Doesn’t April feel a little quieter on the deal front? Not quiet, but quieter? Some worry it might be early signs of a slowdown, like the one that’s felt in other parts of the world. Maybe. Though it’s worth noting April is always a quiet month, in terms of total funding raised announced: it was the quietest month in 2019, the quietest month again in 2020, and the second quietest month in 2021.

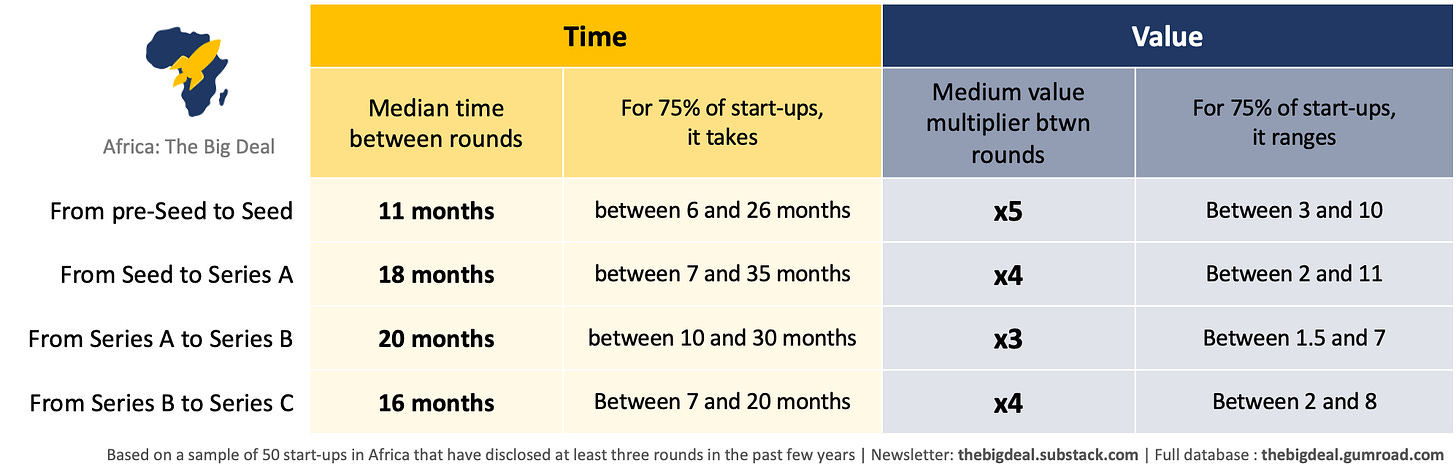

For start-up executives and co-founders who plan to raise soon, two top-of-mind questions often are: ‘When should we raise our next round?’ and ‘How big should it be?’, compared to the previous one. The main answer to these is… ‘It depends’. Because it really does. The timeline and size of a raise should be dictated by the needs of the venture, rather than by textbook metrics. We know it’s hard to resist the temptation to benchmark oneself though, so this week we studied 50 start-ups who have raised at least 3 rounds in the past few years, and looked at the time between the announcement of the rounds, and the multiplier between the value of the rounds. Here is what we found:

Beyond the median, we are sharing the range three quarters of the start-ups studied fell in, as a way to illustrate the high level of variation between start-ups in terms of when and how much they decide/manage to raise. There are not, however, very strong differences between the rounds. All in all, these numbers should be taken as an indication of what is happening in the market, rather than a target to stick to. Especially as you will find that some very successful start-ups might not have looked to be doing well in comparison to others at some point, because - and I repeat myself on purpose here - they focused on when and how much they needed to raise, as opposed to adhering to a pre-established pattern or expected fundraising metrics.

Thanks for staying with us yet another week. We’ve just passed the 4,000 subscribers mark :). Your feedback and new ideas are really what keeps us going. So please do keep them coming!

And talking of deals and fundraising, AfricInvest is actively building its pipeline of debt deals on its DealRoom hosted by Asoko Insight. If you’re an African SME with north of $1.25m in annual revenue, and are considering a debt investment to access growth or working capital, you might want to check them out.