🌦️ 2023 🌦️ Fewer investors, but no exodus 🌦️

Despite a YoY drop, a core group of resolute investors confirmed their commitment, while the continent continued to attract newcomers.

Previous on Africa: The Big Deal: 87% of start-up funding in Africa in 2023 went to the ‘Big Four’. Kenya (#1), Egypt (#2) & South Africa (#3) monopolised 90%+ of the funding in their respective regions, while Nigeria’s share dropped.

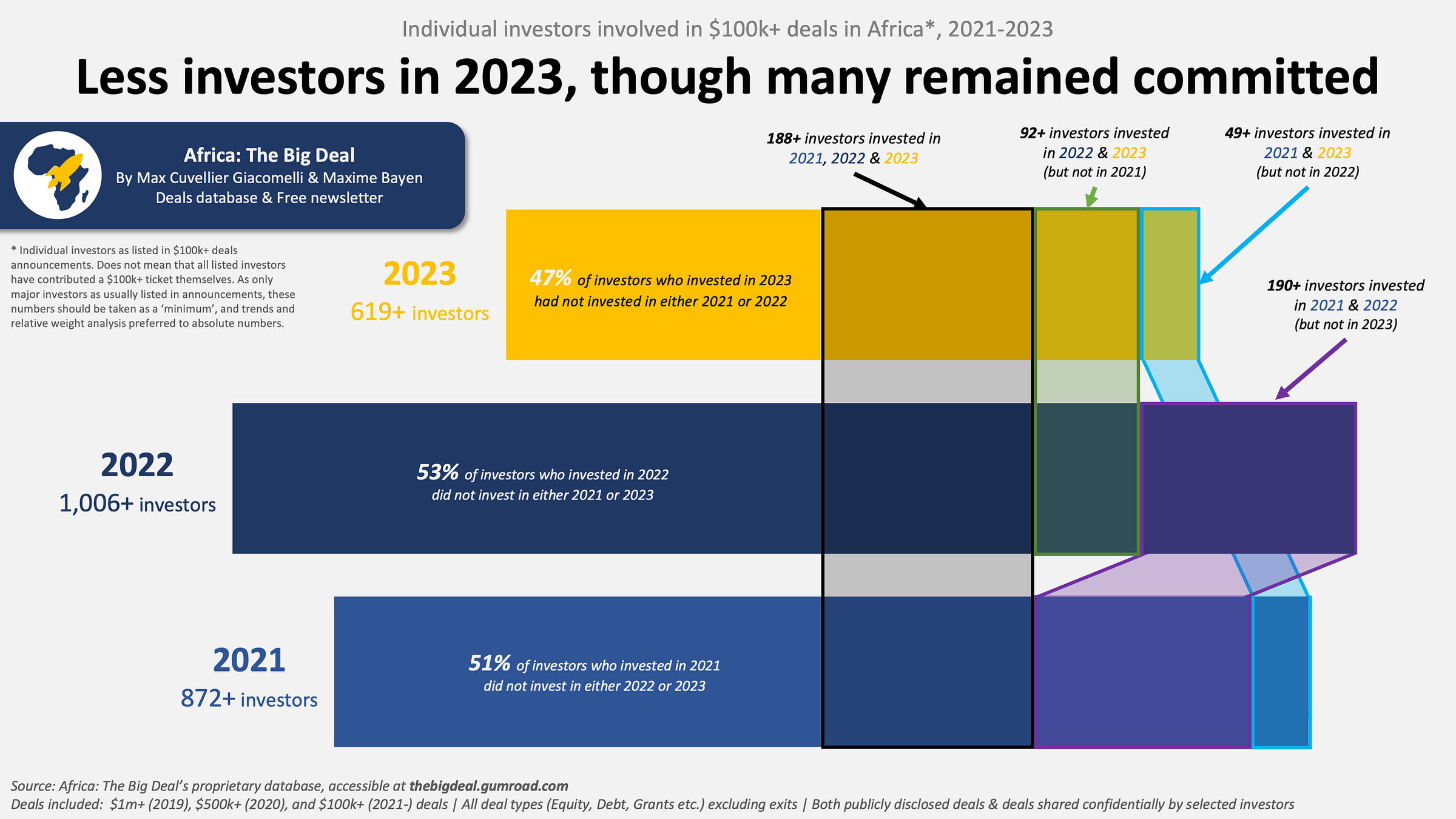

At least 1,790 unique investors were involved in one $100k+ deal or more since 2021 (we’re counting those mentioned in public announcements and those who shared deal data in confidence with us). In 2023, we recorded 619+ unique investors, a -38% YoY drop, which is very much aligned with not only the drop in overall funding but also in number of ventures raising $100K or more (-39% YoY for both).

It would be tempting to think that in a tough investment climate, only those who had invested in the continent beforehand decided to do so in 2023. But this isn’t exactly the case as 47% of investors who invested in a $100k+ deal in 2023 had not invested in one in either 2021 or 2022. Out of those who had been involved in a deal in the previous two years, 15% had been active in 2021 only, 28% in 2022 only, 58% in both 2021 and 2022. In this group of 188+ resolute investors, Africa-HQ’ed investors are overrepresented (40%); in comparison, they made up a third of investors who had not previously invested in 2021 or 2022.

It is also interesting to zoom in on investors who were active in both 2022 and 2023 (280+) and to look into how their level of activity evolved: only a minority (17%) invested in more deals in 2023 than the year before, while 36% signed the same number of deals, and almost half (47%) reduced their deal activity. Comparatively, 38% of investors active 2021 who were also active in 2022 had increased their deal activity year-on-year.

Of all those active in 2023, 71% were involved in only one deal $100k+, and this percentage goes up to 89% if we consider investors involved in three deals or less. Both proportions are just slightly higher than they were in 2021 and 2022. On the other end of the spectrum, if we focus on the most active investors (involved in at least a $100k+ deal a month, therefore at least 12 during the year), there were ‘only’ 10 of those in 2023 (3 of which provided grant funding exclusively). As a comparison, they were 27 in 2022…

This last group plays a particularly important role in the ecosystem, and they ‘might’ be getting their own analysis soon... Until then, you can still access our full database of underlying deals at a discount here, and we count on you to join us in a week’s time for our free LinkedIn Live event on January 17. Thanks to the 1,300+ of you who have already registered!