Fintech in Gold🥇 Competition heats up

Fintech is holding its share of deals in 2022, but losing ground in terms of amount raised, opening the way for other sectors to thrive

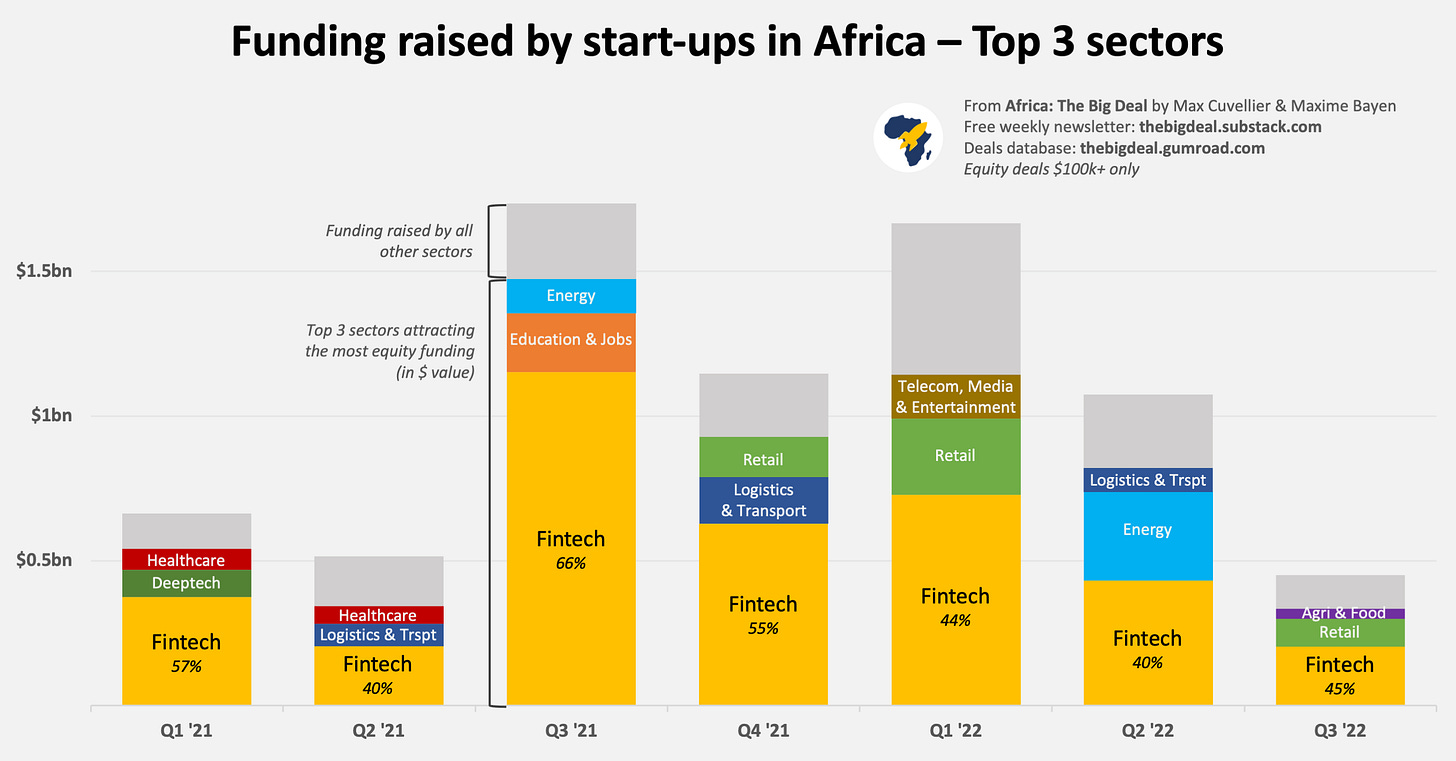

Yassir’s $150m Series B announcement last week came as a good reminder that the ecosystem can still deliver mega deals, and that they don’t have to be in one of the Big Four, or in fintech for that matter. It’s actually been nine months since we last looked at funding raised in Africa with a sector lens, and given how eventful 2022’s been, an update feels overdue. So let’s look at the split of $100k+ equity deals in the past couple of years, shall we?

First of all, the relative split in terms of number of deals between 2021 and 2022 (as of end of October) is extremely stable: no sector registered a change of more than 2% in their share of deals between the two periods. As a result, the Top 5 sectors in number of deals remains unchanged: Fintech (33% in 2021 vs. 32% in 2022YTD), Logistics & Transport (10% vs. 11%), Services (9% vs. 9%), Retail (9% vs. 10%) and Healthcare (9% vs. 7%).

Now in terms of amount raised, fintech remains in the lead in 2022 to date, but is the biggest loser, relatively speaking, with a -16% loss in share of funding between 2021 (58%) and 2022 to date (42%). Fintech start-ups raised $2.4bn in equity funding in 2021 but ‘only’ $1.4bn in 2022 so far, with just two months to go. This loss can be attributed both to the lower number of $100m+ fintech ‘mega deals’, and to the fact that fintech ‘pure players’ bagged very large amounts of funding in 2021, and paved the way for investments in other sectors where fintech plays a role, but is not at the centre of the value proposition. The only other sector that lost significant ground between the two periods is Education & Jobs (-6%, from 7% to 1%). On the other hand, three sectors are consolidating their share of funding raised: Retail; Energy; and Telecom, Media & Entertainment (+6% each). These three sectors - along with Deeptech, driven by InstaDeep’s $100m raise in January - have already raised more funding in absolute numbers in 2022 than they had in the whole of 2021. Overall, the growth fuelled by investments in start-ups on the continent in 2022 is less polarised - some would say healthier - that what we’d seen in 2021…

It’s hard to believe 2022 will be over in a matter of weeks. But I’m sure the ecosystem hasn’t said its last word, so we’re keeping a very close eye on announcements - as always - and updating our database of deals dutifully. As a loyal reader, you get access to it at a discount. But you knew that already ;) See you next week!