First things first: on behalf of Elodie, Maxime and myself (Max), I would like to extend our best wishes to all of you 13k+ followers on Substack and 16k+ on Linkedin for the new year. We truly appreciate your support, which keeps us going when we have to populate our database or write the next post before or after a busy day... Thank you!

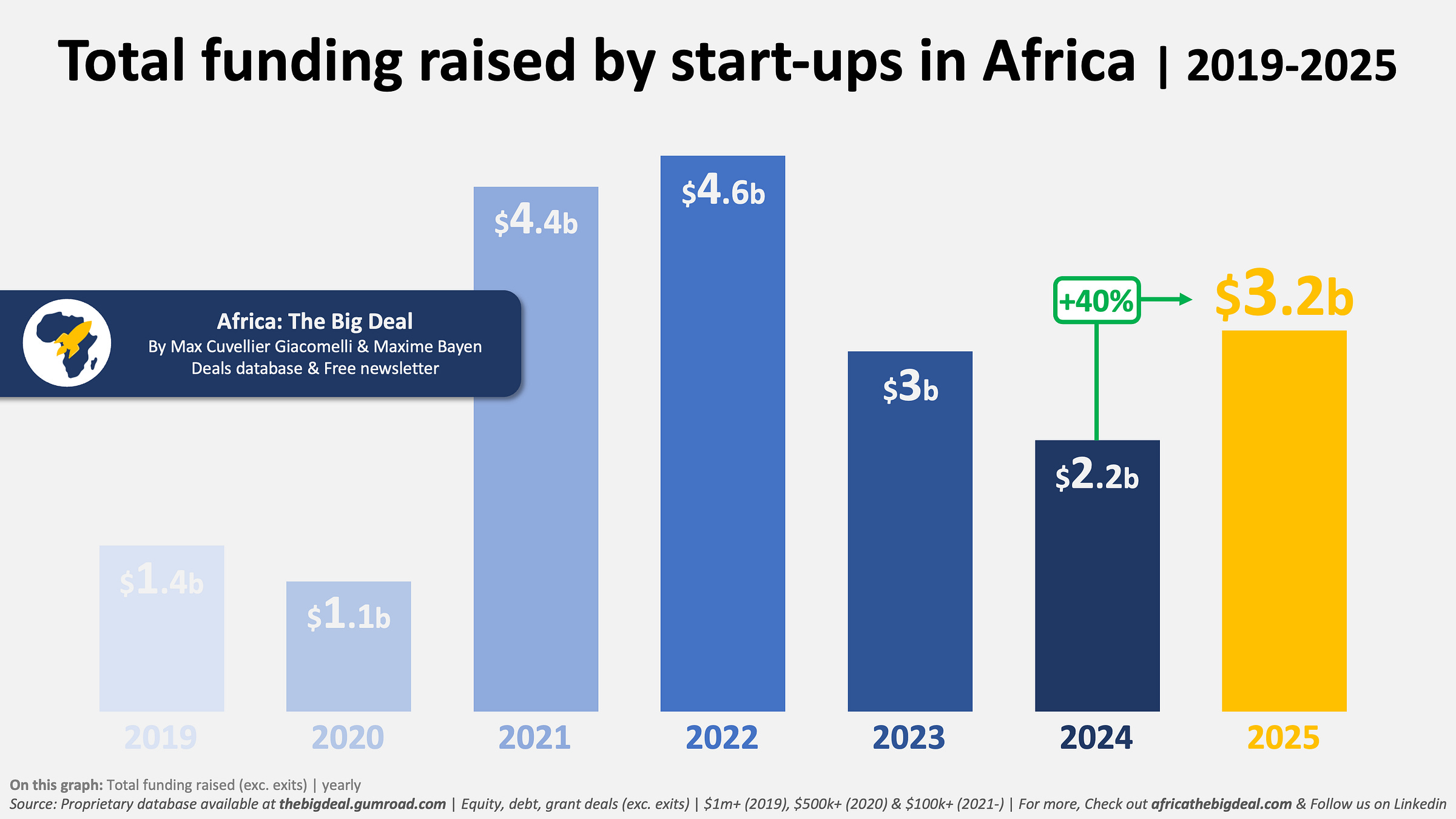

Now all the numbers are in, it is time for us to start our 2025 IN REVIEW series, analysing 2025 data, how it compares to previous years, and what it might mean for the future. We’re starting off with some high-level numbers that really set the tone. Firstly, start-ups in Africa raised $3.2 billion in 2025 (exc. exits). This is an impressive number in itself of course, but it also represents very solid growth compared to 2024: +40% YoY. This is particularly welcome after two consecutive years of decline (-35% YoY in 2023, -25% YoY in 2024). The year ended at fundraising levels not only higher than 2024, but also 2023.

Almost 500 ventures raised at least $100k on the continent in 2025 (exc. exits), a number almost identical to both 2024 (+2% YoY) and 2023 levels. What is notable though is the higher number of ventures raising larger amounts. Indeed, 215 ventures raised $1m or more, which is higher than 2024 (193, +11% YoY) and comparable to 2023. But is even more flagrant for the top raisers: 69 start-ups bagged more than $10m in 2025, compared to just 40 in 2024 (+73% YoY) and 62 in 2023. As a matter of fact, this is the second-highest number since we started tracking numbers back in 2019 (the top was 2022, with 97). 8 of them announced more than $100m in funding in 2025 (vs. 5 in 2024 and 4 in 2023). Most of those were either in the energy (d.light, Sun King, M-Kopa, Spiro) or fintech (Wave, MNT-Halan, Moniepoint) space.

And obviously, you wouldn’t get investment without… investors. In 2025, we identified at least 554 investors who got involved in a $100k+ deal on the continent. This number is likely underestimated as it won’t include small angels whose names are rarely listed, but it gives a good sense of the number of investors who have signed a sizeable check (at least 10s of 1000s of $) during the year. This number is almost identical to our 2024 estimate, but lower than 2023 levels (650+). The share of investors who have been involved in more than one (31%) or more than 5 deals (7%) is comparable - if a little higher - than in the past couple of years. The most active investor (excluding grant-making organisations) has been Digital Africa with at least 23 investments announced in 2025.

Before we wrap up for today - and as we can now look back at 7 years of data - I thought these numbers were quite telling to share: since 2019, start-ups in Africa have raised almost $20 billion (exc. exits). 2,200+ ventures have raised at least $100k over the period, including 1,000+ who have raised over $1m, nearly 300 over $10m and 33 over $100m. MTN-Halan tops the charts with over $1 billion in fundraising.. And 2,500+ investors have participated in at least one deal over the period.

Voilà. We want to stay true to our promise and keep our posts short(ish), so I’ll stop here for today. There is so much more to talk about of course, and we’ll keep distilling the analysis in the coming days and weeks. In the meanwhile, if you need access to the full underlying data (those $20 billion worth of deals I mentioned above), you can access it here with a discount. And one last thing: as you’ve seen at the top, we’ve tried something different this time with a video version of the post for those of you who prefer this type of format. If you like it, do let me know so I know if I should continue. Thanks! Max