🔎 Monthly highlights - October 2023

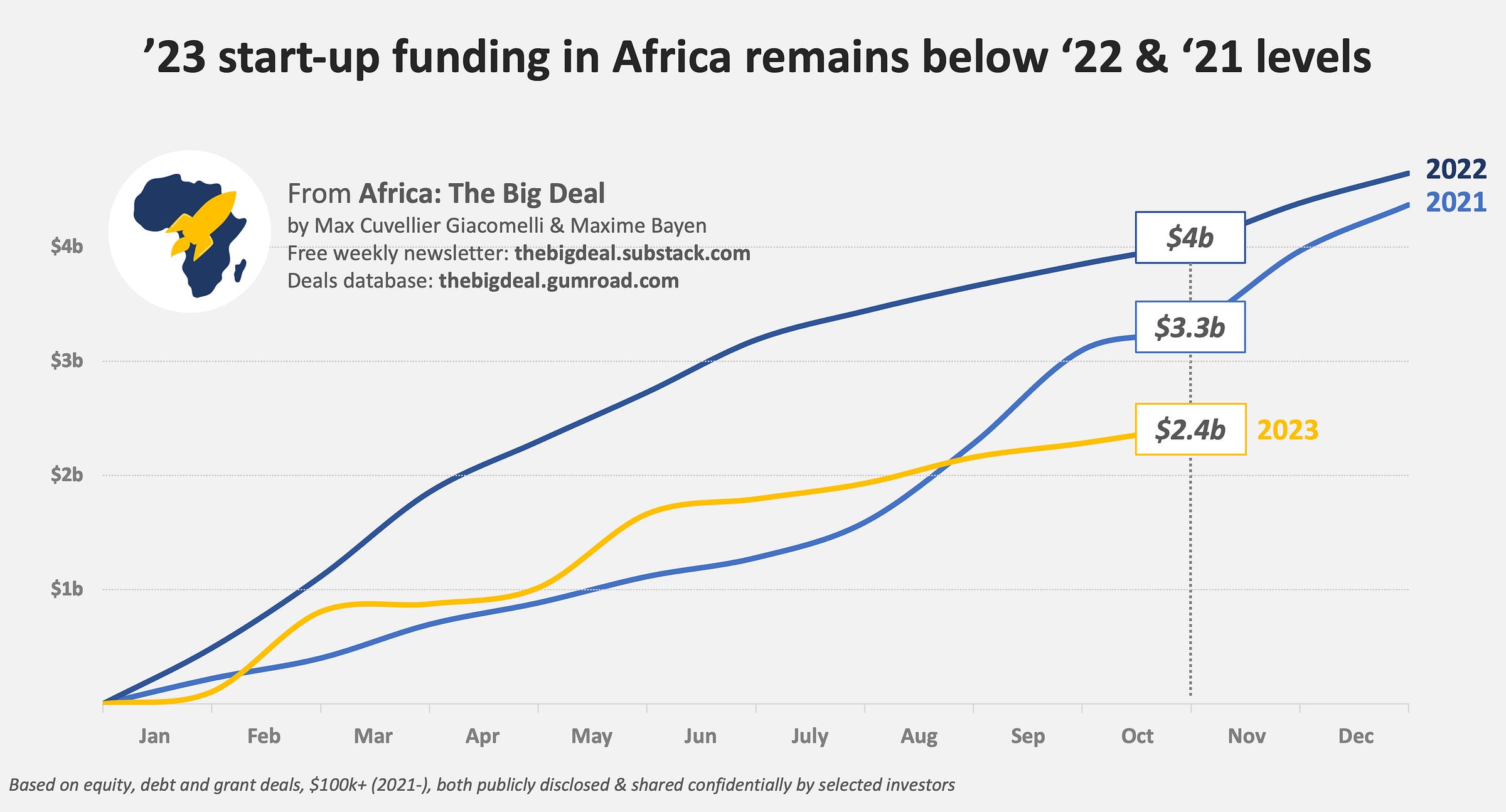

Funding levels continued to track below 2021 and 2022 levels in October.

As you may remember, September fundraising levels in Africa were particularly low. The moderately good news is that they bounced back a little bit in October. If we’re looking at equity only, start-ups on the continent raised $69m last month, a 12% MoM increase compared to September ($61m). If we add debt - and a couple grants -, the total reaches $148m (+20% MoM). That said, these numbers remain much below last year’s numbers: -23% YoY ($148m vs. $193m) if we’re looking at all types of funding, and a quite dramatic -60% YoY (i.e. ÷2.5) if we look at equity only ($69m vs. $169m). As a comparison, on average in 2021-2022 start-ups in Africa were raising $330m a month in equity funding ($376m including debt and grants). That said, October 2023 numbers compare more favourably to pre-’funding heatwave’ numbers: in October 2020 start-ups in Africa had raised only $71m (inc. $39m equity).

In terms of funding raised in 2023 to date, the total amount now reaches $2.4b - including $1.4b in equity -, quite behind the totals of 2021 and 2022. In 2022, start-ups had already raised that much funding by April, before the funding winter started…

Which countries claimed most of the October funding? Well, here the picture is very different whether we’re looking at equity only or equity + debt + grants. Indeed, of the $67m of debt announced in October, $65m (98%) went to Kenya and are to credit to M-Kopa’s IFC loan. The $12.5m of grant funding to start-ups announced on the continent in October also went entirely to Kenya (Maisha Meds & One Acre Fund). What it means is that if we consider equity + debt + grants, Kenya is in the lead with 53% of the funding raised ($79m), followed by South Africa (25%), Nigeria (10%) and Egypt (6%). However, if we only consider equity funding, South Africa claims the top spot ($37m, 54%), ahead of Nigeria (21%) and Egypt (14%); with $1.5m Kenya is actually in the 6th spot behind Cote d’Ivoire and Senegal.

Given the size of the M-Kopa transaction, the same bias can be found when we look at funding by sector. Considering only equity funding, fintech was the sector attracting most funding in October (42%, $29m), followed by energy ($17m, 25%). Obviously though, if we include debt and grants, the share of energy funding jumps to 57%, while fintech’s share drops to 20%.

Don’t get us wrong: despite reporting not-so-great news for quite a few months now, we remain optimistic. Why? Because we know that there are many great African start-ups out there, solving real problems, and representing great investment opportunities for VCs, angels etc. But also because new funds keep being announced - like Norssken22’s $205m debut fund -, which proves that there is capital waiting to be deployed on the continent... Now, that’s it for this week. But before I go, I’ll leave you with a discount code if you’re not already subscribed to our database. See you soon!