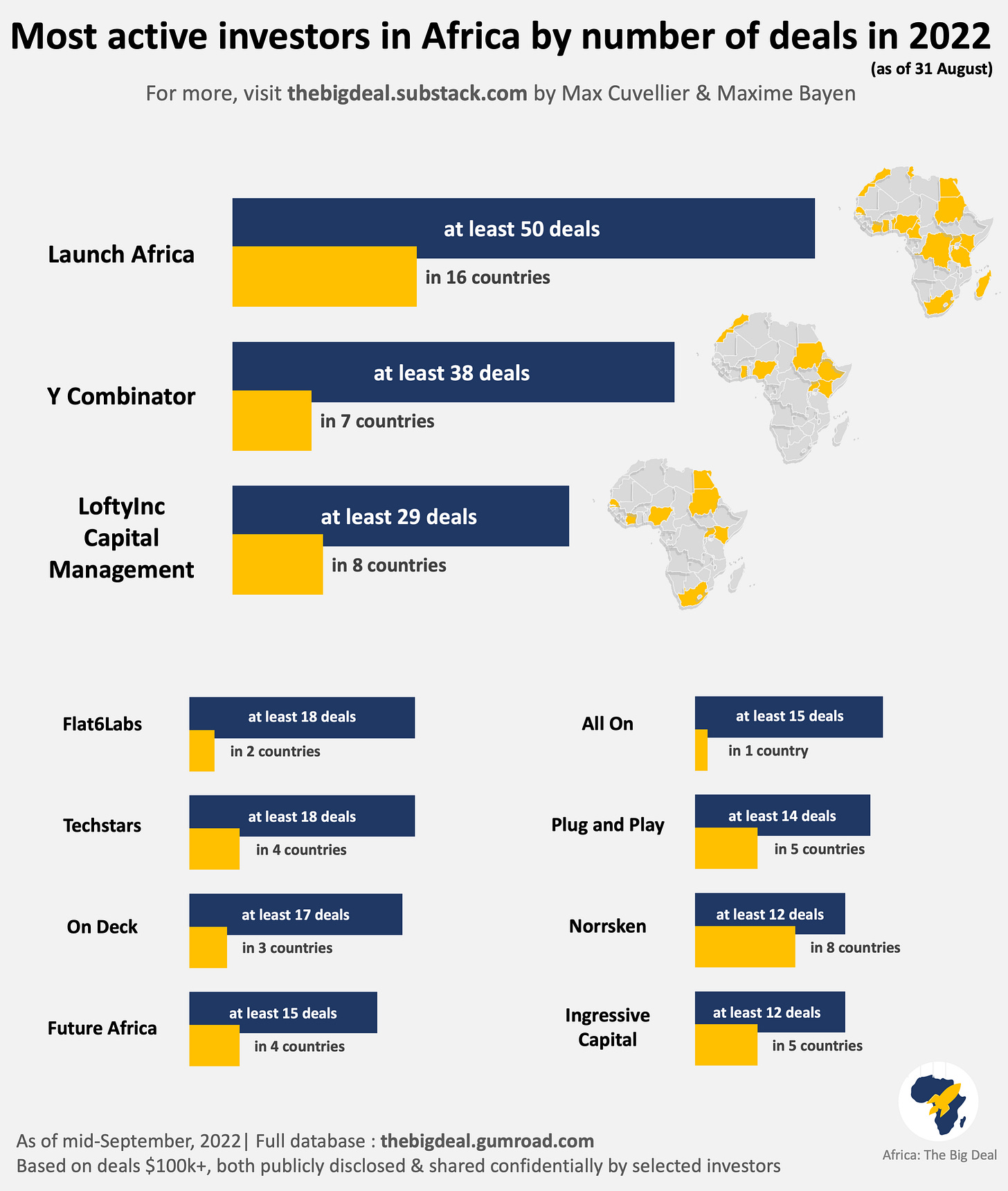

Who are the most active investors in Africa in 2022 so far?

800+ investors have already put money in at least one $100k+ start-up deal in Africa this year, a 33% increase compared to the same time last year. And they’re also much more active: 250 have done two investments or more (+45% YoY); 60 of them have participated in 5 deals or more (+48% YoY). This week, we’re focusing on the heavy-hitters, the most active investors on the continent in terms of number of $100k+ deals they have been involved in (both publicly disclosed, and shared confidentially). They might not be deploying the most capital in dollar amount, but they play an incredibly important role in building the ecosystem. Indeed, 89% of the deals they’re involved in - when labelled - are either ‘pre-seed’ or ‘seed’.

Who are they?* Launch Africa - who already topped the list in 2021 - is leading again in 2022 with at least 50 deals to date in 16 countries (already 3 more than in 2021). Y Combinator (with already more deals than in 2021) and LoftyInc complete the top 3. The rest of the list is made of quite a few familiar names though Kepple Africa and 4DX are missing, but they’re close behind, with 10 deals each. Plug and Play and Ingressive Capital had not made the top 10 last year, but were already quite active with 13 and 7 deals respectively. All On (only 2 investments last year) and On Deck (none) are the ‘new kids on the block’. Interestingly, quite of few of those investors (YC, Flat6Labs, Techstars, On Deck, Plug and Play, Norrsken…) double as robust accelerator programmes, proving that investors at this stage seek to provide much more value to their investees than just capital.

In terms of the geographies where they invest the most, all but one (Flat6Labs, focused on Northern Africa) have made at least one investment in Nigeria this year so far. As a matter of fact, they’ve all made at least 3 investments there (YC has done 25!). All but two have made at least one investment in Kenya. About half of them have been active in Ghana, Egypt, South Africa and Uganda. Despite the efforts of some to diversify geographically (Launch Africa has done half of their investments outside the Big Four in 2022 so far), on average three quarters of the deals they’re involved in happen in one of the Big Four.

A final word of advice, if we may: though these ‘top investors’ are an obvious target for early-stage start-ups, they also get 100s - if not 1,000s - of pitch decks a year. So if you’re fundraising, our recommendation is to go way beyond this list, for instance by identifying investors who have a sweet spot for the sector or the market your start-up’s in.

As many readers reach out to us seeking fundraising advice, we hope this data will be helpful to them. Our database (available here with a discount) might also be helpful to identify other potential investors. If you’re an investor yourself and are not sure whether all your deals are being accounted for in the database, please do not hesitate to get in touch, as many already do. We’ll happily fill in the gaps, confidentially if you prefer. See you all next week for the Q3 results!

* We are only including VC deals in this analysis. But a special mention should be given to three very active providers of non-dilutive capital this year so far: the Google For Startups Black Founders Fund (60 grants in 10 markets), the Government of Canada (20 plastic waste management grants in 7 markets) and USADF with 13 grants to off-grid energy Nigerian start-ups, in addition to All On’s mix of convertible debt and grants.