The rise of East Africa 🚀

East Africa and Kenya held on to their top spot in 2024...

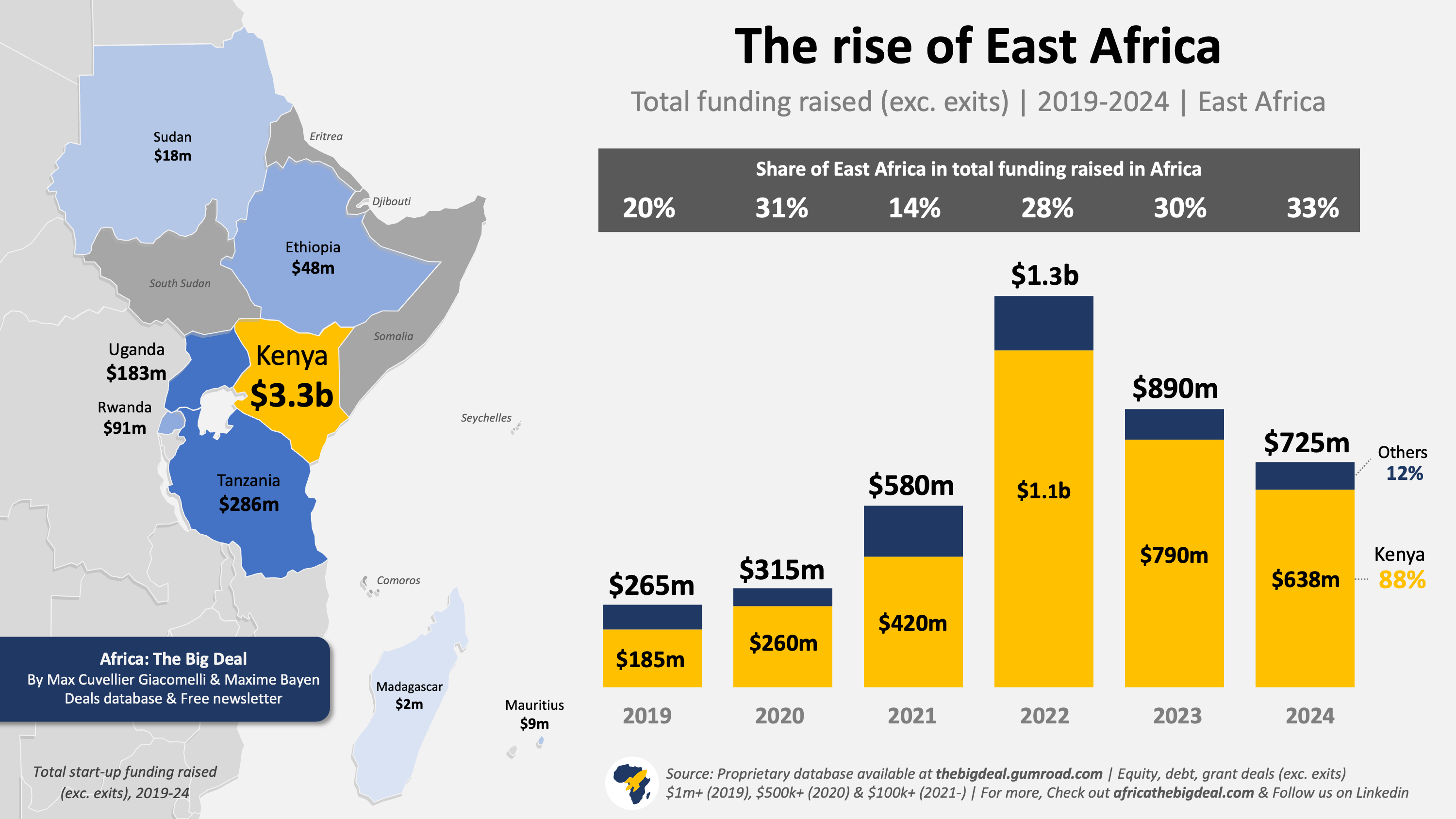

As we covered briefly in our 2024 Round-Up, in both 2023 and 2024 East Africa and Kenya have respectively been the region and the market attracting the most start-up funding (exc. exits) on the continent. So we thought this was an impressive enough performance to justify taking a bit of a closer look…

Technically, East Africa had already topped the charts in 2020 with 31% of the funding at the time, but only by a very very short margin (we’re talking only $6m more than West Africa, out of a total of $1.1b). But it is really since the end of the funding heatwave in mid-2022 that East Africa’s leadership has clearly emerged. Indeed, the region has claimed 30% of all the funding since mid-2022 (exc. exits), ahead of all the other regions. As a comparison, in the previous 2.5-year period (2020 to mid-2022), East Africa had been a very distant second with 22% of the funding raised, vs. 41% for West Africa. All in all, start-ups in East Africa have raised just over $4b in funding since 2019, 25% of the total raised on the continent.

Sent your pitch deck and heard nothing?… With Pitchwise, see exactly how investors engage - who’s interested, what they focus on… - and when to follow up. No more guessing. Just smarter fundraising.

Behind the region’s rise is really one country’s own success: since 2019, Kenya attracted $3.3b, i.e. 84% of the region’s total. And if anything, the trend has been that of an increase of Kenya’s share in the region’s funding over the period. Since the beginning of the funding winter in mid-2022, Kenya has consistently been the country attracting the most funding on the continent, a spot previously held by Nigeria. As such, it is by far the ‘Big Four’ country punching above its weight the most: in 2024 for instance, Kenya represented roughly 4% of the continent’s nominal GDP and population but attracted as much as 29% of the continent’s start-up funding…

Who is raising all that funding? The top 3 is made of the historical pay-as-you-go off-grid-electric triad - Sun King, M-Kopa & d.light - who raised nearly $1.5b (44% of the total) since 2019. They are followed by retail/supply chain disruptors - Twiga Foods, Wasoko, Copia Global - who raised $400m in total in the same period, but have been facing a lot of difficulties recently (Copia liquidated; both Twiga and Wasoko are restructuring). Beyond these heavy hitters, overall more than 150 ventures have raised $1m or more in the country since 2019.

But there’s a life beyond Kenya of course. In Tanzania, close to $300m were raised since 2019 (#7 on the continent), half of which have gone to Zola Electric and Nala alone. Uganda (#10) completes the region’s top 3, again with two ventures claiming half of the funding over the period, Tugende and Asaak. Rwanda is the only other market toying with the $100m mark, followed by Ethiopia and Sudan (with its YC-backed fintech Elevate). Little activity was registered in Mauritius and Madagascar over the period, and we could not identify any deals above $100k in the remaining six markets (beyond off-shore crypto exchanges registered in the Seychelles for tax purposes)…

That’s it for our whistle stop of the region. We hope you’ve enjoyed the ride, though if some of your questions have not been answered, do feel free to get in touch, or to subscribe to our database where you’ll find information about the close to 500 start-ups who raised funding in the region since 2019. With a discount, of course. A très bientôt, Max