3 billion reasons to stay positive 💰💰💰

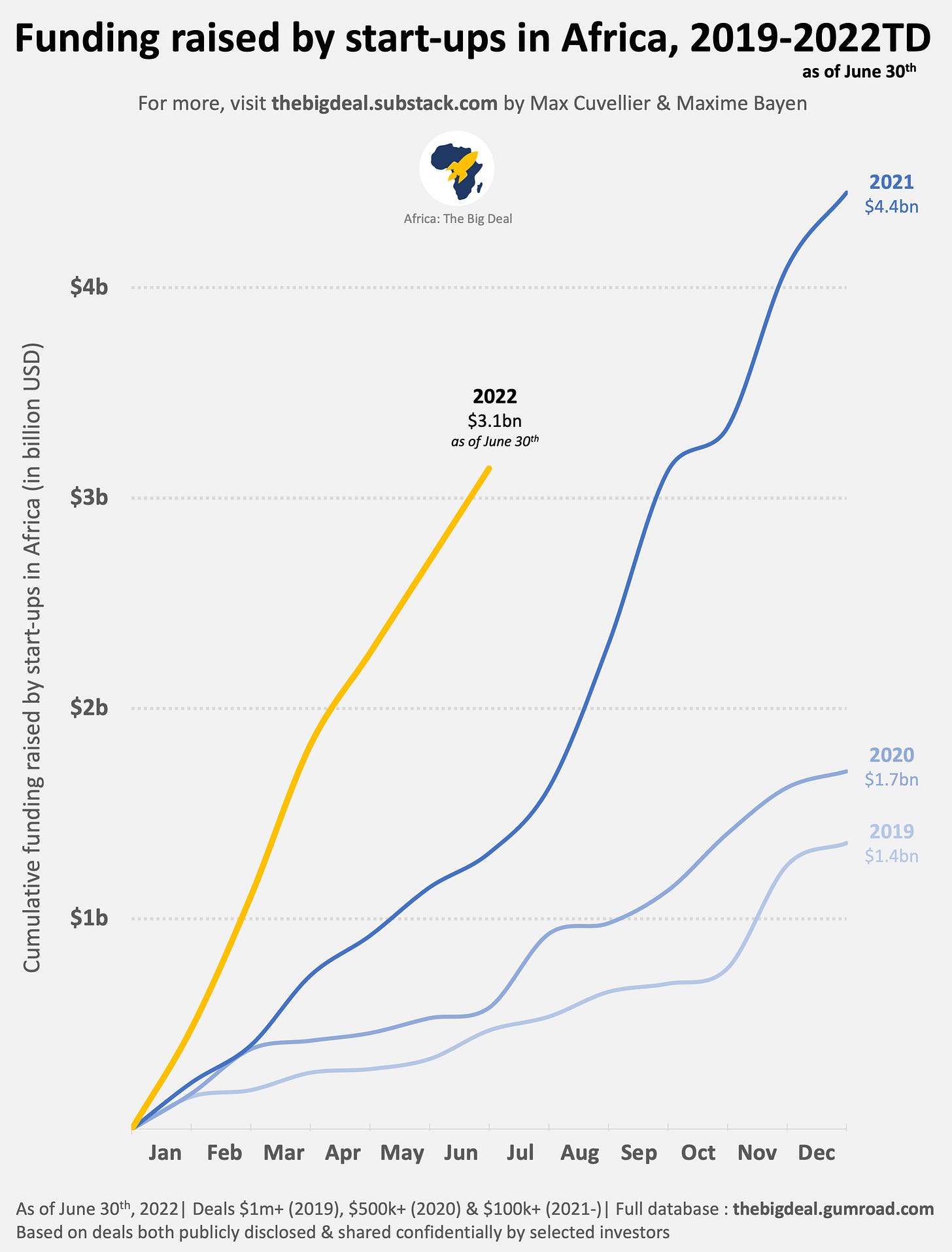

Start-ups in Africa have raised more than $3 billion in the first half of 2022 and recorded their strongest June, Q2 and H1 ever.

Down rounds, mass layoffs, bankruptcies… The global tech news is certainly nerve-racking these days. Yet to quote our very own Maxime Bayen in a conversation we had last week: “If we didn’t know the global context, and just looked at the numbers, no one right now would be talking about a slowdown in tech funding in Africa…”. The little pessimist in me’s first reaction was ‘Yes, but!’: Yes, but start-ups are telling us it’s harder to raise capital. And that valuation conversations are pretty tough these days. Yet, the story the numbers tell us is pretty solid. Start-ups in Africa have raised $1.3bn in Q2 2022, which adds up to $3.1bn in the first half of the year. Let me put it this way: June 2022 was the ecosystem’s strongest June ever in terms of fundraising. Q2 2022 was the ecosystem’s strongest Q2 ever. H1 2022 was the ecosystem’s strongest H1 ever. And we’re not talking small increments here; we’re talking 2.7x, 2.3x and 2.4x year-on-year growth, respectively. Is there a darker story to tell if you start digging into each of the Big Four’s data? Well, not really. June 2022 was much stronger than June 2021 in South Africa (6.4x YoY), Egypt (3.4x) and Kenya (3.3x); only in Nigeria do we see a dip (-30%), which does not weigh down on its Q2 and H1 numbers though. Indeed, Q2 2022 was stronger than Q2 2021 across the board: 12x in Kenya, 2.4x in Egypt, 2.3x in Nigeria, and 1.3x in South Africa. And finally H1 2022 really has got nothing to envy to H1 2021 in Kenya (5.2x YoY), Egypt (3.2x) or Nigeria (2.3x). Even in South Africa, where numbers so far this year had been a cause for concern, MFS Africa’s Series C $100m ‘top-up’ in June means that results for H1 2022 ended up almost on par with the H1 2021 performance (-0.6% YoY). Now there’s no denying that the context is tough and that between inflation, food insecurity, bear markets, supply chain issues and more, start-ups in Africa are/will be affected in their growth and capacity to raise. But because the next part of the journey might be a bit rocky, shouldn’t make you forget how much of a blast you’ve had so far. Q3 will be decisive - especially because it was so very strong last year - but there is definitely room for optimism. Here’s hoping that future numbers don’t contradict me too much!

If you want to dive into the numbers (beware though: it’s addictive!) and play with the raw data (468 deals in 2022 alone, ~1,700 in total), don’t forget to use this discount code to access the database. As a regular reader of this newsletter, you’ve definitely earned it! We also want to hear about your views on the current situation, and what it may mean for the market, so don’t hesitate to join the conversation on Twitter (Maxime, Max) and Linkedin (Max, Maxime). Bye for now!