2025 IN REVIEW - Mapping the money 🗺️

The Big Four dominate once again. Nigeria continues to slip...

If you haven’t already read and/or watched the first part of our 2025 IN REVIEW series, you can find it here. And you will find a video version of this post if you scroll down.

One of the first questions we get asked when we start talking about start-up funding in Africa is always: ‘Which countries are coming on top?’ And since 2019 the short answer hasn’t changed: ‘The Big Four’…

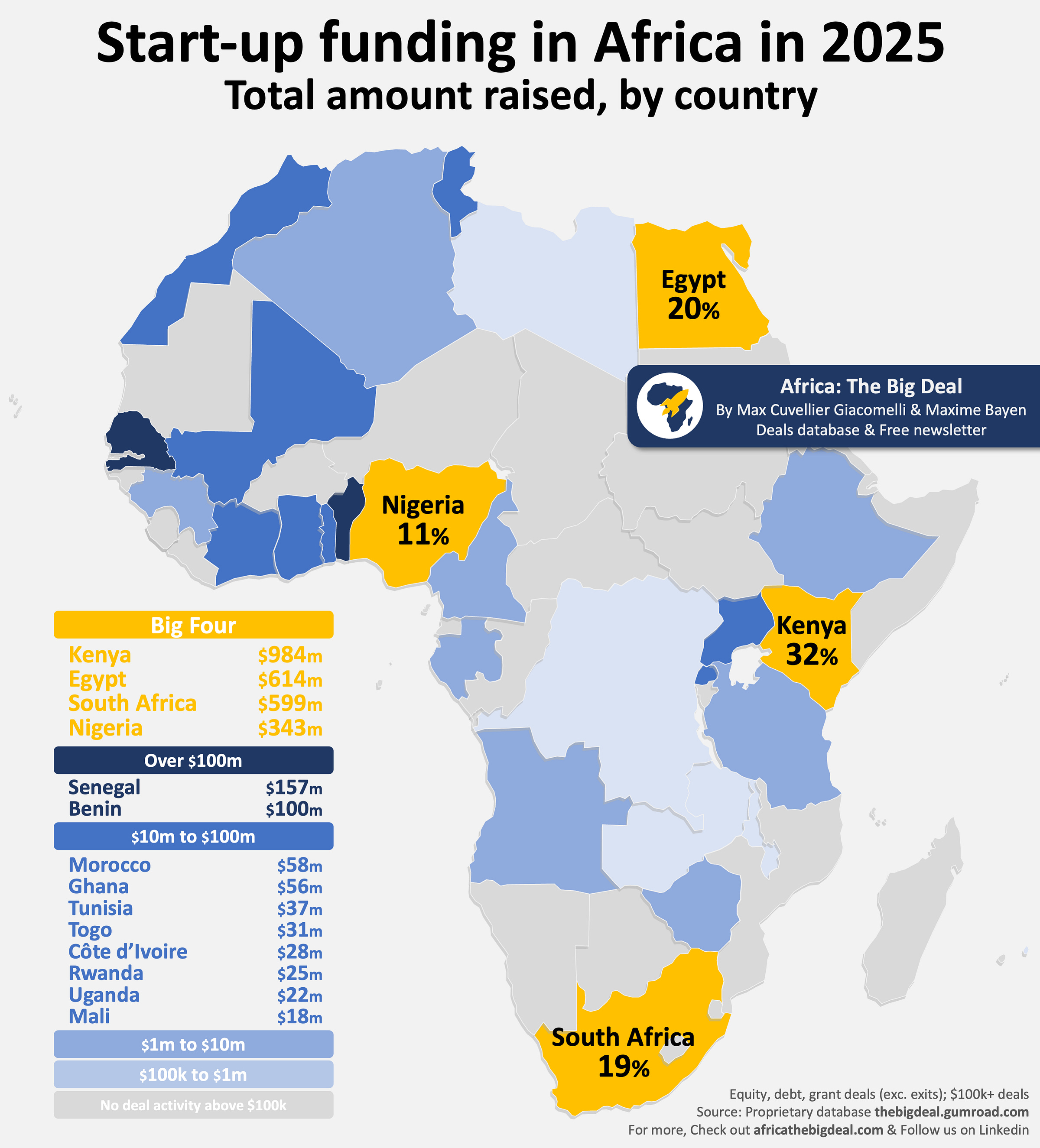

Once again in 2025, the Big Four have attracted the majority (82%) of all start-up funding on the continent. (As a reminder, the Big Four - Egypt, Kenya, Nigeria and South Africa - represent a combined ~30% of Africa’s population and ~40% of its nominal GDP). Nothing new here then: this proportion has been pretty constant since 2019, oscillating between 80% and 86%. The Big Four’s share in 2025 is also exactly the same whether we look specifically at equity or debt (82%). Because the Big Four concentrate a lot of the larger deals, the picture is quite different if we look at the number of individual ventures raising money in 2025 though. Overall, 64% were located in one of these four markets. But while 81% of the start-ups raising $10m or more were HQ’ed in the Big Four, the share falls to 69% if we look at those raising between $1m and $10m, and to 56% for those raising between $100k and $1m. There is life beyond the Big Four; but we’ll come back to that in a moment.

First, let’s zoom in on each of the Big Four individually,

Kenya topped the charts in terms of funding raised, almost hitting the $1b mark. This is the most funding an individual market has attracted in a single year since 2022. In fact, it represented almost a third of the total raised on the continent in 2025. Funding in the country grew +52% YoY overall. Debt ($582m, +33% YoY) represented 60% of the total raised, and the amount of equity raised ($383m) almost doubled YoY. Most of the performance was driven by large energy players (d.light, Sun King, M-Kopa (though arguably now a fintech), Burn and PowerGen). 75 ventures raised $100k or more in Kenya in 2025 (#3), a -23% YoY drop (the worst performance on this metric in the Big Four).

Egypt came second with $614m raised, 20% of the total. Funding in the country grew at a similar rate as Kenya: +51% YoY. Roughly half of the amount raised was equity, and the rest debt. Egypt was also the second-largest market in terms of debt funding ($278m, 24% of Africa’s total). 61 start-ups raised $100k or more in the country last year (#4).

South Africa ranked third as funding in the country also grew +51% YoY to reach $600m, 19% of the total raised on the continent. Over 90% of the funding was raised as equity ($545m) though, making it the biggest market in terms of equity funding (29% of Africa’s total) by quite a margin. We did a deep-dive on South Africa a few weeks ago you might find interesting. The number of ventures raising at least $100k jumped significantly YoY (83, +63% YoY), placing the country at #2 (vs #4 in 2024).

Nigeria ($343m) underperformed in 2025 and was the only one of the Big Four to see a drop in funding raised compared to 2024 (-17% YoY) and a decrease of its share of total funding raised on the continent (from 19% in 2024 to 11% in 2025). This is the lowest share we’ve ever recorded for Nigeria since we started tracking the numbers back in 2019. In fact, no Big Four market dipped so low in terms of its share of overall funding since 2020. Equity - which represented 83% of the total raised in the country - dropped -22% YoY. However, Nigeria continued to lead in terms of number of ventures raising $100k or more in 2025 (86), despite a -14% YoY decrease.

What is happening beyond the Big Four, you may ask? Two other markets registered over $100m in funding raised in 2025: Senegal (#5, $157m) climbed up from the #10 spot in 2024, mostly thanks to Wave’s $137m debt round. In Benin (#6, $100m), almost all the funding came from Spiro’s $100m round, just like in 2024. There is a healthy group of countries where start-ups raised between $10m and $100m in Northern - Morocco (#7, $58m) & Tunisia (#9, $37m) -, Western - Ghana (#8, $56m), Togo (#10, $31m), CIV (#11, $28m) & Mali (#14, $18m) -, and Eastern Africa - Rwanda (#12, $25m) & Uganda (#13, $22m). An additional 8 markets attracted between $1m and $10m in funding, and another 6 saw some minimal deal activity. In 26 country though, we were not able to identify any deal above $100k. In number of ventures raising at least $100k however, the ranking is quite different though, with Ghana (#5), Morocco (#6), Tunisia (#7), Tanzania (#8), Rwanda (#9) and Uganda (#10) making up the top 10.

Finally, at a regional level, Eastern Africa was in the lead in 2025 when it comes to the total funding raised (34%), followed by Western (24%), Northern (23%), Southern (19%) and Central Africa (0.1%). This split is very similar to what we’d seen in 2024, with the exception of a slight slip of Western Africa (from 27% to 24%) as other markets in the region did well, but couldn’t quite compensate Nigeria’s YoY drop. Over a longer period of time, things have evolved quite dramatically: back in 2021, Western Africa was clearly dominating (48%), with the other regions at quite a distance: 23% for Southern Africa, 14% for Northern Africa and for Eastern Africa (now the leading region in terms of funding). When it comes to the number of ventures raising at least $100k, Western Africa (29%) was actually in the lead in 2025, followed by Eastern (27%), Northern (23%), Southern (18%) and Central Africa (2%).

As mentioned above, you will find below 👇 a video version of this post, with many more graphs. And if you need access to the full underlying data, as you’re probably aware by now, all you need to do is subscribe to our database, available here at a discount. And see you soon for more analysis: equity vs. debt, sector view, gender lens, world comparison… they’ll all hit your mailboxes eventually. Bye! Max