9 digits or nothing.

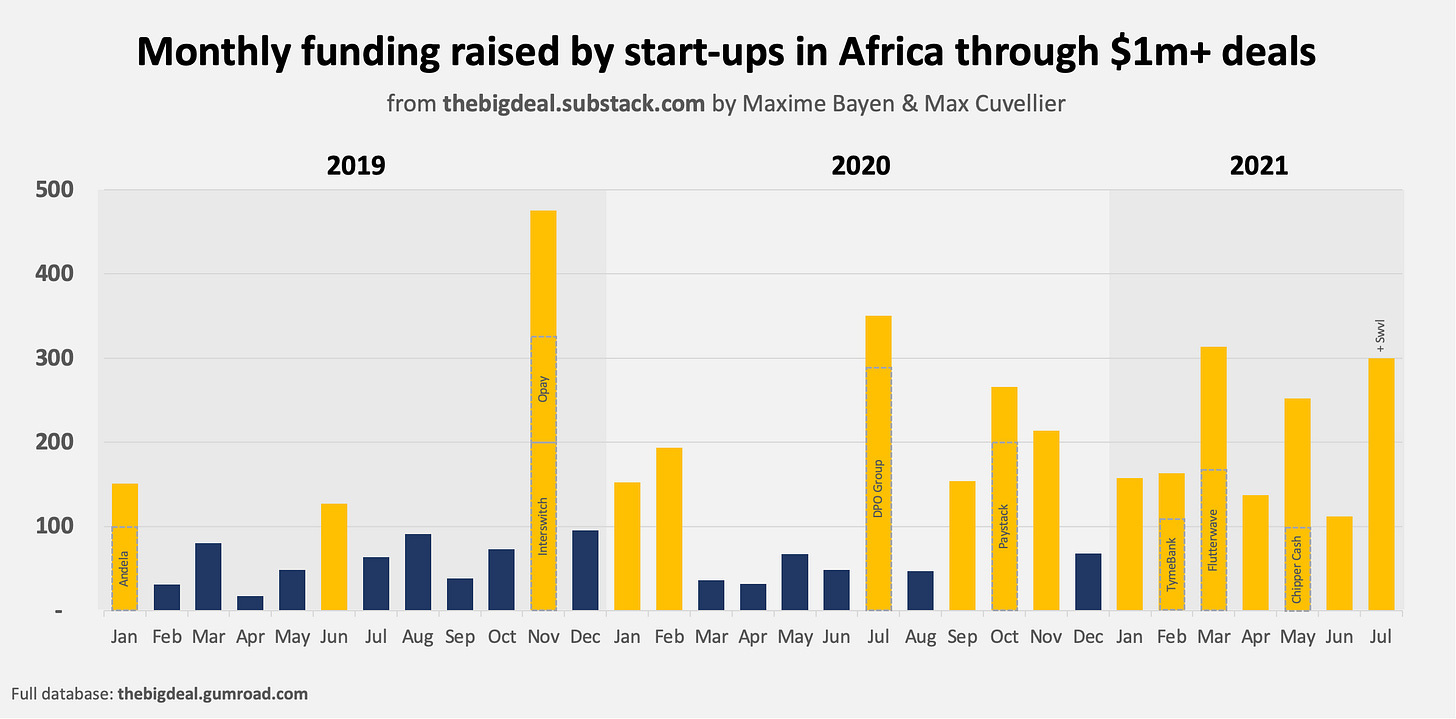

Since January, start-ups in Africa have consistently raised more than $100m a month

Back in 2019, there were 3 months when start-ups in Africa raised more than $100m through deals $1m & over. In 2020, there were 6. In 2021 so far, start-ups in Africa have raised at least $100m every single month*. In February, March and May, this was driven in part by very large $100m+ fintech deals : TymeBank, Flutterwave and Chipper Cash respectively.

Now, you will see that the Swvl number is not yet included in the July tally. ICYMI, on July 28, they announced their plan to go public in a $1.5bn SPAC merger, a first of its kind for a start-up operating in Africa. It’s definitely big, but we’ve not yet managed to find a robust source laying out how much one should consider Swvl have ‘raised’ in the process. If you think you have the answer, please do drop us a note. And if just like us you’re still learning about SPACs, here are 3 articles we found useful: 1, 2, 3.

It’s a great track record for the ecosystem so far, but What does the future hold? Well, with Kuda raising $55m on August 2nd, it wouldn’t be surprising if August eventually joined this series of consecutive 9-digit months…

We’re going to post a bit less regularly this month as we enjoy time with our loved ones, but we’re still very much keeping an eye on deals, and looking forward to your comments and shares. And we hope you’re also getting a chance to let your hair down!

* The numbers on the graph only include deals $1m & over (for comparability’s sake with 2019 and 2020). Deals between $100k and $1m represent an extra $9m a month on average in 2021 so far. For a full list of those, check out the database here.