Slow and steady wins the race (?) 🐢

After a very successful July, August has been rather quiet, to say the least

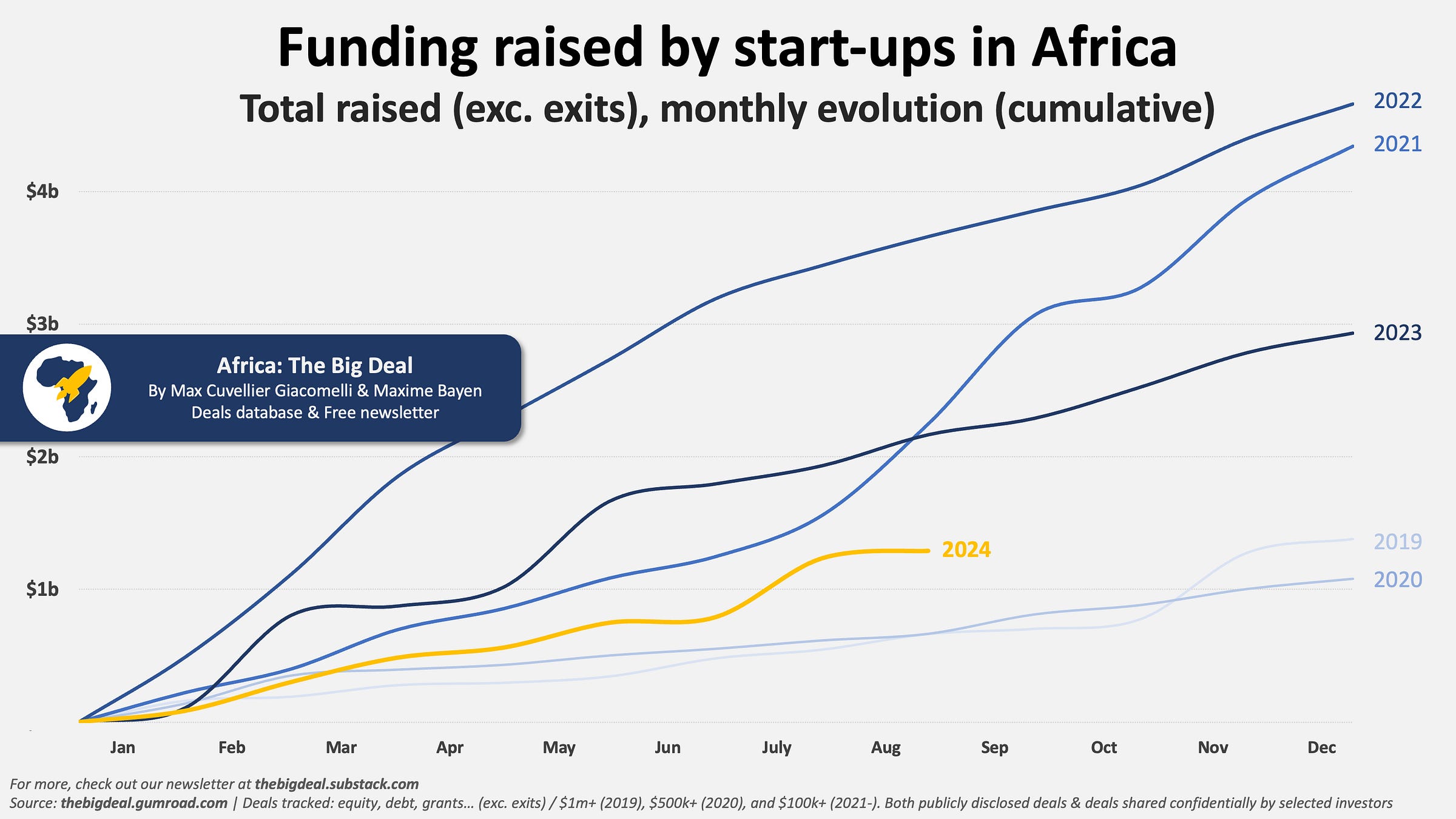

When we covered the really good performance of the ecosystem in July last month, we knew there was a risk that it might not keep up in August. And in fact, things have been much slower last month: start-ups in Africa announced only $56m in funding, down from $443m in July (~8x less) and $234m in August 2023 (~4x less), making August 2024 the second-slowest month in four years in terms of funding raised, after June 2024 ($42m). The majority of this funding was raised as equity (87%); the rest was debt (9%) and grants (4%).

A total of 27 start-ups announced they had funding in August, well below the monthly average over the past twelve months (40+). The three largest deals recorded were: Dutch DFI FMO’s $10m investment into Ghanaian Fintech Fido as part of its Series B round; Solarise Africa’s $9m announcement (Energy, South Africa); and Nigerian fintech Waza (YC W23) coming out of stealth mode and announcing $8m in funding ($3m seed, $5m debt). No exits were recorded last month.

2024 keeps tracking below recent years (-40% YoY compared to 2023), but if we care to look on the bright side: despite the August lull -, the ecosystem’s performance was so good in July that the funding raised in Q3 (with one month still to go) is already higher than in Q1 and Q2.

… And we’re back. Hopefully most of you also had a chance to take a bit of time off to recharge your batteries in the past couple of months. By now you know the drill: if for whatever reason (raising your next round? or your next fund?) you need access to the granular data behind this analysis, please use this link to access our database with a little discount. And as we’re often asked: please feel free to use our graphs in your decks, reports etc. If you can make sure you quote us as a source though so people can get a chance to discover our content, that’s much appreciated. Thanks! Max