Vital yet At Risk: How to build resilience in Pre-Seed financing in Africa

[Guest blog] Grégoire de Padirac of Digital Africa - the most active investor in Africa in number of deals in 2025 - advocates for a renewed focus on pre-seed on the continent...

Pre-seed financing remains the backbone of African innovation, yet it is often overshadowed by the news of mega funding rounds. As a startup’s first capital raise, it typically finances incomplete teams and rudimentary prototypes, precisely where capital is scarcest. In other regions, founders often bridge this phase through personal savings and “love money” (Friends, Family and Fools). In Africa, however, such resources are far more limited.

Economic history shows that no major technology ecosystem - African ecosystems included - has emerged without substantial initial public investment. In the United States, DARPA and the SBIR (Small Business Innovation Research) program, which injects over $2.5 billion annually, paved the way for the internet and modern venture capital. In France, Bpifrance’s Fonds National d’Amorçage (FNA) demonstrated a striking leverage effect: €1 of public investment mobilizes up to €18 of private capital.

These precedents have directly inspired fund-of-funds initiatives in Tunisia (Anava) and Morocco (Mohammed VI Investment Fund), as well as direct investment vehicles such as Egypt Ventures and Senegal’s DER/FJ. Yet across the continent, these initiatives remain rare and modest in scale.

Business angels and family offices also play a critical role. Their impact, however, becomes truly decisive only once ecosystems mature, when exits occur and successful entrepreneurs reinvest as angel investors. This virtuous cycle requires sustained and sizable investment flows, as illustrated by the trajectory of Karim Beguir and InstaDeep in North Africa.

Most African states struggle to play this catalytic role. Private pioneers and international donors have partially bridged the gap, feeding the pipeline toward Series A and B rounds. Today, however, this vital link is dangerously weakening.

A contracting, subsidy-dependent market

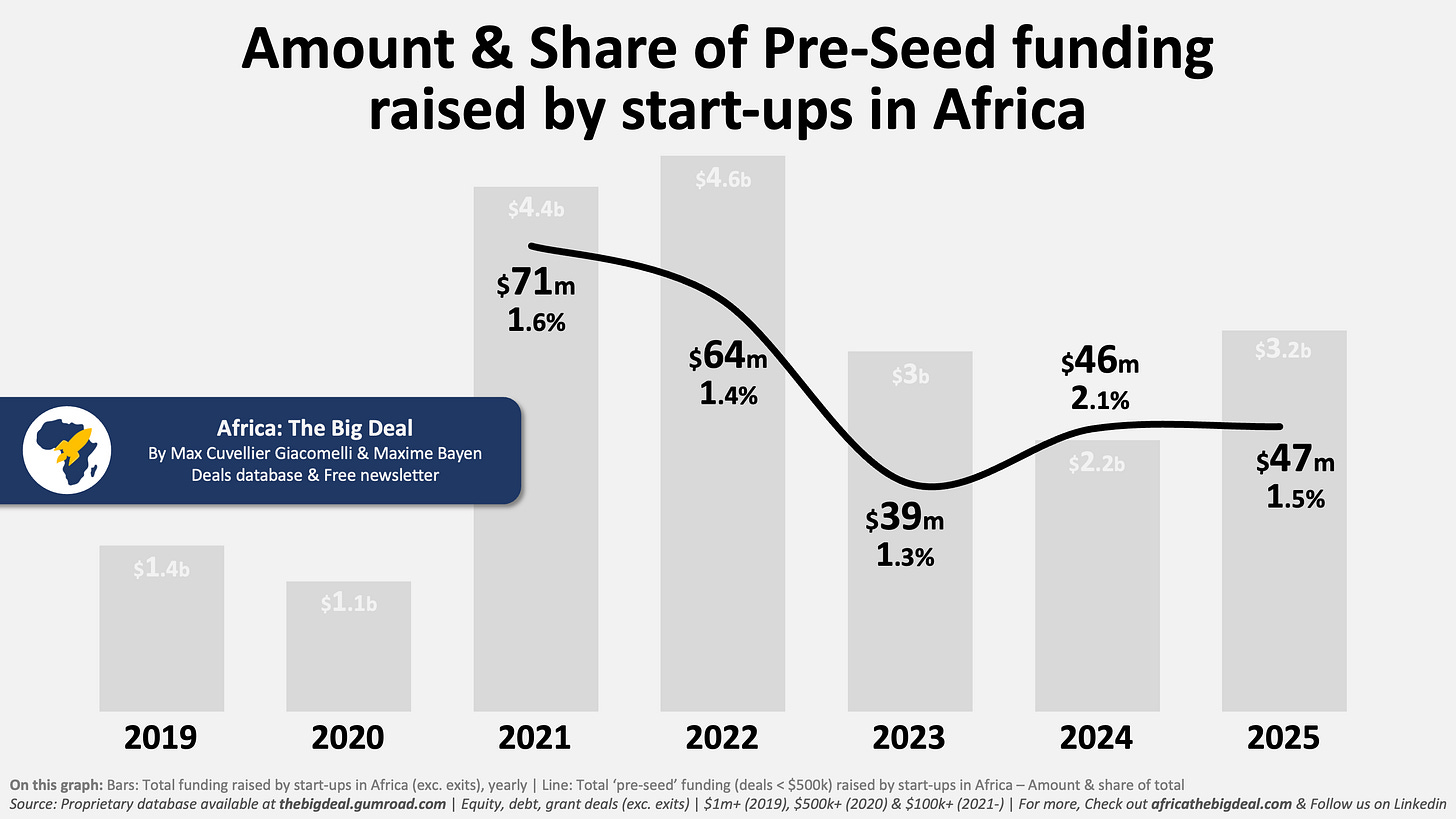

Recent data from the Africa The Big Deal database reveals worrying stagnation. Pre-seed remains marginal, capturing only 1.5% of total capital invested on the continent, compared to 4–6% in the United States.

Volume. In 2025, 281 startups closed pre-seed rounds totaling $46.5 million. This figure is virtually unchanged from 2024, even as the rest of the African venture capital market grew by 40%.

From a methodological standpoint, investments ranging from $100k to $500k were classified as pre-seed investments, reflecting typical cheque sizes at this stage in Africa. Of the 281 investments identified, 53% were first-time investments, while the remainder were follow-on rounds executed at very early stages of maturity.

Players. The number of active pre-seed investors is declining sharply: 135 in 2025, down from 155 in 2024 and 200 in 2022. Investment velocity has also slowed significantly, averaging 3.6 deals per investor per year, compared to 5.9 in 2022.

Concentration. Investments remain heavily concentrated in the “Big 4” (Nigeria, Kenya, South Africa, and Egypt), which together capture nearly 60% of total pre-seed flows.

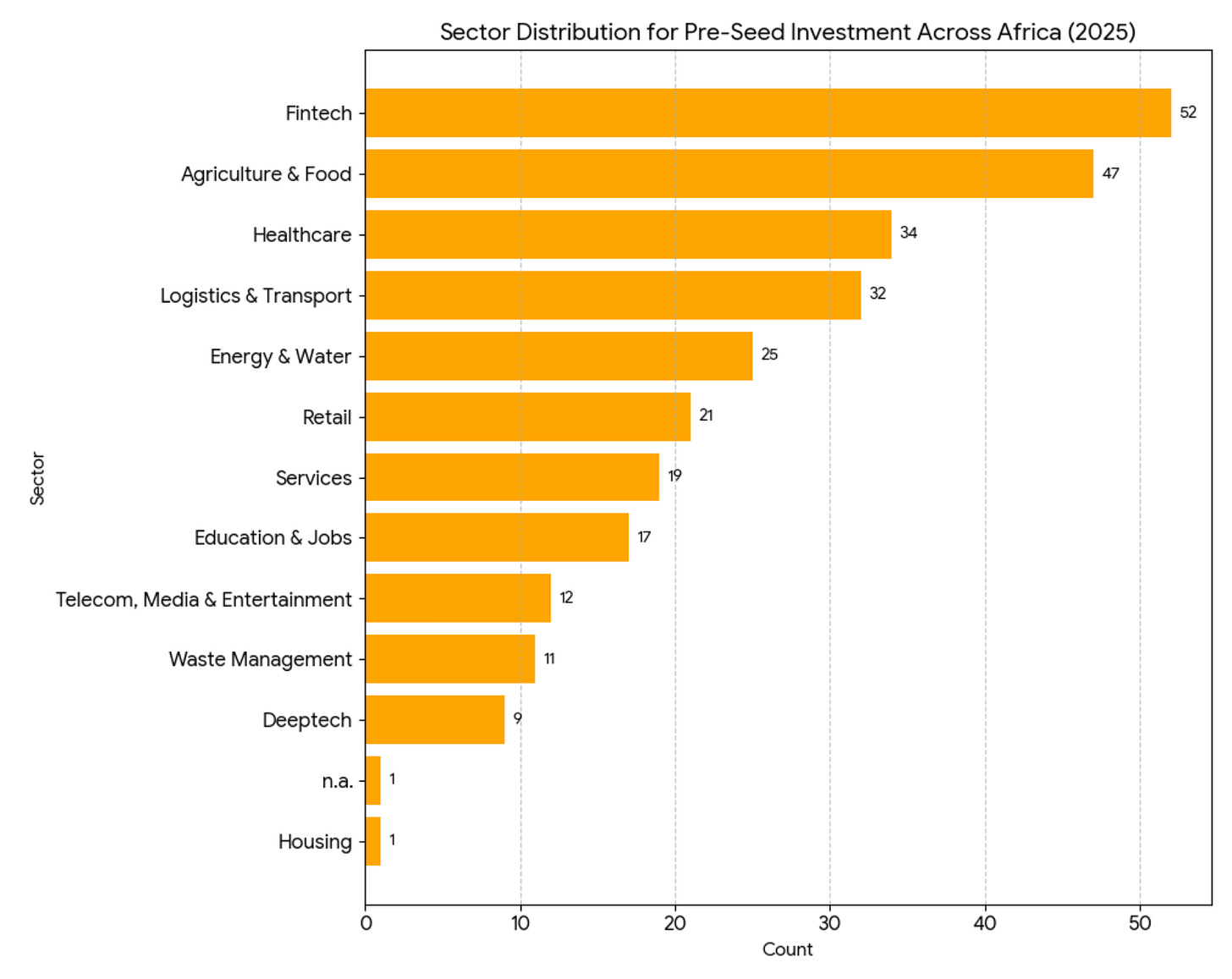

Sectoral distribution in 2025 shows a modest concentration in Fintech and Agriculture & Food, which together account for a significant share of pre-seed deal flow. This mirrors both the structural importance of financial inclusion and the outsized role of impact funds across African economies. Healthcare, Logistics & Transport, and Energy & Water also attract substantial pre-seed activity, reflecting growing interest in essential services and infrastructure-adjacent solutions. By contrast, sectors such as Deeptech, Waste Management, and Housing remain underrepresented, underscoring their higher perceived risk, longer time horizons, and greater capital intensity.

More concerning still is the deterioration of the financing structure itself. Dependence on grants is increasing: in 2025, grants account for 42% of pre-seed financing in value, up from 20% in 2021. In key markets such as Kenya and Tanzania, grants represent 50% and 74% of total pre-seed funding respectively. While grants are useful for R&D and impact externalities, they rarely create the market discipline required for a sustainable entrepreneurial ecosystem. Their growing weight also skews deal flow toward impact-first models, often at the expense of economic viability.

The withdrawal of historic players and the European response

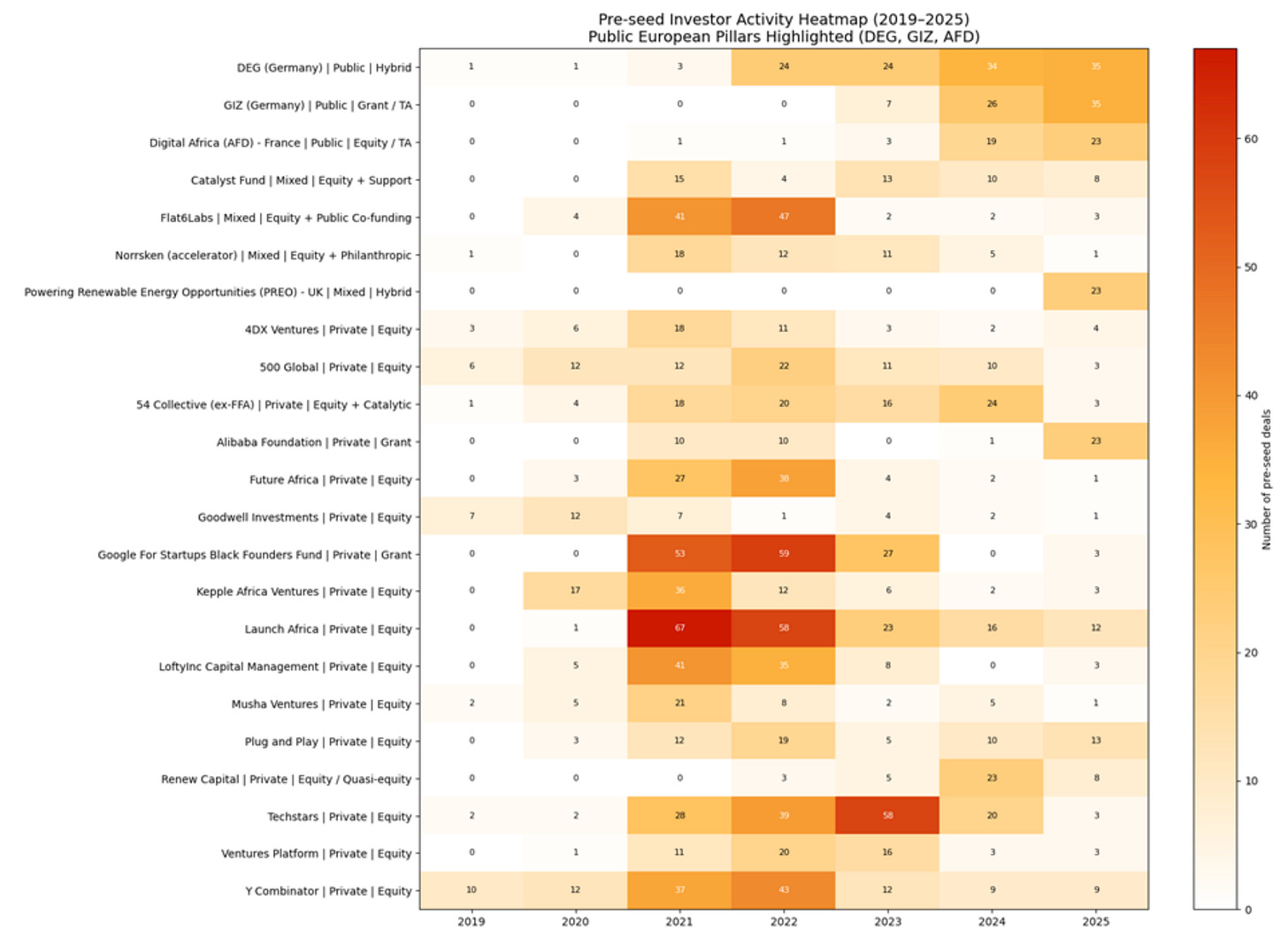

Between 2019 and 2025, the withdrawal of historic players such as Techstars, Y Combinator, and the Google Black Founders Fund - combined with the repositioning of Loftyinc and Launch Africa - reduced private pre-seed investment capacity by more than 60%. In response, European public actors stepped in to fill the vacuum, most notably Germany through its matching funding program with DEG/GIZ, the United Kingdom through PREO, and France through AFD/Digital Africa.

France has structured a targeted response centered on direct equity investment. A clear division of labor has emerged. Proparco, through Choose Africa VC, focuses on fund investments and larger, more mature tickets. Its subsidiary, Digital Africa, operates micro direct investments starting at the pre-seed stage - ranging from €20k to €100k through its Fuzé initiative - explicitly targeting the market failure abandoned by private investors. In 2025 alone, with 28 investments, Digital Africa accounted for 35% of equity investments beyond the Big 4 by deal count (40% in Francophone Africa), while deploying just 2% of total equity tech funding in that region.

With only $46 million deployed at the pre-seed stage for a tech ecosystem valued at $3.2 billion, Africa must urgently structure and reinforce this critical segment.

Public capital is necessary… but must be rigorously managed

If public funding is essential, its governance must be equally disciplined. Three golden rules should guide pre-seed programmes in Africa.

Private-sector management. Deployment should be delegated to private actors, or to entities operating under similar modalities: pursuit of financial returns, performance-based incentives for fund managers, strict discipline over operating costs, and above all operational agility. Public bureaucracies, by nature risk-averse, are incompatible with the speed and flexibility required at the pre-seed stage.

Profit-driven incentives. Investment decisions must prioritize return potential. Supporting companies capable of generating returns not only creates sustainable jobs and wealth but, critically, helps build a functioning venture capital market. The primary ecosystem-level objective is the emergence of success stories that trigger a virtuous cycle. Long-term social and environmental outcomes will be stronger when companies are anchored in robust, market-driven ecosystems. From the first cheque onward, each investment should therefore rest on a clear conviction regarding the project’s potential for success, independent of any predefined impact agenda.

Strategic patience. States must explicitly accept long time horizons. Venture capital is a long-term endeavour, and measurable outcomes—financial returns or large-scale job creation—may take five to seven years to materialize. In Africa, the pre-seed stage in particular requires patient capital structures, such as evergreen funds, exemplified by Digital Africa’s Fuzé fund.

A sector at a crossroads

African pre-seed equity investment stands at a crossroads, trapped in a blind spot: too small for state-level policies focused on large-scale projects, too risky for private investors, and somewhat anomalous within the international development landscape given its business-driven, non-traditional approach.

The segment must scale both in volume and in durability. To build a robust ecosystem, at least 3% of total financing should flow to pre-seed. Based on a projected $4 billion raised in 2026, this would require deploying roughly $120 million annually across 800 startups. The gap is immense. Bridging it will require a hybrid architecture: catalytic public capital (first loss, evergreen, patient) to prime the pump, intermediated by specialized funds, managed with private-sector discipline, and explicitly designed to support startups toward stages attractive to private investors.

This is the necessary price if entrepreneurship is to meaningfully address the continent’s most vital challenges.

The grant dependency trend from 20% to 42% is alarming becuase it erodes market discipline exactly when startups need it most. The withdrawal of YC/Techstars combined with the 60% capacity reduction creates a dangerous structural gap. Digital Africa's 35% deal share beyond Big 4 at just 2% of capital deployed shows how efficiently targeted micro-tickets can work when managed with private-sector rigor.