Welcome back to the $1m+ club 💯

This week we continue our deep-dive on the start-ups who have raised their first $1m+ round this year so far...

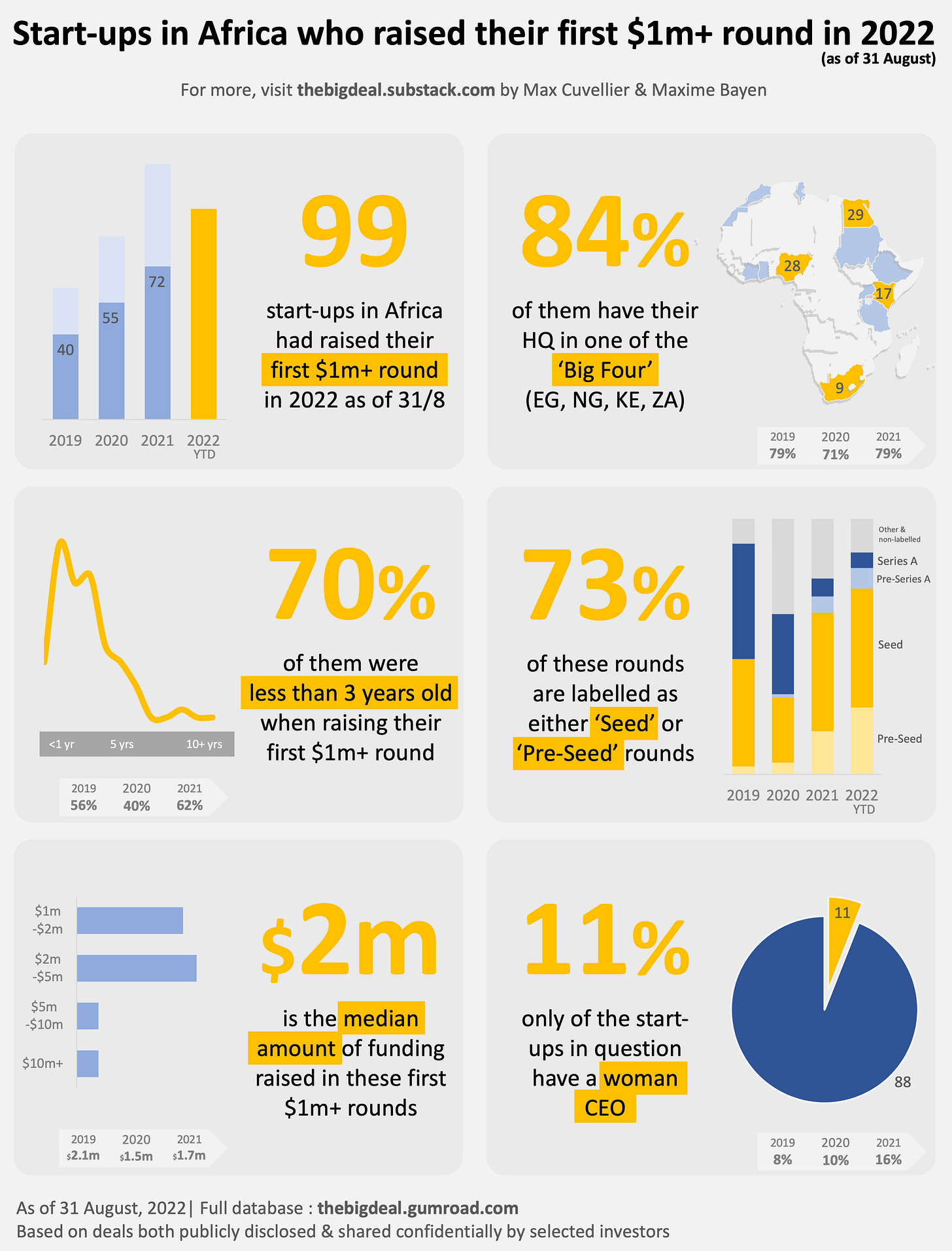

Today, we’re continuing last week’s story focused on the start-ups in Africa who have raised their first 7-digit round in 2022 so far. If you’ve missed it, you can access it here, but in short: there’s very promising YoY growth, most of them are based in the Big Four, the median round is ~$2m, and most-likely labelled as ‘Seed’ (or ‘Pre-Seed’). What else?

What are they doing? I’ll let you guess which sector is the most represented… Yes, you’re right: it’s fintech. Fintech start-ups make up over a third (36%) of the ventures who have raised their first $1m+ round in 2022 so far. This proportion has been quite stable since 2019, despite a slight dip in 2020 (27%). The next two most represented sectors in 2022 to date are Logistics & Transports, and Retail.

What about the founding team? Almost half of the start-ups have two co-founders, a quarter have a single founder, and the remaining quarter have 3 or more. This split has been quite consistent over time, though the proportion of larger teams (3+) has been slowly declining since 2019.

And gender? Unfortunately - yet unsurprisingly - women are very much underrepresented. Indeed, three quarters of the start-ups in question have either a single male founder (51%) or an all-male founding team (22%). In contrast, single female founders (4%) and all-female founding teams (1%) represent only 5% of them; and there’s no sign of improvement over time. The rest (21%) are gender-diverse founding teams. As a direct result of this - as the CEO is almost always a (co-)founder - women-led start-ups are massively underrepresented with only one in nine (11%). And this number is lower than in 2021 (16%).

Now, raising the first $1m+ round is a great milestone per se, but it’s only really worth it if it helps the venture grow. If we measure growth by the ability to raise further funding - arguably a pretty imperfect metric, but at least a metric we’re able to track -, the results are very encouraging. Of the start-ups who raised their first $1m+ round in 2019, almost two thirds (39 out of 62) have announced further funding since, sometimes more than once. It is the case for half (43 out of 86) of those who raised their first $1m+ round in 2020, and a quarter of those who had raised it in 2021 (27 out of 112). These follow-on deals - coupled with the increasing number of start-ups raising their first $1m+ rounds - illustrates how the ecosystem in Africa has been building, and continues to build very strong foundations for future growth.

This concludes our 2-part analysis of the “$1m+ club”. We’ll be back next week with a new topic; comments and suggestions are very much welcome as always! In the meanwhile, if you’re interested in subscribing to the database - with now more than 1,900 deals -, don’t forget to use this discount code, unless you prefer to pay full price of course. The database currently has a 4.9🌟 rating on gumroad (just saying). Ciao!