Fintech etc.

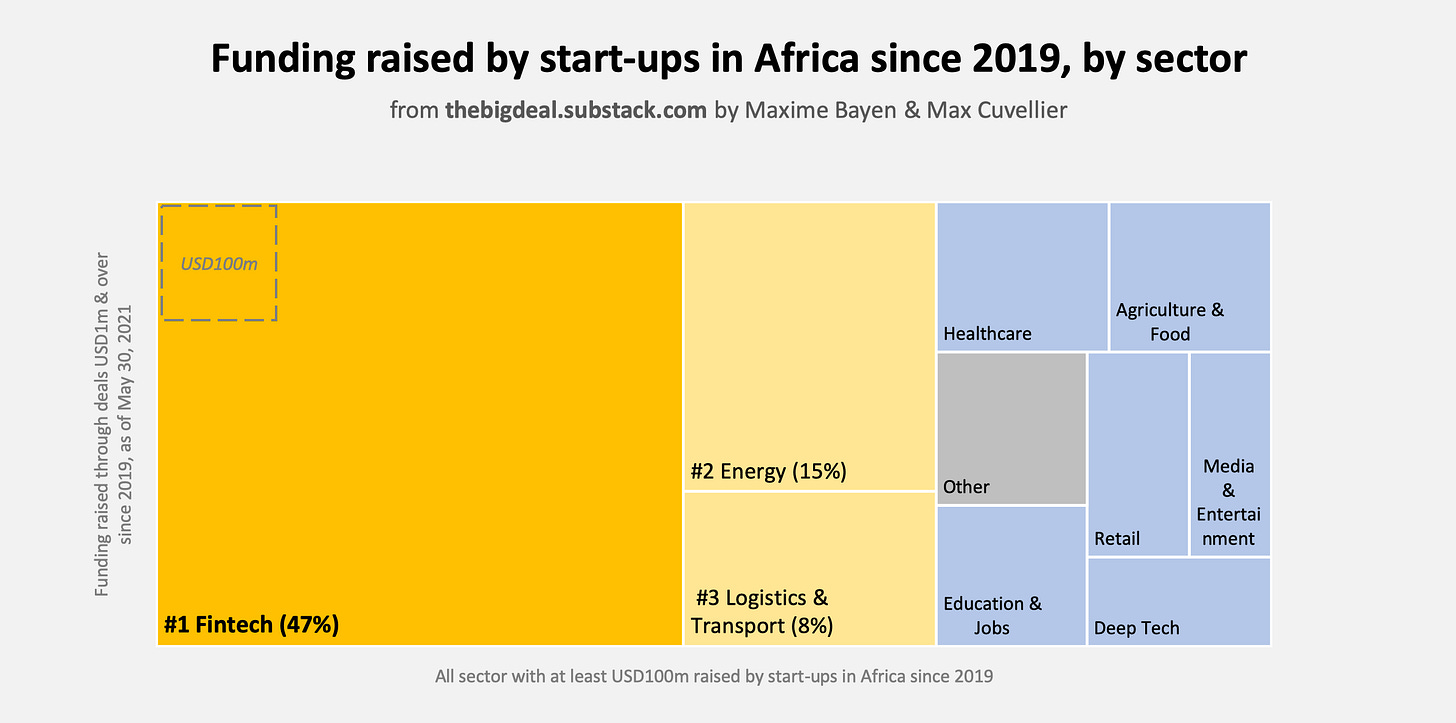

Fintech keeps dominating the funding landscape in Africa, but many sectors have attracted USD100m or more since 2019

Everywhere fintech is making headlines, and Africa is no exception. With north of $1.8 billion since 2019, fintech start-ups have raised 47% of all the funding raised by start-ups in Africa through $1m+ deals during the period, dwarfing all the other sectors. And this share actually increased between 2019 (43%) and 2020 (50%); in 2021, it stands at 47% so far. And that’s not yet including the Chipper Cash $100m Series C announced last night, (or OPay’s planned $400m round). Energy (15%) and Logistics & Transport (8%) hold the second and third place respectively. Six other industries - with shares ranging from 3% to 6% - complete the list, some with rather stable performances year on year, such as Education & Jobs, while others tend to get boosted by a few large deals such as Healthcare (more here), or Deep Tech (with Gro Intelligence’s $85m round in January 2021). There are also very strong geographic disparities. Nigeria is a fintech powerhouse with $1bn+ raised since 2019, 70% of the total raised by start-ups in the country. In South Africa, 46% of the funding goes to fintech, but the two sectors completing the top 3 are actually Media & Entertainment (16%) and Healthcare (9%, thanks to LifeQ’s $47m Series A announced last week). Kenya offers a more balanced picture: fintech leads yet again but with 37% of the total funding raised, while Agriculture & Food, Energy, and Deep Tech each represent 10%-20% of the total funding raised there. Finally, Egypt offers a complete different picture: at 12% of the total, fintech ranks only third, behind Logistics & Transport (40%, driven to a large extent by Swvl’s rounds) and Healthcare (14%, courtesy of Vezeeta in particular).