More start-ups raising $1m+ in Africa 💵

While overall funding levels remain low compared to previous periods, the number of ventures raising $1m+ is starting to pick up

Last week, we published our overview of the start-up funding in Africa in Q1. While we won’t be doing our next Linkedin Live round-up until the end of H1, we thought we’d still dive a little deeper into the Q1 numbers, with a few more graphs and analysis:

As shared last week, the total funding raised in Q1 2024 by start-ups in Africa was almost halved compared to Q1 2023 (-47% YoY). It also remains lower than what was recorded in 2022 (an all-time record) or 2021. On the positive side though, the number of start-ups who have raised at least $1m during the quarter is higher than previous Q1s’ levels, except for 2022 of course.

Actually, while the amount raised quarterly is still at its lowest since Q4 2020, we can see that the number of ventures raising at least $1m during a quarter has started to bounce back in Q3 2023 and continued to do so consistently since.

If we look at equity and debt separately, we notice that equity levels in Q1 2024 were quite comparable to Q4 2023 levels (with ‘only’ a -9% decrease QoQ), while debt levels dipped (-44% QoQ). As debt has grown relatively to equity in the past few quarters - you may remember we dubbed 2023 ‘the year of the debt’ -, this impacted the overall funding performance more than it would have in previous years. The equity to debt ratio stood at 2.5:1 in Q1, compared to an average of 1.6:1 in 2023. It remains much higher than in previous years (5:1 in 2022 and 14:1 in 2021).

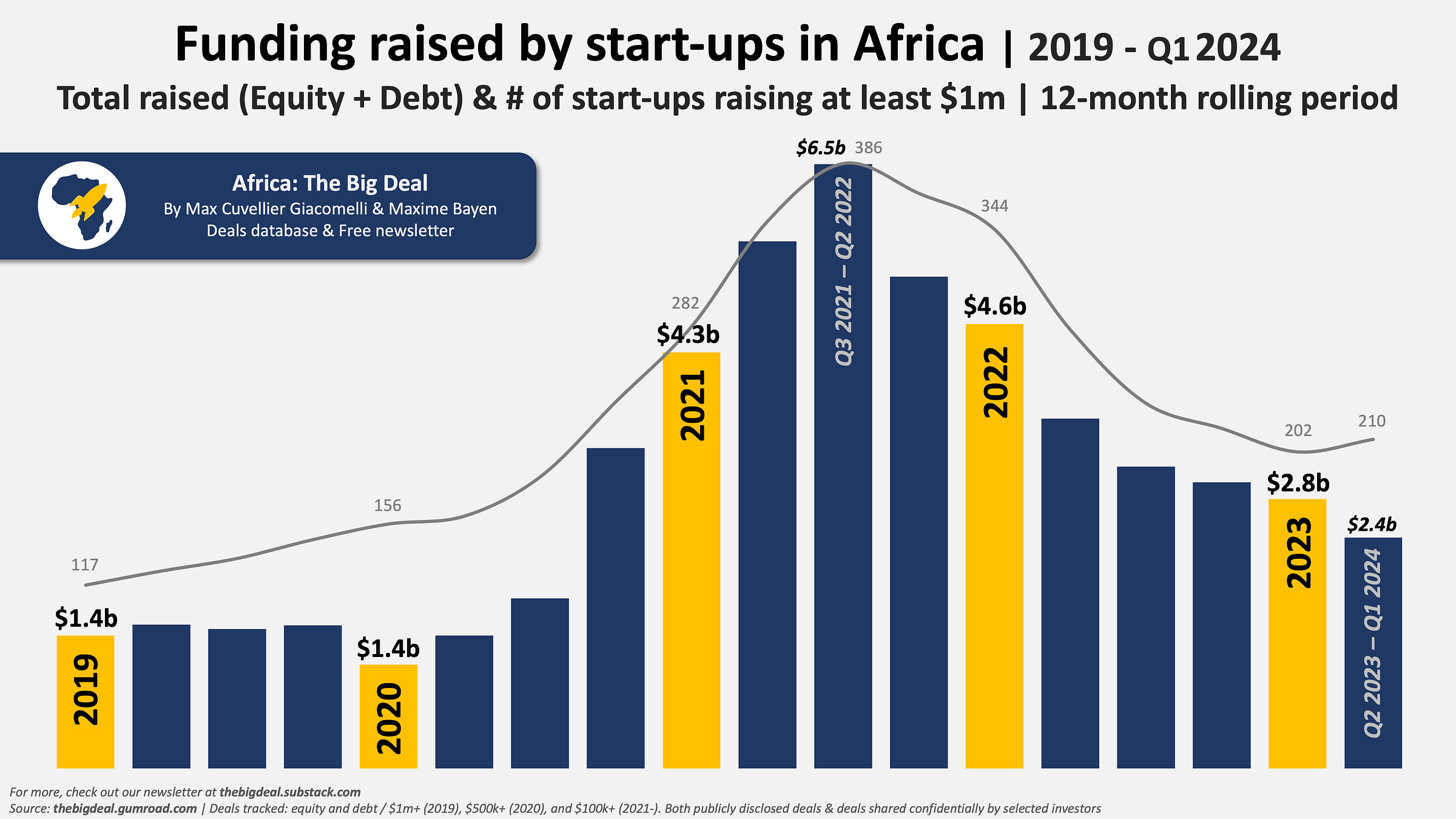

An interesting way to look at the numbers is to focus on 12-month rolling periods. From this view, we can see that funding in the ecosystem is yet to bounce back unfortunately: in the past 12 months (April 2023-March 2024) start-ups in Africa raised $2.4b, 14% less than in the previous 12-month period (Q1-Q4 2023). The amount raised in the past 12 months represents only 38% of the amount raised during the most successful 12-month period for the ecosystem i.e. $6.5b between July 2021 and June 2022, at the height of the funding heatwave.

To leave on a positive note though, if we focus on the number of ventures raising at least $1m in each period, we observe that this number did in fact start to grow again in the last period, after six consecutive periods of decline…

Voilà, that’s it for today. For once, this week’s analysis left me quite optimistic as it helped get away - at least a little - from the ‘how low can it go’ narrative. As always, you lovely readers can access the underlying data with a discount by using this link. A (very) warm hug from Delhi! Max