🎓 An investment in knowledge pays the best interest

A breakdown of the $500m+ invested in Edtech and Jobtech start-ups in Africa since 2019

🎧NEW🎧 Try “Listening mode”, au audio version of this week’s post, for those of you who consume content on the go

Last week I came across this sobering statistic: 9 in 10 children in Africa cannot read by the age of 10. That’s tens of millions of children who might not have access to the social and economic opportunities they deserve. And then I thought: the problem is so big, and so important to address, that start-ups in Africa must be on it! So I opened our database, recoded the data for deals in the ‘Education & Jobs’ sector, and here is what I found:

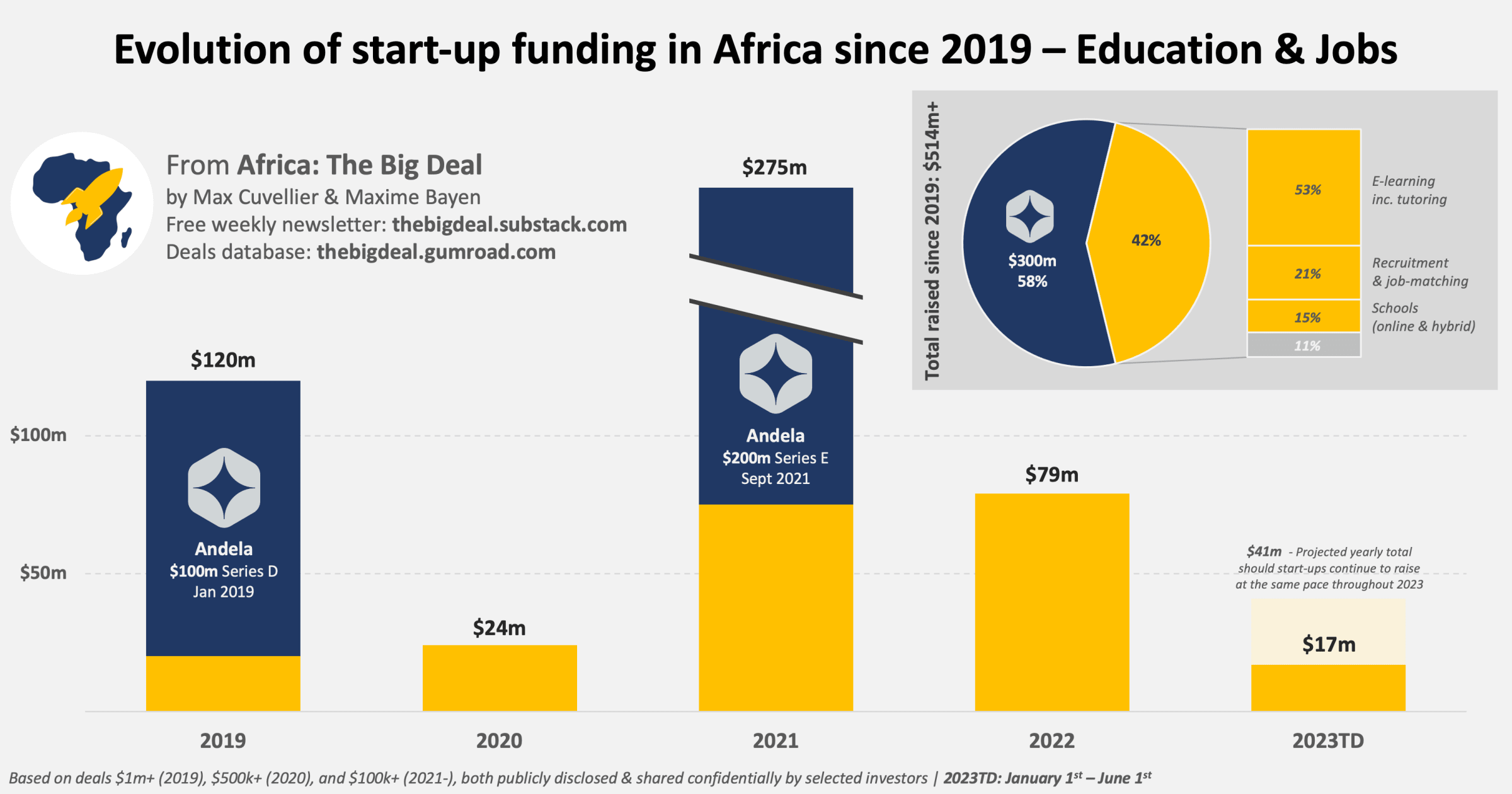

While the $500m+ of funding invested in the sector since 2019 might seem sizeable in absolute terms, it is rather inconsequential compared to the $13bn+ (exc. exits) that have been invested in start-ups in Africa in the past 4.5 years (less than 4%). And the thing is: almost 60% of that funding went to one single organisation - Andela - which raised two mega rounds during the period, totalling $300m. Obviously, that skews the numbers quite a bit…. Overall, there were 73 $1m+ deals in the sector since 2019 (about 4 per quarter), involving 59 ventures in total. Geographically, two thirds of deals were concentrated in Nigeria, Egypt, and South Africa who jointly attracted 84% of all the funding (62% excluding Andela).

But what types of solutions are we talking about? Excluding Andela, half of the ‘Education & Jobs’ funding has been going to e-learning platforms, sometimes with an element of online tutoring. A bit less than a quarter went to recruitment, job-matching and outsourcing models (e.g. Meaningful Gigs), a few of which include training à la Andela. The rest are schools - either hybrid or online - (e.g. SPARK Schools) and a few HR/Talent management solutions, school management platforms etc. Coming back to the figures on learning poverty that triggered this analysis, how much of the sector’s funding is contributing to solving this particular issue? Not a lot I’m afraid: 75% of the funding (41% exc. Andela) was focused on models targeting either corporates (B2B) or professionals. Of the ~$100m invested in businesses focused on the needs of K-12 students, it is quite tricky to tell how much focuses on early education (e.g. Eneza Education), but it is very unlikely to be more than half of that amount (~$50m), with one grant - Lego Foundation’s $27.8m award to Ubongo in December 2022 - making up a large part of this number…

A lot of you have to be creative and explore new avenues to continue growing in the current context. Have you considered Indian partners? India has made great strides in the entrepreneurship space and a lot of investors and successful founders are now considering Africa for expansion and partnerships. If you’re a start-up looking to raise - or even a VC raising a fund - it might be wise to explore… But where to start? Actually, a lot of Indian Africa-enthusiasts will be at the Third India-Africa Entrepreneurship & Investment (EAIF) Summit next month. Attendance is free: You should check it out!

While you have to group deals in sectors or categories to be able to follow trends, this exercise was a good reminder that it is particularly important to take time to do more than just scratch the surface. The overall volume invested in start-ups in Africa since 2019 can look big ($15bn+ inc. exits), yet once you consider the number of countries and sectors - and how a few mega-deals can skew the numbers -, it calls for careful analysis. The good news is that you can do all of that yourselves if you like, by receiving an updated database of all $100k+ deals in your mailbox, for less than $10 a month! That’s what I would call a steal ;)