Previously, on Africa: The Big Deal: 500+ investors got involved in at least one $100k+ deal last year; some of them were pretty active … Full episode:

To conclude our series on 2024 start-up fundraising in Africa, we thought it would be helpful to compare the trends on the continent to what is happening in other parts of world. Here we’re focusing exclusively on equity investments, for comparability’s sake with CB Insights’ data.

With $1.5b in equity raised in 2024, Africa represented 0.6% of the total globally ($275b). This is modest, and it doesn’t come anywhere near Africa’s contribution to global GDP (PPP) (~5%), let alone Africa’s share of global population (~18%). Talent is equally distributed, Opportunity is not; and many investors continue to fail to realise the potential of Africa’s entrepreneurs and markets, missing great deals in the process. It can’t be right that a continent of ~1.4 billion people - with its challenges of course - attracts about the same amount in start-up funding as Miami ($1.8b), the 12th city in the United States in terms of equity fundraising last year…

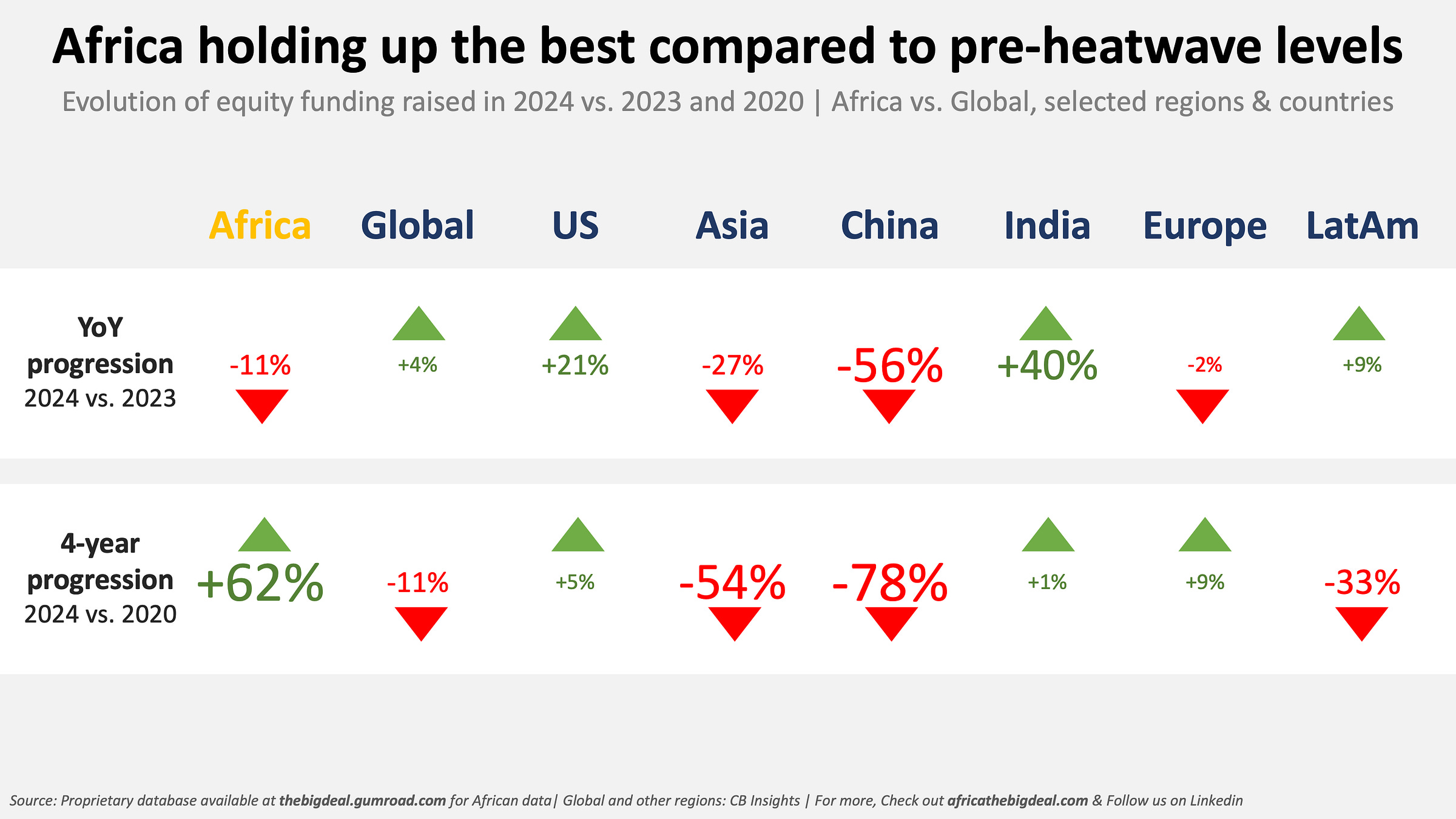

Beyond the numbers themselves, what do other regions tell us about Africa’s performance in terms of equity fundraising in 2024 vs 2023 (-11% YoY, remember)? Well, it is a bit of mixed bag: overall the continent did better than Asia (-27% YoY) where the numbers were pulled down by China’s particularly poor performance (-56% YoY) - see FT’s ‘How China has ‘throttled’ its private sector’ for more. However in Asia still, India - with a population and GDP equivalent to Africa’s - had a very strong year, boasting some +40% YoY growth. If we look over to the west, we’re also noticing growth both in the US/North America (+21% YoY) and in Latin America (+9% YoY). All things considered, equity start-up funding in Africa contracted -11% YoY in 2024, while it grew +4% YoY globally.

📺📒🧾 If you’re here, we’re assuming you’re aware this is part of a bigger project which included a live presentation, a full deck, and an underlying database…. What? You didn’t know?! Then check out this post urgently:

Well, you know us: We don’t like to leave you on a negative note, and this time around our silver-lining comes from a look at longer-term trends i.e. comparing pre-heatwave funding levels (2020) to 2024. The purpose is to try and identify how ecosystems have recovered from the post-heatwave slowdown. And in that case, Africa is doing really well with +62% over the 2020-2024 period ($1.5b vs $0.9b). The other regions and markets that display positive trends over the same period have more or less gotten back to their 2020 levels e.g. the US (+5%), Europe (+9%) and India (+1%). In other parts of the world however, 2024 numbers remain way below 2020 levels, like in LatAm (-33%), in Asia (-54%), and notably in China (-78%). Globally, we are looking at a -11% contraction and Africa is the only real outlier.

That’s it for today. Actually, that’s going to be it for our 2024 analysis for now. We’ll do a recap to wrap it all up with a nice bow in the coming days, but at this stage it feels like we’ve given you quite a bit to think about… and pass around of course. If you need more details, different cuts of the data etc., it’s likely you could use access to the full underlying database, and that you would enjoy a little discount. Remember: if you’re a female founder or CEO though, you’re actually entitled to a 75% (!) discount... OK, Bye for now then! Oh, actually, just one last thing…