Mapping the money 🗺️

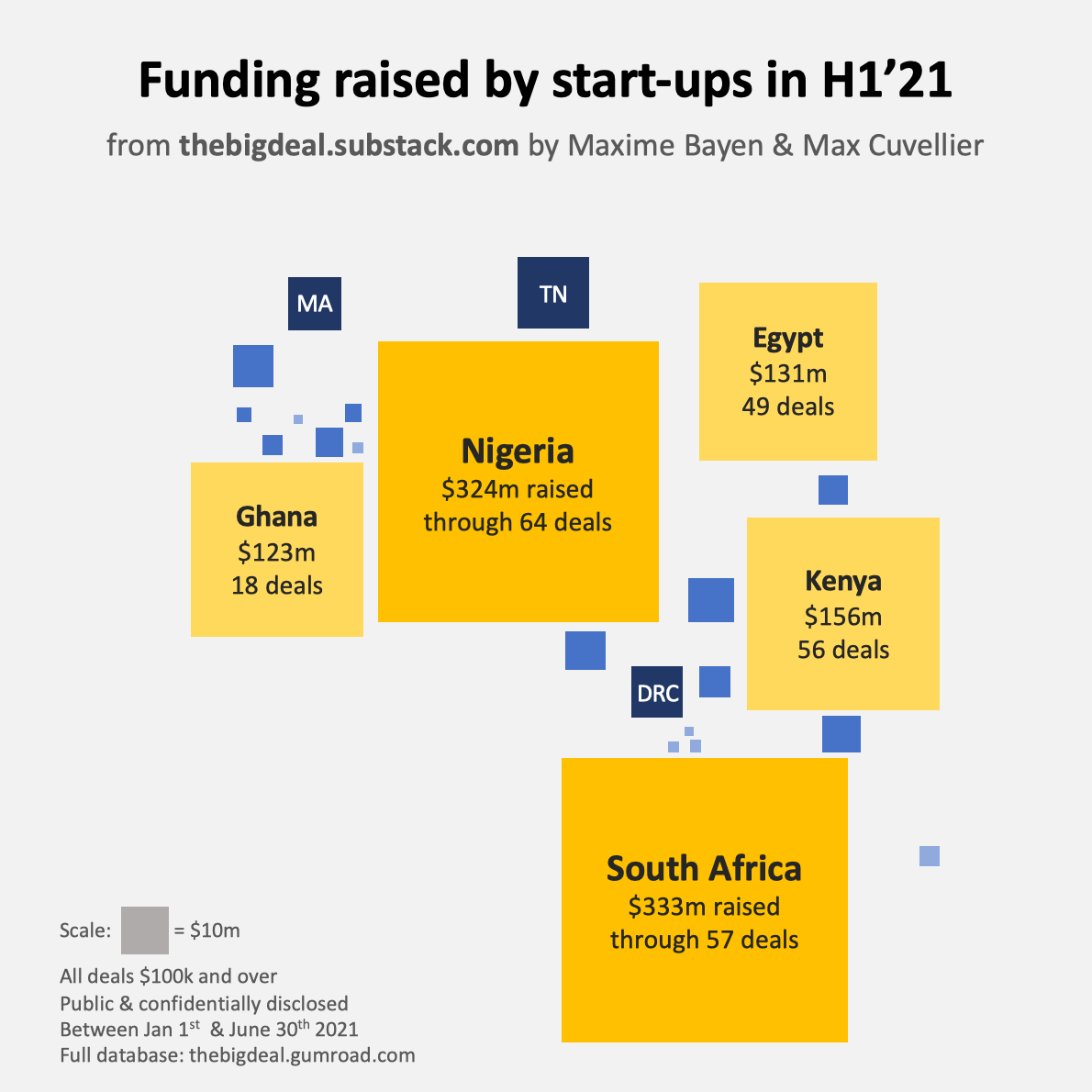

89% of the funding raised in H1 went to the Top5 markets, with South Africa and Nigeria leading the pack

The tech ecosystem in Africa has had a pretty phenomenal first half of the year with ~$1.2bn+ raised through deals $100k and over. Let’s have a look at where all this money was invested:

South Africa and Nigeria are in a league of their own, and together attracted more than half of all the funding raised on the continent (28% & 27% respectively, $300m+ each).

Kenya, Egypt and Ghana complete the Top5 (13%, 11% & 10% respectively). Though with a much smaller number of deals (18) compared to the other four markets (where the number of deal ranges from 49 to 64), Ghana’s overall performance - mostly driven by Chipper Cash’s $100m Series C - is on par with some of the ‘Big Four’ (or should we say ‘Big Five’?)

The rest of the funding (just over 10%) went to deals spread across 19 markets

Tunisia, Morocco and the DRC with more than $10m each

Uganda, Senegal, Cameroon, Tanzania, Ethiopia, Rwanda, Benin, Cote d’Ivoire, Mali and Sierra Leone, with at least one $1m+ deal each

Madagascar, Botswana, Zimbabwe, Togo, Burkina Faso, and Zambia, with all deals below the $1m mark

And there is definitely more to come… Nearly $150m (!) have already been raised by start-ups in Africa in the first 10 days of H2, most of which went to Nigeria ($100m+ inc. $42m to FairMoney) and Egypt ($42m+ inc. $40m to MaxAB), which are now overtaken South Africa and Kenya respectively. In short: Watch this space!

Thanks for reading, and don’t hesitate to share this with anyone you think could find this helpful. The full database is available at http://thebigdeal.gumroad.com.