[Updated on 26 April, 2.20pm GMT] This post was updated to include Bloom (YC W22, Sudan) which was initially omitted from the stats. Apologies to the Bloom team. You can read more about their work here.

There has been some debate recently about the Y Combinator model, but this is not what this post about :) What we’ve done though is look at the start-ups in YC’s public directory, and then crossed the data with our deals database. And here is what we found:

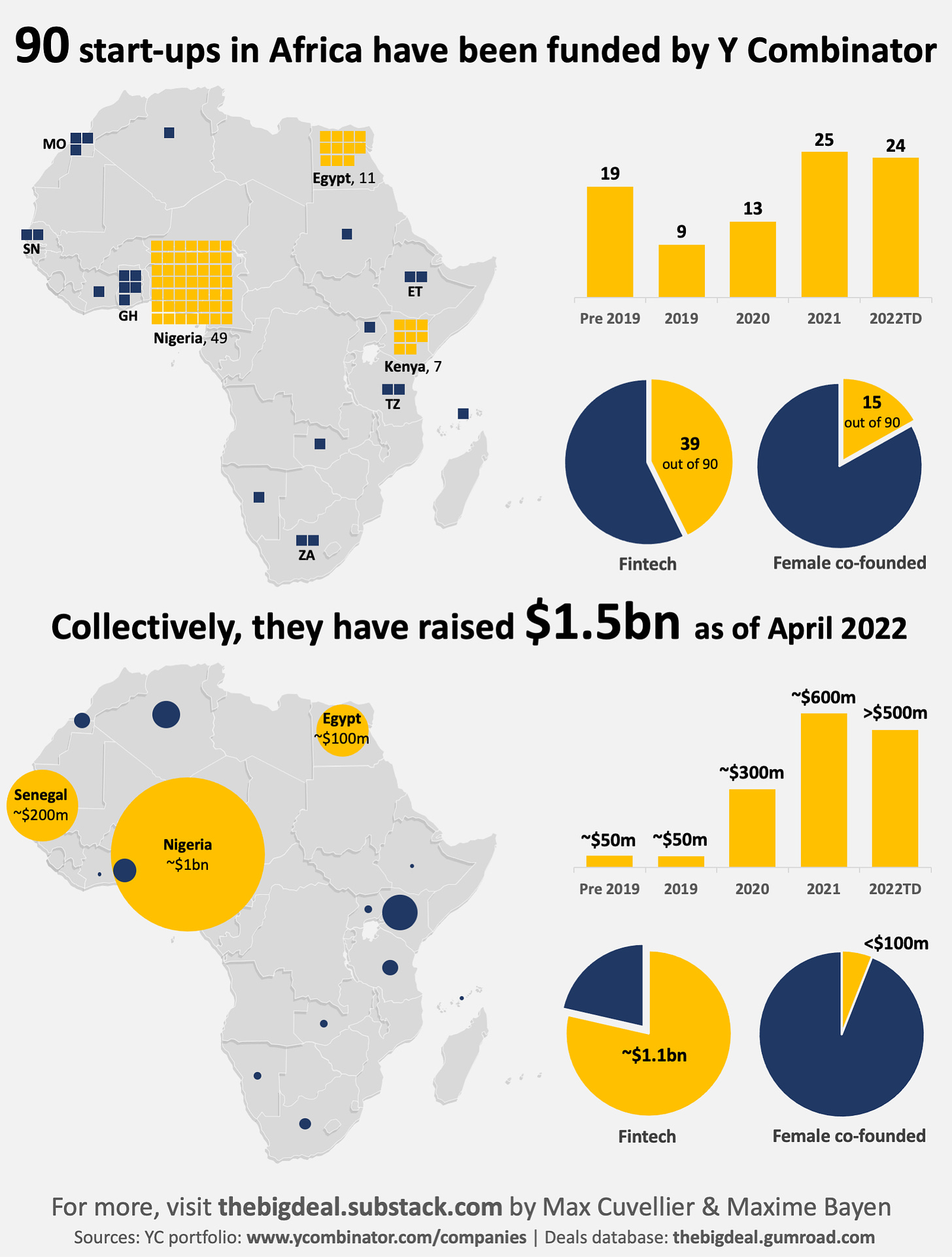

Who are the African YC start-ups? There are 90 of them (i.e. 2.5% of the total 3,655). More than half of them (49) are based in Nigeria, followed by Egypt (11), Kenya (7) and Ghana (5). Overall 16 countries are represented. The most represented sector is fintech (39, 43%), which is a much higher percentage than in YC’s overall portfolio (12%). Most of the African start-ups in YC’s portfolio are recent additions: 49 (54%) joined the portfolio in 2021 (25) and 2022 (24). 17% (15) have a female co-founder, which is slightly above YC’s global average (15%); most of these female co-founded start-ups are recent investments. Only a couple though have a female CEO.

How well have they done at fundraising? Collectively, they have raised nearly $1.5 billion. This number includes Paystack’s $200m acquisition by Stripe in 2020. Most of this funding ($1.1bn) has been raised since the beginning of 2021. More than two thirds of the total amount ($1bn) were raised by YC start-ups in Nigeria. Nearly 80% of the total amount raised went to fintech start-ups; Logistics & Transports (8%), AgriTech (6%) and HealthTech (4%) are the other sectors attracting investment, yet at much smaller levels. 19 of the start-ustps have already raised more than $10m, three of which have bagged $100m+ ‘mega deals’: Flutterwave (YC S16), Paystack (YC W16), and Wave (YC W12). Less than 6% of the funding was raised by female co-founded start-ups, and almost no none of the funding (<0.1%) has gone to female-led ventures.

Though it was a bit tedious to have to extract the data manually, YC’s public directory is quite an interesting tool. We’ll add this information as a data point in our deals database moving forward; if you’re a subscriber, look out for the new ‘YC cohort’ column in the upcoming monthly update of the database on May 1st.

Ever heard about MANSA? Its Due Diligence platform collects reliable information on local businesses and promotes intra-African trade by helping those registered on the platform to get access to potential trade and business partners. If you’re interested but don’t know where to start, Asoko provides a route onto MANSA with tailored support from their analysts.